Tax incentives for mining and exploration

Canada offers tax incentives for mining activities, including concentrating, smelting and refining, as well as exploration. These incentives from the federal and provincial/territorial governments reduce the tax load for mining companies doing business in Canada and other countries.

On this page

- Provincial and territorial mining taxes and royalties deductions

- Capital cost allowances

- Accelerated capital cost allowances

- Canadian exploration expense claims

- Canadian development expense claims

- Qualifying environmental trusts

- Foreign resource expense and foreign exploration and development expense claims

- Flow-through shares

- Mineral exploration tax credit

Provincial and territorial mining taxes and royalties deduction

Mining taxes and royalties paid to a province or territory for mineral resource income are fully deductible when calculating income for federal income tax.

Capital cost allowances

Most capital assets bought by mining and oil and gas companies qualify for a depreciation rate of 25% on a declining balance basis. The depreciation of tangible assets is allowed under the system of capital cost allowances (CCA). The capital cost of each asset used to earn resource income is allocated to the appropriate class of assets for which a maximum annual depreciation rate is established. Government assistance, such as grants and investment tax credits, plus proceeds from the sale of assets (not exceeding the purchase price), are deducted from the class.

Accelerated capital cost allowances

Accelerated capital cost allowances (ACCAs) for oil sands projects were phased out in 2014. ACCAs for mining were phased out over 2017 to 2020.

Canadian exploration expense claims

Canadian exploration expenses (CEEs) are the costs incurred while determining the existence, location, extent or quality of a mineral resource, petroleum or natural gas in Canada. Since 2018, CEEs no longer include costs involved in bringing a new mine into production, including removing soil or sinking a mine shaft.

CEEs are 100% deductible in the year in which they occur. You can carry unused balances forward indefinitely or transfer them to investors as flow-through shares.

See Section 66.1(6) of the Income Tax Act for more information.

Canadian development expense claims

Canadian development expenses (CDEs) are the costs incurred for:

- sinking or excavating a mine shaft, main haulage way or similar underground work after a mine comes into production

- developing a mine before production

- buying a Canadian mineral property

CDEs can be deducted at a 30% declining balance. You can carry unused balances forward indefinitely or transfer them to investors as flow-through shares (excluding the cost of a Canadian mineral property).

See Section 66.1(6) of the Income Tax Act for more information.

Qualifying environmental trusts

Under a qualifying environmental trust (QET), contributions to qualifying trusts that support mine reclamation can be deducted in the year in which they occurred.

Foreign resource expense and foreign exploration and development expense claims

Canadian mining companies can claim exploration and development costs outside of Canada as a foreign resource expense (FRE) deduction. This is done on a country-by-country basis. The basic FRE deduction for each country is between 10% and 30% of the cumulative FRE balance for that country, but it cannot exceed the amount of available foreign resource income for that country. However, a supplemental FRE deduction may be allowed if the country limitation results in a global FRE claim of less than 30%.

Note: Before 2001, all foreign exploration and development expenses (FEDE) incurred by a Canadian corporation were grouped together in one global tax “pool” called the FEDE balance. If your corporation still has an FEDE pool, it must first take an FEDE deduction equal to the available foreign resource income of the year or 10% of the available FEDE, whichever is greater.

Flow-through shares

A flow-through share (FTS) allows a principal business corporation (PBC) to raise funds for mineral exploration and development in Canada.

By issuing FTSs, a company can “flow through” certain expenses to the share purchaser. These expenses are then considered to have been incurred by the investor, not the corporation. This can reduce the investor’s taxable income.

Individual investors benefit in the following ways:

- They receive a 100% tax deduction for the amount they invested in the shares, plus a 15% or 30% tax credit in the case of an eligible expense.

- They may see their investment appreciate if the exploration is successful.

The corporations issuing FTSs do not have to be Canadian, but the FTS investors must pay taxes in Canada and incur the expenses in Canada on qualified activities. Resource expenses that may be flowed through include CEEs and CDEs (excluding the cost of a Canadian mineral property).

Mineral exploration tax credit

The mineral exploration tax credit (METC) is a 15% credit designed to help exploration companies raise equity funds in addition to the regular tax deduction associated with FTS investments. In 2018, the government extended the METC until March 31, 2024.

How does the METC work?

The METC is a 15% non-refundable tax credit on eligible exploration expenses. Investors can apply it against the federal income tax that they would otherwise pay for the taxation year in which the investment was made. The credit can be carried back 3 years and carried forward 20 years. A taxpayer claiming the METC may also claim the 100% CEE deduction, which applies for both federal and provincial/territorial income tax purposes.

Taxpayers in provinces or territories that provide additional exploration incentives may combine those with the METC. However, using any tax credit offered by the provinces or territories reduces the amount of expenses that are eligible for the METC and the amount of deductible CEE.

Eligible taxpayers

Individuals (other than a trust) who are deemed to incur eligible exploration expenses, either individually or through a partnership, pursuant to an FTS agreement with a PBC, are eligible for the METC. For these purposes, a PBC is a corporation whose principal business is exploration, mining or mineral processing.

Eligible exploration expenses

Expenses eligible for the METC are defined as flow-through mining expenditures (FTMEs). Technically, FTMEs are restricted to the type of Canadian exploration expenses that are described in paragraph (f) of subsection 66.1(6) of the federal Income Tax Act. For example, costs related to prospecting and carrying out geological, geophysical or geochemical surveys conducted from or above the surface of the earth in searching for a base metal or precious metal deposit are eligible expenses for METC treatment.

Corporate responsibilities

The METC is only available for expenses related to exploration carried out from or above the surface of the earth. However, a corporation may also incur expenses that qualify only for the CEE deduction. The corporation is responsible for identifying and renouncing the different categories of exploration expenses for federal income tax purposes.

Benefits of investing in the METC

Because the federal investment incentive is delivered in the form of a tax credit, it is the same for all individual investors, regardless of their marginal federal income tax rates. However, a number of federal FTS incentives are still delivered in the form of income tax deductions. The values of those deductions can vary with a taxpayer’s marginal tax rate. Taxpayers’ after-tax situations will therefore depend on their province or territory of residence.

Understanding the after‑tax cost of a $1,000 FTS investment

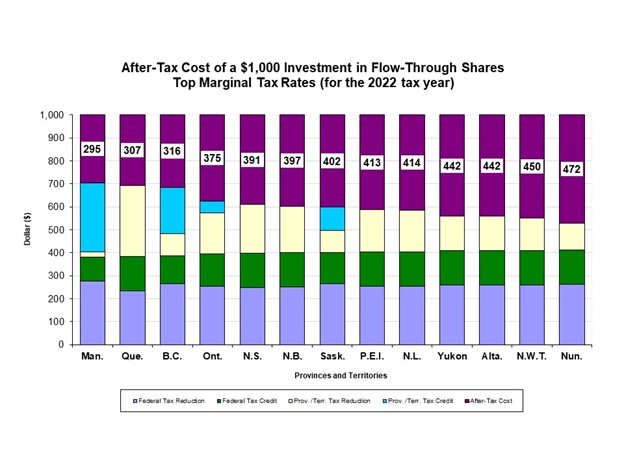

The chart below shows the after-tax costs of a $1,000 FTS investment depending on which province or territory the taxpayer lives in. (The chart was created using top marginal tax rates for 2022.)

Text version

After-tax cost of a $1,000 investment in FTSs by top marginal tax rates (for the 2022 tax year)

The chart is a stacked bar chart that highlights the after-tax cost of a $1,000 investment in FTSs for the province or territory where the taxpayer resides, taking into account the top marginal tax rate of the taxpayer for the 2022 tax year.

The taxpayer reduces the cost of their investment according to the amount of abatements or tax credits available under the tax acts in force where they reside. The investment cost data by jurisdiction are shown in ascending order. A taxpayer in Manitoba has the lowest after‑tax cost at $295. This is followed by Quebec at $307, British Columbia at $316, Ontario at $375, Nova Scotia at $391, New Brunswick at $397, Saskatchewan at $402, Prince Edward Island at $413, Newfoundland and Labrador at $414, Yukon and Alberta at $442, the Northwest Territories at $450 and Nunavut at $472. The variation in the after-tax costs is due mainly to the different tax rates in force and the availability of tax credits and allowances over and above the CEE deduction.

Page details

- Date modified: