Extractive Sector Transparency Measures Act (ESTMA) FAQs

Submission and publication of reports

Are businesses that do not make any reportable payments under the Act required to submit a report?

NRCan does not require businesses (“entities”) that do not make any reportable payments to government within a financial year to submit a report; however, reporting entities are encouraged to notify NRCan by email within 150 days following the end of their financial year that no report will be submitted for that year.

Sample email:

Please be advised that [insert Legal Entity Name] ([insert ESTMA ID no.]) has made no reportable payments under the ESTMA for the year ended [insert fiscal year end date].

In the situation where a parent entity has no reportable payments, the business may still be required to submit an ESTMA report on behalf of its subsidiaries.

An entity must ensure that all reportable payments it makes and all reportable payments made by entities it controls, directly or indirectly, are included in its ESTMA report.

A parent entity may elect to not publish a report if all of the following conditions are met:

- All the reportable payments were made by subsidiaries;

- Those subsidiaries are also reporting entities under the ESTMA; and

- The reportable payments in question are included in ESTMA reports filed by those subsidiaries

Parent and subsidiary reporting entities must always follow the requirements set out in section 11 of the Act and in the Technical Reporting Specifications (PDF, 830 KB).

How do businesses report if they change their financial year?

Businesses subject to the Act (“entities”) that change their financial year must submit a report for the period between the end of the previous financial year and the start of the new financial year, before beginning to report based on the new financial year.

For example, if an entity changes its financial year from June–May to January–December, it has to submit a report for the months of June–December in the year that the change occurs. In the following years, the entity has to submit its report for the months of January–December.

Entities submitting shortened reports as a result of a change to their financial year must inform NRCan of the change as part of their report submission and may include a note within the report or as an addendum to provide context for the shortened reporting period.

How do businesses submit a consolidated report when the parent/subsidiary(ies) have different financial years?

Subsidiaries that are reporting entities in their own right (i.e., they are either listed on a Canadian stock exchange or meet the size threshold detailed in section 8(1)(b) of the Act) have two options for reporting if they have a different financial year than their parent:

- Opt against consolidated reporting and submit a separate ESTMA report: in this scenario, a subsidiary that is a reporting entity in its own right submits an ESTMA report covering all of its reportable payments made within its financial year. The parent no longer includes that subsidiary’s payments in its report to avoid duplicate reporting.

- Submit a top-up report in addition to the consolidated report: in this scenario, the parent includes part of the reporting subsidiary’s financial year in its consolidated report and the subsidiary provides a separate top-up report containing payments it made during any part of its financial year that is not covered by the consolidated report (as per section 11(c) of the Act).

Please note that for the purposes of determining reportable payments under the ESTMA, the parent entity must aggregate the payments of its subsidiaries by payee and category to determine whether they meet the Can$100,000 threshold.

Subsidiaries that are not reporting entities in their own right (i.e., they are not listed on a Canadian stock exchange and do not meet the size threshold detailed in section 8(1)(b) of the Act) cannot submit an ESTMA report to satisfy the reporting requirements of their parent. In this scenario, the parent must include the payments of all such subsidiaries that it controls directly or indirectly in its report based on its own financial year.

Printable version (PDF, 195 KB)

Text version

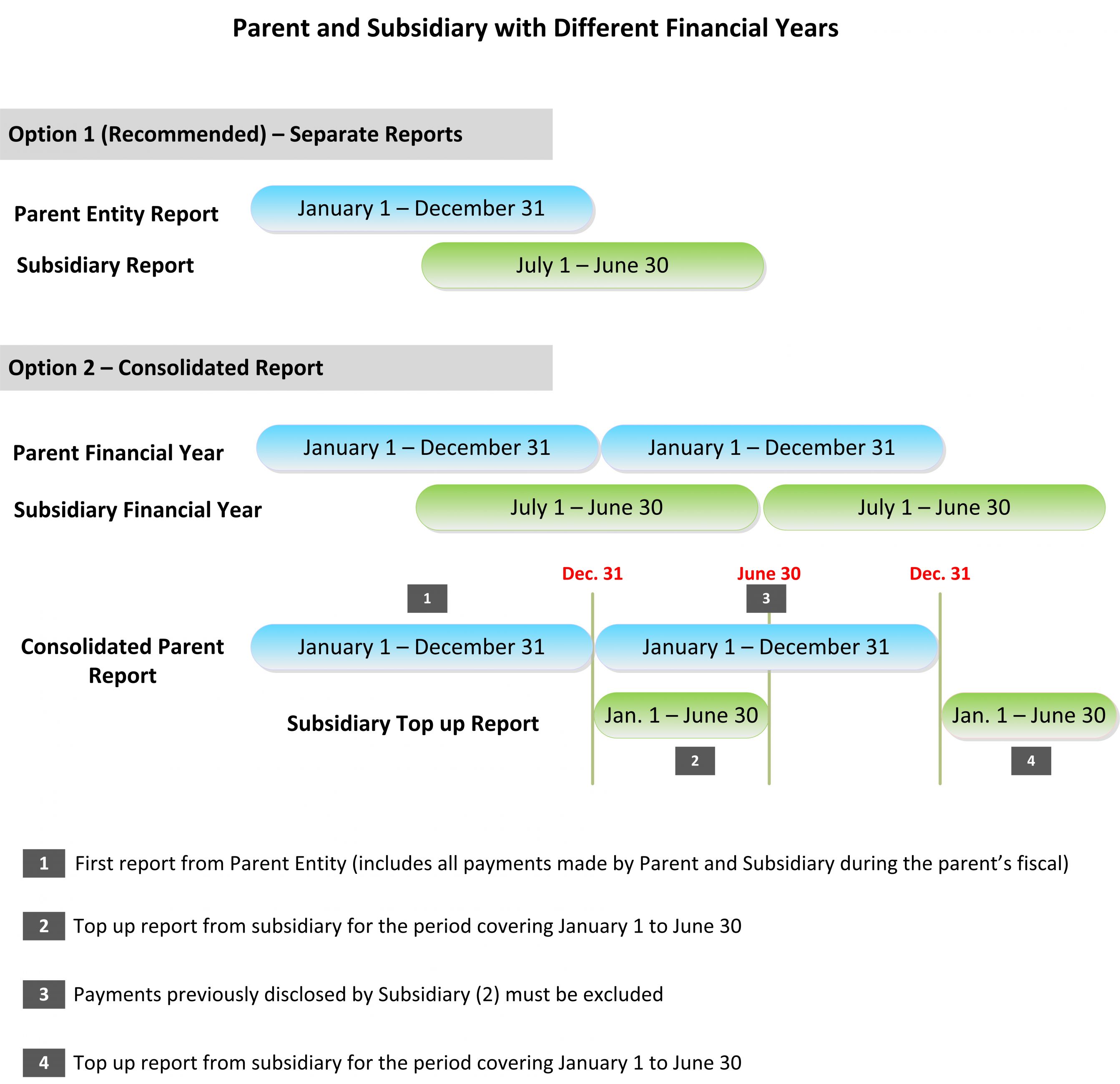

This image depicts the two options for submitting an ESTMA report if parent and subsidiary reporting entities have different financial years.

If, for example, a parent entity has a January 1 to December 31 financial year and its subsidiary has a July 1 to June 30 financial year. NRCan recommends option one, which is submitting separate reports.

In option two, the same parent and subsidiary can choose to submit a consolidated report. The parent reporting entity submits the first report, which includes all the payments it made, as well as those made by its subsidiary during the parent entity’s financial year of January 1 to December 31.

The subsidiary then provides a top-up report for the period of January 1 to June 30 to cover the period of its financial year not already disclosed in its parent entity’s report. It would provide a similar top-up report each year thereafter.

In year two and subsequent years, the parent entity’s report would include all reportable payments made by the parent entity and the subsidiary during the parent’s financial year; however, it would exclude the payments reported in the subsidiary’s top-up report to avoid double counting payments.

If a business uses the Excel reporting template to complete its ESTMA report, can it publish that report in PDF on its website?

Yes, but the Excel template must be converted to machine-readable PDF format. The following are instructions on how to properly convert the file:

For MS Excel 2013 and earlier versions:

- Select the File tab at the top left corner of the screen

- Click Save as

- Click the down arrow of the Save as type field and select PDF (*.pdf)

- Click the Options button

- Under Publish what, select Entire workbook

- Click OK, then Save

For MS Excel 2016 and newer versions:

- Select the File tab at the top left corner of the screen

- Click Export

- Click Publish as PDF or XPS

- Click the Options button

- Under Publish what, select Entire workbook

- Click OK

How do businesses that do not have a website publish their report online?

It is the responsibility of the businesses that are subject to the Act (“entities") to ensure that their completed ESTMA report is published on the Internet in a publicly accessible manner for no less than five (5) years in order to be compliant with the Act. The reports do not necessarily have to be published on a corporate website. For example, entities without proprietary corporate websites can publish ESTMA reports using SEDAR or free online services, such as Google Drive or Dropbox.

Reporting requirements

What is project-level reporting?

Payments must be reported at the project level, when possible. This means that businesses (“entities”) must specify in the reporting template the name of the project to which a particular payment relates. Some payments, such as corporate income taxes, may not be attributable to a specific project. Entities can report these payments at the payee level only.

“Project” means the operational activities that are governed by a single contract, licence, lease, concession or similar legal agreement and form the basis for payment liabilities with a government. If multiple such agreements are substantially interconnected, they would be considered a single project.

“Substantially interconnected” means forming a set of operationally and geographically integrated agreements (e.g., contracts and licences) with substantially similar terms that are signed with a government, resulting in payment liabilities.

How is the value of an in-kind payment determined?

If an entity subject to the Act (“entity”) can determine the cost of an in-kind payment, that is the value that should be reported. If the cost is not determinable, the in-kind payment should be reported at fair market value. A reporting entity must identify the payment made in-kind and include a supplementary note in its report briefly summarizing how the value of the in-kind payment was determined.

“In-kind payment” includes agreed reallocation of funds for changes to internal processes as a condition of the commercial development of oil, gas or minerals.

Must non-operating members of a joint operation also report the payments that have already been reported under the ESTMA by the operator?

When the operator of a joint agreement is a reporting entity and it reports all of the payments it has made on behalf of the non-operating members, the non-operators are not required to report those payments made on their behalf (as per section 3(d) of the Act) for two reasons:

- If the operator reports all of the payments, the purpose of the Act, which is to make the payments transparent to the public, is met

- Requiring the non-operators to also report those same payments would create duplication in reported payments

Non-operator members must ensure that they report any payments they made directly to a payee, as well as any payments made for them that are not reported by the operator.

Reporting entities are encouraged to document their due diligence in determining their reporting obligations under the Act, including their analysis of the facts and circumstances of specific situations.

Must non-operating members of a joint operation report the payments that have been made for them by the operator, when the operator is not reporting the payments as an ESTMA reporting entity?

If the operator of a joint agreement is not a reporting entity (i.e., it is not required to submit an ESTMA report), the non-operator reporting entities must report all of the payments that they made directly to the payee as well as all payments that have been made for them (as per section 3(d) of the Act) by the operator.

There may be cases where payments are made for a reporting entity, but the reporting entity is not aware if those payments are being reported by the operator, what the payments are or who they are being made to. Compliance with the Act requires that reporting entities make efforts to obtain this information.

Reporting entities are encouraged to document their due diligence in determining their reporting obligations under the Act, including their analysis of the facts and circumstances of specific situations.

How do businesses report on joint operating agreements in situations of joint control (e.g., the partnership is fifty-fifty or there is no clear operator)?

In situations where two or more reporting entities exercise joint control and no single operator is in a position to report the payments made for all non-operating members, reporting entities have flexibility in determining how to report these payments in a manner that achieves the purpose of the Act, which is to make the reportable payments transparent to the public.

Depending on the nature of the operations and the relationships between each member of the joint operation, reporting entities may choose to have a single member report all of the payments on behalf of the rest of the members, with the other members only reporting any payments they made directly to a payee. Another option may be for each member to report their proportion of the reportable payments that have been made to a payee. Context on how they choose to report the payments can be included in the Notes section of the reporting template.

Reporting entities are encouraged to document their due diligence in determining their reporting obligations under the Act, including their analysis of the facts and circumstances of specific situations.

Do businesses have to submit a report in situations of receivership or bankruptcy?

The Act does not include any provision that would exempt a reporting entity from its obligations to disclose reportable payments, even in cases of receivership or bankruptcy. As such, a reporting entity in receivership or bankruptcy is required to disclose any reportable payments made in a given financial year up to the point at which it ceased operating.

Section 8(2) of the Act also stipulates that ESTMA reports must continue to be made available online for five years and records of payments to governments must be retained for seven years from the date the information on a payment was published in a report and provided to NRCan.

In situations of receivership, court-appointed receivers may be empowered to take any steps required to meet any of an entity’s statutory obligations through their receivership orders. As such, a court-appointed receiver may be able to produce an ESTMA report and attest to it in the event that the officers of a reporting entity in receivership are not available to do so. If NRCan has not received a report or a statement of no reportable payments from a reporting entity that is in receivership, the Department may request that its receiver meet that obligation on its behalf.

Should reporting entities in situations of receivership or bankruptcy encounter challenges in meeting their reporting requirements, they are encouraged to provide details of these circumstances to NRCan by email.

How do businesses report when they are in the midst of mergers and acquisitions?

Mergers and acquisitions involving reporting entities entail some considerations for reporting and compliance under the Act.

Which party is responsible for reporting in case of an acquisition or merger?

If a merger or acquisition triggered an end of financial year for any reporting entities involved, they should submit ESTMA reports disclosing any reportable payments made in their financial years up to the effective date of the consolidation or transaction. NRCan allows parties of a merger or acquisition to report separately or have one party report on behalf of the other(s) – the sole requirement being that all qualifying payments are reported to NRCan in a timely and accurate manner. If one party assumes responsibility for reporting on behalf of the other(s), a descriptive note should also be included in their ESTMA report.

Which party, if any, is responsible for maintaining reports online and retaining payment records?

If a reporting entity ceases to operate or exist as a separate corporate entity because of a merger or acquisition, the Act requires that its reports and information be made available to the public for a period of five (5) years. As such, a parent entity must continue to make the reports of any reporting entity it acquires available online, just as a new corporate entity created from a merger with a reporting entity must continue to make the previous reports of all parties to the merger accessible to the public.

Additionally, entities must keep records of their payments made in a financial year for a seven (7) year period that begins on the day on which entities provide their reports to NRCan or are deemed to have done so through a consolidated or substituted report. In an acquisition scenario, a parent entity would therefore have to retain the financial records of an entity it acquired for the prescribed period, and a merged entity would have to retain the separate financial records of each of the parties to the merger.

Are amalgamated entities required to submit an ESTMA report?

An amalgamated corporate entity whose predecessors were reporting entities and that operates under a new legal name should enroll with NRCan to obtain a unique ESTMA ID number if they continue to qualify as a reporting entity under the Act.

Amalgamated entities operating under the legal name of one of their predecessors do not have to enroll with NRCan a second time, but should:

- Notify NRCan via email that a merger has taken place;

- Transmit a copy of the Certificate of Amalgamation; and

- Inform NRCan which ESTMA ID number should be retained for reporting purposes

Are entities required to report changes related to shares and stock exchange listings?

As part of some acquisitions, acquiring entities may purchase all the issued and outstanding common shares of the acquired businesses and the acquired businesses will be delisted from Canadian stock exchanges. As such, reporting entities should notify NRCan of any changes to their reporting status following an acquisition.

Compliance

Will NRCan be conducting compliance verification or audits of the ESTMA reports?

NRCan will be taking a hybrid risk- and complaint-based approach to compliance verification. ESTMA reports are assessed based on an internal risk assessment framework and actionable third-party complaints to ensure ESTMA compliance and data integrity. Entities found to be at a higher risk of non-compliance may be flagged for further compliance verification, including requests for information/documents, interviews, or third-party audits conducted at the entity’s own expense. Examples of risk criteria that may be considered when determining entities that are at higher risk of non-compliance include:

- Entities that submit a report with multiple errors

- Entities that do not rectify errors in their reports in an acceptable and timely manner

- Entities that did not report on or provide context on why they did not have to report on joint ventures

- Entities that are flagged for data anomalies

What happens if a reporting entity fails to comply with the reporting requirements (sections 9, 12 or 13) of the Act?

NRCan is committed to undertaking outreach and working with industry to ensure that reporting obligations are well understood. If a person or entity is found to be willfully not compliant with reporting requirements or corrective measures, obstructs an audit, knowingly provides false or misleading information, or fails to comply with any other provisions in sections 9, 12 or 13 of the Act, NRCan may recommend prosecution to the Director of Public Prosecutions under section 24 of the Act, which allows for fines of up to $250,000 per day per offence.

Can a third party submit a complaint about a report?

NRCan will consider requests by third parties to further examine a report submitted under the ESTMA if there are reasonable grounds that support further scrutiny. Requests for further examination of a submitted report can be sent by email or regular mail to:

Extractive Sector Transparency Office

Lands and Minerals Sector

Natural Resources Canada

580 Booth Street, 9th floor

Ottawa, ON K1A 0E4

Can a third-party complaint be submitted on an anonymous basis?

An anonymous third-party complaint may be submitted without having a name and identity associated with it. However, where information is provided anonymously, NRCan will not be able to contact the complaining party for additional information nor will it inform them of the findings or status of a resulting compliance review. If you wish to submit identifying information along with a third-party complaint for communications purposes while also remaining anonymous, please clearly indicate this in your communications with NRCan.

Will NRCan investigate suspected criminal activity?

The ESTMA was developed to deter and detect corruption, including any forms of corruption under any of sections 119 to 121 and 341 of the Criminal Code and sections 3 and 4 of the Corruption of Foreign Public Officials Act. The responsibility for investigations of any possible criminal activity will rest with the relevant law enforcement agency. Any suspected evidence of bribes, corruption, or related offences uncovered by, or provided to, NRCan staff will be immediately referred to the Royal Canadian Mounted Police (RCMP) and any other relevant law enforcement agency. Entities, external auditors, and other relevant persons are strongly encouraged to report any suspected bribes or related offences directly to the RCMP (see the Report Corruption section of the RCMP’s Corruption website).

- Learn about the ESTMA and its key reporting obligations

- Learn how to enroll with Natural Resources Canada

- Learn how to prepare an ESTMA report and download technical reporting specifications, guidance, reporting templates and forms

- Learn how Natural Resources Canada determines acceptable substitutes for those under the ESTMA and view current substitution determinations

- View all ESTMA reports published within the last five years

- Contact the Extractive Sector Transparency Office

Page details

- Date modified: