Natural Resources Canada Quarterly Financial Report (unaudited) For the Quarter Ended December 31, 2011

Statement outlining results, risks and significant changes in operations, personnel and programs

1. Introduction

This quarterly financial report should be read in conjunction with the Main Estimates, Supplementary Estimates A and B and previous quarterly financial reports for the current year. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly financial report has not been subject to an external audit or review.

1.1 Authority, Mandate and Program Activities

Natural Resources Canada (NRCan) seeks to enhance the responsible development and use of Canada’s natural resources and the competitiveness of Canada’s natural resources products. We are an established leader in science and technology in the fields of energy, forests, and minerals and metals and use our expertise in earth sciences to build and maintain an up-to-date knowledge base of our landmass. NRCan develops policies and programs that enhance the contribution of the natural resources sector to the economy and improve the quality of life for all Canadians.

Further details on NRCan’s authority, mandate and program activities can be found in Part II of the Main Estimates.

1.2 Basis of Presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes NRCan’s spending authorities granted by Parliament, and those used by NRCan are consistent with the Main Estimates, Supplementary Estimates A and B, Operating Budget Carry Forward and reimbursements from Treasury Board of eligible paylist expendituresFootnote 1 for the 2011-12 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

NRCan uses the full accrual method of accounting to prepare and present its annual unaudited departmental financial statements that are part of the Departmental Performance Report. However, the spending authorities voted by Parliament remain on an expenditure basis of accounting.

2. Highlights of Fiscal Quarter and Fiscal Year To Date Results

This departmental quarterly financial report should be read in conjunction with the first and second quarterly financial reports. The details presented in this report focus on and compare the third quarter and year-to-date results of 2011-12 with those of 2010-11.

Authorities

Year-to date, the authorities available for use have decreased from $4,539 million in 2010-11 to $4,262 million in 2011-12 for a net decrease of $277 million.

During the third quarter of 2011-12, the authorities available for use have increased by $567 million; from $3,695 million as reported in the second quarterly financial report to $4,262 million as reported in the Statement of Authorities table of the current quarterly financial report.

Comparatively, during the third quarter of 2010-11, the authorities available for use increased by $41 million (from $ 4,498 million to $4,539 million).

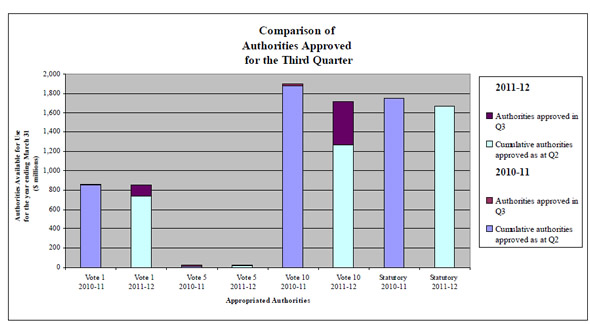

The increase in authorities approved during the third quarter of both 2011-12 ($567 million) and 2010-11 ($41 million) are highlighted in Graph 1 below:

Graph 1

Comparison of Authorities Approved for the Third Quarter

Text Version

Graph 1

| 2010-11 | 2011-12 | |||

|---|---|---|---|---|

| Cumulative authorities approved as at Q2 | Authorities approved in Q3 | Cumulative authorities approved as at Q2 | Authorities approved in Q3 | |

| Vote 1 | 851 | 10 | 735 | 114 |

| Vote 5 | 16 | 10 | 20 | 4 |

| Vote 10 | 1,878 | 21 | 1,268 | 449 |

| Statutory | 1,754 | - | 1,673 | - |

| Total Authorities Available for Use | 4,498 | 41 | 3,695 | 567 |

During the third quarter of 2011-12 the approved increase in authorities of $566.6 million reflect $549.8 million approved in Supplementary Estimates B and $16.8 million from reimbursement of eligible paylist from Treasury Board as follows:

- $114.1 million in Operating expenditures authorities for the following items:

- $71.9 million in support of Clean Energy programs;

- $16.8 million in reimbursement of eligible paylist expenditures from the Treasury Board;

- $11.7 million to defray operational expenditures of the Atomic Energy of Canada Limited Restructuring Sector to complete the divestiture of the CANDU Reactor Division of Atomic Energy of Canada Limited;

- $7.3 million to support the Forest Innovation Program and the Expanding Market Opportunities Program;

- $6.0 million related to government advertising programs;

- $3.7 million to help Canadians adapt to the impacts of climate change under Canada’s Clean Air Agenda;

- $1.8 million for the renewal of the Genomics Research and Development Initiative; and

- offset by a $5 million decrease in net transfers to other government departments for various initiatives and the internal reallocation of resources.

- $3.6 million in Capital expenditures authorities for the following initiatives:

- $2.8 million in transfers for the construction of the Canadian Forces Arctic Training Centre in Resolute, Nunavut;

- $0.6 million for internal reallocations of resources across votes; and

- $0.3 million from other government departments for public security related to the Chemical, Biological, Radiological and Nuclear Research and Technology Initiative.

- $448.9 million in Grants and contributions authorities for the following programs:

- $397.9 million in support of Clean Energy programs;

- $52.1 million to support the Forest Innovation Program and the Expanding Market Opportunities Program; and

- offset by a $1 million decrease in transfers to other government departments.

Comparatively, during the third quarter of 2010-11, the authorities available for use increased by $41 million. The increase in authorities occurred as follows:

- $9.7 million in Operating expenditures, the most significant changes occurred as follows:

- $9 million for the reimbursements of eligible paylist expenditures and other adjustments from the Treasury Board;

- $18.6 million increase in several departmental programs; and

- offset by $17.5 million as a result of reduction due to the Strategic Review ($14.1 million), reduced authorities in collective bargaining ($2.2 million) and for the Port Hope Area Initiative ($1.2 million).

- $10.4 million in Capital expenditures authorities, most of which were for the following initiatives:

- $9 million related to the Arctic Research Infrastructure Fund; and

- $0.9 million in transfers from other government departments for public security related to the Chemical, Biological, Radiological and Nuclear Research and Technology Initiative.

- $21.1 million in Grants and contributions authorities for the following programs:

- $23.6 million for investments in Forest Industry Transformation Program;

- $9.3 million for Non-Reactor-Based Isotope Supply Contribution Program;

- $3.9 million increase for various contribution agreements; and

- offset by $15.6 million as a result of reduction due to Strategic Review ($7.8 million) and reduced authorities in ecoEnergy for Biofuels ($7.8 million).

There were no changes to statutory authorities in the third quarters of 2011-2012 and 2010-2011.

Budgetary Expenditures by Standard Objects

Year-to-date spending represents $1,842 million (43.2%) of total funding available compared to $2,450 million (54.5%) at the same time last year, for a year-to-date net decrease of $608 million. The decrease is primarily attributable to delay in spending due to a later than usual budget following the election of May 2011.

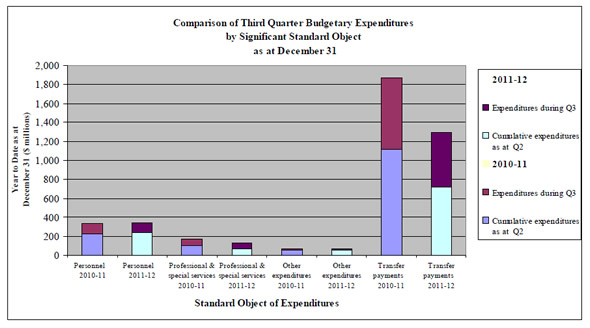

As shown in Graph 2 below and also presented in the Budgetary Expenditures by Standard Object table, personnel, professional and special services and transfer payments are the most significant categories of expenditures. Combined, they represent 97.4% ($744.3 million) of the total departmental expenditures for the third quarter of 2011-12.

Graph 2

Comparison of Third Quarter Budgetary Expenditures by Significant Standard Object as at December 31

Text Version

Graph 2

| 2010-11 | 2011-12 | |||

|---|---|---|---|---|

| Cumulative expenditures as at Q2 | Expenditures during Q3 | Cumulative expenditures as at Q2 | Expenditures during Q3 | |

| Personnel | 225 | 115 | 241 | 108 |

| Professional & special services | 107 | 62 | 69 | 59 |

| Other expenditures | 55 | 17 | 59 | 13 |

| Transfer payments | 1,120 | 749 | 716 | 578 |

| Total gross budgetary expenditures | 1,507 | 943 | 1,084 | 758 |

Expenditures decreased by $185.3 million between the third quarter of 2010-11 ($943 million) and 2011-12 ($757.7 million). The decrease is highlighted as follows:

- Personnel expenditures decreased by $7.1 million primarily as a result of a:

- delay in payment for employer contributions ($4.5 million); and

- decrease in part-time and casual employees ($2.2 million).

- Professional and special services decreased by $4.1 million as a result of:

- a reduction in authorities in 2011-12 for the Accelerated Infrastructure Program for projects such as the Federal Contaminated Sites Action Plan ($1 million) and Federal Labs ($3 million).

- Transfer payments decreased by $171.1 million which is primarily attributable to the following:

- a decrease of $117.3 million under the Atlantic Accord Acts payment, which are affected by oil and gas prices and levels of production;

- a decrease of $97.2 million in expenditures attributable to the expiration in 2010-11 of the Newfoundland Offshore Fiscal Equalization Offset statutory payment;

- a decrease of $49 million under the eco ENERGY Home Retrofit Grant Program caused by the late renewal of the program in Budget 2011, resulting in a large share of the payments expected to be made in the fourth quarter;

- a decrease of $14.7 million under the Markets and Innovation (which replaced Innovation and Investing in Canada's Forest Sector) as a result of a decrease in program funding in 2011-12 compared to 2010-11;

- a decrease of $10.4 million associated with the completion of the Clean Air Agenda programs in 2011-12;

- a decrease of $2.4 million under the Leadership for Environmental Advantage in Forestry which is in-line with the approved authorities of the program, $4 million for 2011-12 compared with $6.4 million for 2010-11;

- an increase of $75.7 million under the Pulp and Paper Green Transformation Program which is in-line with the approved authorities of the program, $538.6 million in 2011-12 compared with $387 million in 2010-11;

- an increase of $23.8 million under the ecoENERGY for Biofuels as more projects are underway; and

- an increase of $12.2 million under the Clean Energy Fund as more projects are underway.

3. Risks and Uncertainties

Like other departments, NRCan has had to absorb the impact associated with the operating budget freeze announced in Budget 2010 while mitigating the risks to the delivery of its core mandate. NRCan has been implementing the following actions in this respect:

- Some of the pressures were alleviated through attrition – not staffing vacant positions created by retirement combined with implementation of administrative efficiencies;

- All staffing actions were closely monitored to ensure budgets authorities were respected – in particular, new staffing actions were carefully reviewed to ensure that any vacant positions could be filled by employees potentially affected by the 2009 Strategic Review and/or change in direction of program renewals; and

- Monitoring and reporting measures were enhanced to ensure reduced expenditure levels in the area of travel, hospitality and conferences (i.e., as of December 31, 2011, NRCan has spent $11.4 million or 47% of the Budget 2010 cap of $24.3 million).

In addition to addressing the operating budget freeze, the Department has had to manage risks associated with the diligent implementation of new programs funded in the 2011 Federal Budget tabled in June 2011. Budget 2011 included more than $546 million of new funding for 2011-12 for NRCan.

The late launch during the year of key programs (due to the late Budget 2011 announcements), coupled with lower-than-anticipated economic growth has in some cases affected the pace at which projects based on partnerships with external stakeholders and industry, for example joint research, development and demonstration projects, could be implemented.

Those appropriated authorities that remain unspent as at December 31, 2011 represent 57%, of which 40.7% were committed, 4.5% will be transferred to future years and the remaining 11% was in the free balance and will be monitored closely.

As those risks were identified early in the year, NRCan had identified during the second quarter, mitigation strategies to address possible changes to the spending profile of some programs. In the third quarter, NRCan continued to pay close attention to these strategies and implemented only those that were warranted, such as ensuring that the programs’ performance targets would be met over the actual lives of the programs.

For the remaining part of the 2011-12 fiscal year, NRCan will continue to closely monitor its budget, its human resource management strategy and ensure the timely implementation of measures announced in Budget 2011. More generally, to monitor program funding and expenditures on an ongoing basis, NRCan is building on its existing stewardship and oversight practices, including conducting comprehensive monthly analysis of trends and forecasting in salary expenditures and non-salary expenditures to ensure affordability and sustainability. These analyses continue to be key in the decision-making process to ensure the department remains within its approved resource levels.

Furthermore, NRCan is working to minimize its discretionary operating budget spending. In addition, NRCan has requested the reprofile in both operating and grants and contributions authorities in order to ensure program delivery and address pressures in 2012-13.

Beyond the factors mentioned above, NRCan continues to manage its business in relation to the key operational, strategic and external risks identified in NRCan’s Corporate Risk Profile.

4. Significant Changes in Relation to Operations, Personnel, Programs

Since the first quarterly financial report published on August 29, 2011, NRCan has initiated the launch of programs announced in Budget 2011. The majority of the Budget 2011 items for NRCan were considered in the 2011-12 Supplementary Estimates B and voted by Parliament in December; therefore, they are reflected in current authorities available for use. The remaining Budget 2011 items for NRCan will be considered in the 2011-12 Supplementary Estimates C to be voted by Parliament in March. These are not yet reflected in current authorities of this quarterly financial report.

On August 4, 2011, pursuant to section 31.1 of the Financial Administration Act and to an Order-in-Council (OIC) (P.C. 2011-0877), Shared Services Canada (SSC) was established. The mandate of the new organization is to standardize and consolidate information technology services in the federal government in order to reduce costs, improve services, and leverage capacity in the public and private sectors through pooled resources and greater buying power.

On November 15, 2011, a subsequent OIC (P.C. 2011-1297) was signed to transfer to SSC the responsibility for providing email, data centre and network services from a number of organizations across the Government of Canada, including NRCan. This resulted in NRCan transferring 70 funded positions to SSC. NRCan’s quarterly financial report continues to reflect financial information related to the transferred services.

There have been no other significant changes in relation to operations, personnel and programs during the third quarter.

Approved by:

____________________________

Serge P. Dupont

Deputy Minister

____________________________

Bill Merklinger, CMA

Chief Financial Officer

____________________________

Date signed

Ottawa, Canada

____________________________

Date signed

Ottawa, Canada

| (in thousands of dollars) | Fiscal year 2011-2012 | Fiscal year 2010-2011 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending* March 31, 2012 | Used during the quarter ended Dec 31, 2011 | Used year-to-date at quarter-end | Total available for use for the year ending* March 31, 2011 | Used during the quarter ended Dec 31, 2010 | Used year-to-date at quarter-end | |

| Vote 1 - Net Operating Expenditures | 849,381 | 159,249 | 495,323 | 860,176 | 169,379 | 525,082 |

| Vote 5 - Capital Expenditures | 23,538 | 5,730 | 8,494 | 26,477 | 5,268 | 13,051 |

| Vote 10 - Grants and Contributions | 1,716,388 | 289,395 | 588,023 | 1,898,727 | 246,786 | 572,300 |

| Statutory Payments | ||||||

| Minister of Natural Resources – Salary and motor car allowance |

78 | 58 | 58 | 79 | 19 | 58 |

| Refund of Previous Years Revenue | - | 87 | 87 | - | - | - |

| Collection agency fees | - | - | - | - | 5 | 5 |

| Proceeds from surplus asset disposal | - | 82 | 82 | - | 183 | 317 |

| Contributions to employee benefit plans | 58,743 | 14,686 | 44,058 | 57,568 | 19,189 | 43,176 |

| Grant to the Canada Foundation for Sustainable Development Technology |

- | - | - | 20,000 | - | - |

| Payment to the Canada/Newfoundland Offshore Petroleum Board |

6,825 | (1,547) | 2,531 | 6,500 | 1,736 | 5,758 |

| Contribution to the Canada/Nova Scotia Offshore Petroleum Board |

3,400 | 913 | 2,588 | 3,400 | 31 | 1,707 |

| Payment to the Nova Scotia Offshore Revenue Account |

179,663 | 45,533 | 96,159 | 295,300 | 80,117 | 151,433 |

| Payment to the Newfoundland Offshore Petroleum Resource Revenue Fund |

1,423,982 | 243,547 | 604,579 | 1,371,238 | 323,106 | 845,762 |

| Newfoundland Fiscal Equalization Offset Payments** |

- | - | - | - | 97,188 | 291,564 |

| Total Statutory Payments | 1,672,691 | 303,359 | 750,142 | 1,754,085 | 521,574 | 1,339,780 |

| Total Budgetary Authorities | 4,261,998 | 757,733 | 1,841,982 | 4,539,465 | 943,007 | 2,450,213 |

* Includes only authorities available for use and granted by Parliament at quarter-end: Main and Supplementary Estimates A and B, Operating Budget Carry Forward, reimbursements from Treasury Board of eligible paylist expenditures and Collective Agreements.

** Funding is received later in the year and matches expenditures

Pursuant to section. 31.1 of the Financial Administration Act and Order in Council P.C. 2011-1297 effective November 15, 2011, all unexpended money relating to the new Shared Services Canada Vote 1 – Operating expenditures has been deemed to be appropriated resulting in a reduction for the same amount in Natural Resources Canada Vote 1 – Operating expenditures. The deemed appropriated amounts are included in this table.

| (in thousands of dollars) | Fiscal year 2011-2012 | Fiscal year 2010-2011 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2012 | Expended during the quarter ended Dec 31, 2011 | Year-to-date used at Quarter end | Planned expenditures for the year ending March 31, 2011 | Expended during the quarter ended Dec 31, 2010 | Year-to-date used at quarter-end | |

| Budgetary Expenditures: | ||||||

| Personnel | 431,717 | 107,911 | 348,487 | 404,943 | 115,027 | 340,338 |

| Transportation and communication | 39,168 | 6,915 | 17,586 | 72,875 | 7,896 | 21,832 |

| Information | 9,466 | 4,558 | 5,419 | 32,142 | 917 | 2,140 |

| Professional and special services | 387,466 | 58,548 | 127,635 | 263,201 | 62,652 | 169,888 |

| Rentals | 11,896 | 3,242 | 10,232 | 21,804 | 1,544 | 11,710 |

| Repair and maintenance | 5,796 | 864 | 1,794 | 16,243 | 4,762 | 8,428 |

| Utilities, materials and supplies | 21,916 | 4,003 | 10,637 | 43,628 | 3,818 | 11,148 |

| Acquisition of land, buildings and works | 23,538 | 222 | 5,136 | 26,476 | 3,227 | 6,429 |

| Acquisition of machinery and equipment | 28,161 | 5,941 | 10,097 | 78,743 | 2,975 | 7,895 |

| Transfer payments | 3,330,258 | 577,842 | 1,293,880 | 3,595,166 | 748,962 | 1,868,526 |

| Other subsidies and payments | 6,528 | (6,106) | 27,020 | 18,776 | (1,429) | 22,596 |

| Total Budgetary Expenditures | 4,295,910 | 763,940 | 1,857,923 | 4,573,997 | 950,351 | 2,470,930 |

| Less: | ||||||

| Total Revenues Netted Against Expenditures | 33,912 | 6,207 | 15,941 | 34,532 | 7,344 | 20,717 |

| Total Net Budgetary Expenditures | 4,261,998 | 757,733 | 1,841,982 | 4,539,465 | 943,007 | 2,450,213 |

Page details

- Date modified: