Natural Resources Canada Quarterly Financial Report (Unaudited) for the Quarter Ended December 31, 2014

Statement outlining results, risks and significant changes in operations, personnel and programs

1. Introduction

This quarterly financial report should be read in conjunction with the Main Estimates, Supplementary Estimates (A) and Supplementary Estimates (B), as well as Canada’s Economic Action Plan 2014 (Budget 2014) and previous quarterly financial reports. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly financial report has not been subject to an external audit or review.

1.1 Authority, Mandate and Programs

Natural Resources Canada (NRCan) seeks to enhance the responsible development and use of Canada’s natural resources and the competitiveness of Canada’s natural resource sectors. The department is an established leader in science and technology in the fields of energy, forests, and minerals and metals, and applies its expertise in earth sciences to build and maintain an up-to-date knowledge base of Canada’s landmass. NRCan develops policies and programs that enhance the contribution of the natural resource sectors to the economy and improve the quality of life of Canadians.Footnote 1

Further details on NRCan’s authority, mandate and programs can be found in Part II of the Main Estimates.

1.2 Basis of Presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes NRCan’s spending authorities granted by Parliament, and those used by NRCan are consistent with the Main Estimates, Supplementary Estimates (A) and Supplementary Estimates (B) for the 2014-15 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the Parliamentary business of supply, the Main Estimates must be tabled in Parliament on or before March 1 preceding the new fiscal year. As the Federal Budget is typically tabled around the same time as Main Estimates, measures announced in the Budget are not included in Main Estimates for either 2014-15 or 2013-14.

In fiscal year 2014-15, frozen allotments are established by Treasury Board authority in departmental votes to prohibit the spending of funds identified as savings measures in Budget 2014. The changes to departmental authorities for future years will be implemented through the Annual Reference Level Update, as approved by Treasury Board, and reflected in the subsequent Main Estimates tabled in Parliament. The same approach was taken in 2013-14 for savings measures in Budget 2013.

NRCan uses the full accrual method of accounting to prepare and present its annual unaudited departmental financial statements, which are part of the Departmental Performance Report. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This Departmental Quarterly Financial Report reflects the results as at December 31, 2014, including Main Estimates, Supplementary Estimates (A) and Supplementary Estimates (B) for which full supply was released. The details presented in this report focus on and compare the third quarter (Q3) results of 2014-15 with those of 2013-14.

Authorities

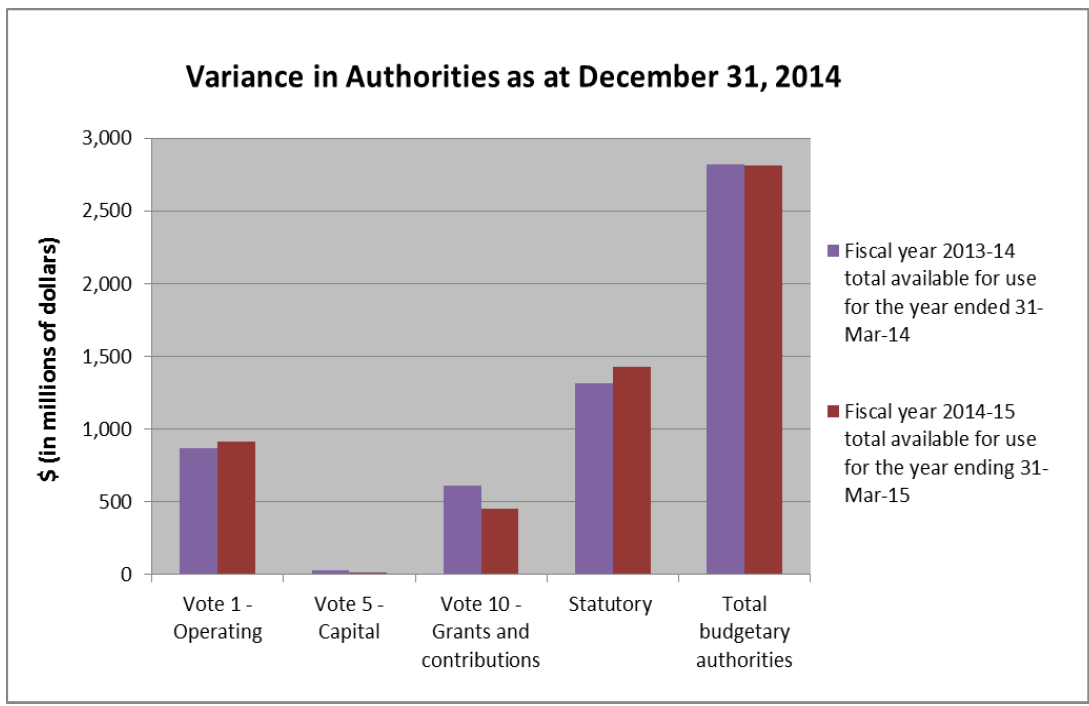

As per Table 1, presented at the end of this document, and on Graph 1 below, as at December 31, 2014, NRCan has authorities available for use of $2,810 million in 2014-15 compared to $2,822.7 million in 2013-14, for a net decrease of $12.7 million or 0.4%.

Graph 1

Text version

| Authority | Fiscal year 2013-14 total available for use for the year ended 31-Mar-14 |

Fiscal year 2014-15 total available for use for the year ending 31-Mar-15 |

|---|---|---|

| Vote 1 - Operating | 869 | 915 |

| Vote 5 - Capital | 29 | 16 |

| Vote 10 - Grants and contributions | 609 | 450 |

| Statutory | 1,316 | 1429 |

| Total budgetary authorities | 2,823 | 2810 |

The decrease of $12.7 million in authorities in 2014-15 compared to 2013-14 is explained by the net effect of both increases and decreases within Vote 1 operating expenditures, Vote 5 capital expenditures, Vote 10 grants and contributions, and statutory authorities, as per the following.

For Vote 1 operating expenditures, a net increase of $46 million between the third quarters of 2014-15 ($915.2 million) and 2013-14 ($869.2 million) in total authorities available for use is explained mainly by the following year-over-year changes:

Increases:

- $29 million for the Port Hope Area Initiative as part of a planned adjustment to the program financial profile;

- $22.9 million for the Nuclear Legacy Liabilities Program as part of a planned adjustment to the program financial profile;

- $17.6 million for the UNCLOS, which is approved in fiscal year 2014-15 through Supplementary Estimates (B); and

- $7.8 million for the Stakeholder Engagement and Outreach Campaign to Build Prosperity for Canada - International Advertising Component as part of a planned adjustment to the program financial profile.

Decreases:

- $16.5 million for the Advertising Campaign Program as it sunsetted on March 31, 2014; and

- $15.2 million for the Budget 2012 Savings Measures and Budget 2013 Travel Reduction as the amount of reduction increased from 2013-14 to 2014-15.

For Vote 5 capital expenditures, a net decrease of $12.5 million between the third quarters of 2014-15 ($16.3 million) and 2013-14 ($28.8 million) in total authorities available for use is explained mainly by the following year-over-year changes:

Increases:

- $1.8 million for transfers from the Operating Vote as part of an alignment exercise in fiscal year 2014-15 only, as the exercise began in 2014-15.

Decreases:

- $10.8 million for the Revitalization of NRCan’s Satellite Station Facilities across Canada as part of a planned adjustment to the program financial profile as work was mostly completed by March 31, 2014; and

- $3.3 million for the relocation of the CANMET Materials Technology Laboratory to Hamilton as work was mostly completed by March 31, 2014.

For Vote 10 grants and contributions, a net decrease of $158.8 million between the third quarters of 2014-15 ($450 million) and 2013-14 ($608.8 million) in total authorities available for use is explained mainly by the following year-over-year changes:

Increases:

- $12.5 million for the grant to Sustainable Development Technology Canada - Tech Fund due to a planned adjustment to the program financial profile.

Decreases:

- $77.4 million for the Clean Energy Fund due to a planned adjustment to the program financial profile resulting from a number of projects not proceeding and the sunsetting of the programs on March 31, 2015;

- $31.1 million for the ecoENERGY for Biofuels Producer Incentive due to a planned adjustment to the program financial profile;

- $29.7 million for the Investments in Forest Industry Transformation Program as it sunsetted on March 31, 2014, and its renewal was included in 2014-15 Supplementary Estimates (B) with a lower funding profile compared to 2013-14; and

- $25 million for the grant to Sustainable Development Technology Canada for the Next Generation Biofuels Fund due to a planned adjustment to the program financial profile.

For statutory items, a net increase of $112.8 million between the third quarters of 2014-15 ($1,428.5 million) and 2013-14 ($1,315.7 million) in total authorities available for use is explained mainly by:

Increases:

- $79.3 million for the Canada Foundation for Sustainable Development Technology - Next Generation Biofuels Fund – Statutory due to a planned adjustment to the program funding profile; and

- $57.4 million in the Newfoundland Offshore Petroleum Resource Revenue Fund as expectations were that more revenue will be collected in 2014-15 than in 2013-14.

Decreases:

- $11.1 million in the Nova Scotia Offshore Revenue Account caused by fluctuations in oil and gas prices and production levels;

- $8.1 million pertaining to the Crown Share Adjustment Payments for Nova Scotia Offshore Petroleum Resources due to a planned adjustment to the program financial profile; and

- $4.6 million for the Contribution to the Employee Benefit Plan as a result of a change in rate and a reduction in salary funding.

In addition to the above detail, other minor increases and decreases occurred within the appropriated funding and in other statutory departmental programs.

Budgetary Expenditures by Standard Object

As at December 31, 2014, year-to-date spending amounts to $1,317.2 million or 46.9% of total funding available, compared to $1,198 million or 42.4% at the same time last year. The increase is mainly related to an increase in transfer payments in 2014-15 compared to payments in 2013-14.

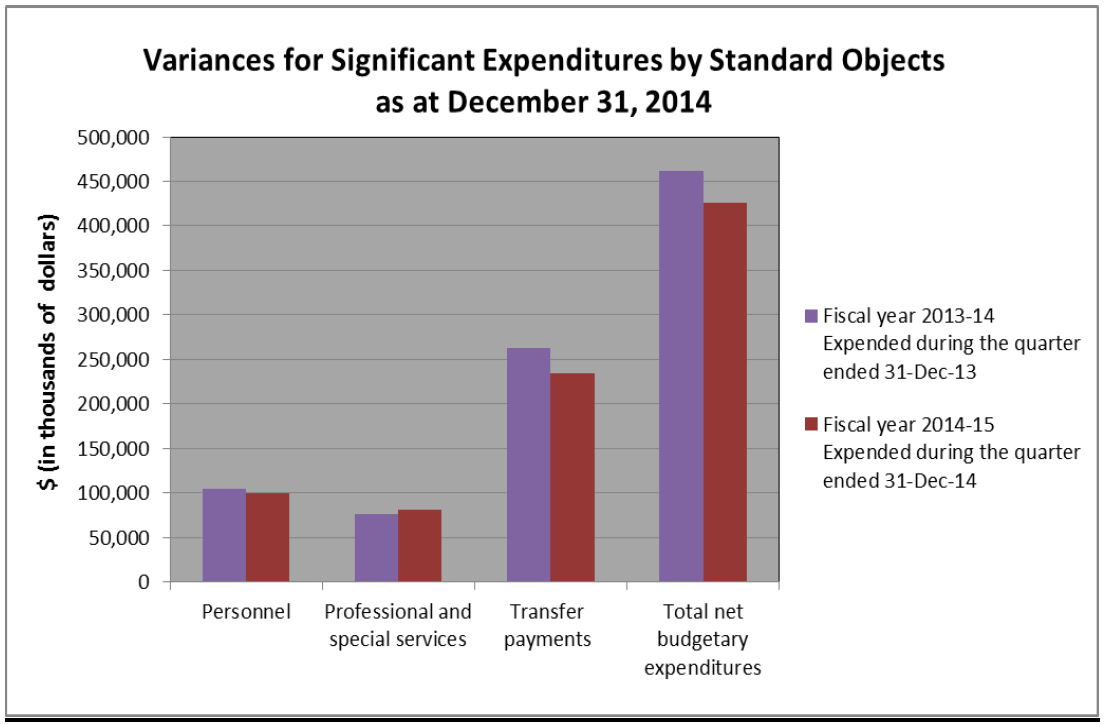

The spending from October 1, 2014 to December 31, 2014, amounts to $426.4 million or 15.2% of total funding available for the fiscal year, compared to $461.9 million or 16.4% for the same quarter last year.

Further analysis has been done on standard objects with significant expenses, which is represented on Graph 2 below. Table 2 at the end of this document presents the spending for all standard objects.

Graph 2

Text version

| Standard Object | Fiscal year 2013-14 Expended during the quarter ended 31-Dec-13 | Fiscal year 2014-15 Expended during the quarter ended 31-Dec-14 |

|---|---|---|

| Personnel | 105,112 | 99,369 |

| Professional and special services | 75,711 | 80,481 |

| Transfer payments | 263,196 | 233,784 |

| Total net budgetary expenditures | 461,886 | 426,385 |

The net decrease of $5.7 million or 5.5% in personnel expenditures for the period October 1 to December 31 between the third quarters of 2014-15 ($99.4 million) and 2013-14 ($105.1 million) is mainly explained by a decrease in FTEs due to the implementation of Budget 2012 Savings Measures, the restructuring of some sectors and a decrease in severance pay to NRCan employees following the ratification of new collective agreements. These reductions also decrease NRCan’s expenditures for the Contribution to the Employee Benefit Plan.

The net decrease of $20.4 million or 6.2% in personnel expenditures between the year-to-date expenditures at the end of the third quarters of 2014-15 ($309.1 million) and 2013-14 ($329.5 million) is related mainly to the same reasons as above.

The increase of $4.8 million or 6.3% in expenditures for professional and special services for the period October 1 to December 31 between the third quarters of 2014-15 ($80.5 million) and 2013-14 ($75.7million) is mainly explained by the following:

Increases:

- $3.6 million related to the Port Hope Area Initiative project due to more invoices being processed in the third quarter of 2014-15 compared to the third quarter of 2013-14;

- $2.7 million related to the Nuclear Legacy Liabilities Program (NLLP) as a result of an increase in payments made in the third quarter of 2014-15 due to an increase in program authorities; and

- $1.1 million due to the ramp-up of the procurement process in 2014-15, which required the ongoing services of external nuclear, financial and legal advisors.

Decreases:

- $1.2 million related to the timing of expenditures from one year to the next for various programs; and

- $1.1 million related to the payments made to Agriculture and Agri-Food Canada for SAP services, as it was paid in the second quarter of 2014 -15 and in third quarter of 2013-14.

The net increase of $8.1 million or 4.2% in expenditures for professional and special services between the year-to-date expenditures at the end of the third quarters of 2014-15 ($201.9 million) and 2013-14 ($193.8 million) relates mainly to the same reasons as above in addition to the following:

Increases:

- $9.2 million related to the Nuclear Legacy Liabilities Program (NLLP) as a result of an increase in payments made in 2014-15 due to an increase in program authorities; and

- $3.3 million due to the ramp-up of the procurement process in 2014-15, which required the ongoing services of external nuclear, financial and legal advisors.

Decreases:

- $1.9 million related to the Cold Stream Well relief drilling that occurred during the third quarter of 2013-14 but did not occur during the third quarter of 2014-15; and

- $1.7 million for the transfers to other government departments as a result of a decrease in various research and development projects.

The decrease of $29.4 million or 11.2% in expenditures for transfer payments for the period October 1 to December 31 between the third quarters of 2014-15 ($233.8 million) and 2013-14 ($263.2 million) primarily consists of:

Increases:

- $3 million for the Contribution to the Canada-Newfoundland and Labrador Offshore Petroleum Board and the Contribution to the Canada-Nova Scotia Offshore Petroleum Board.

Decreases:

- $15 million for the Investments in Forest Industry Transformation Program as it sunsetted on March 31, 2014, and its renewal was included in the 2014-15 Supplementary Estimates (B) with a lower funding profile compared to 2013-14;

- $11 million under the Atlantic Offshore Accord Acts, of which a decrease of $33.2 million is for the payment to the Newfoundland Offshore Petroleum Resource Revenue Fund offset by an increase of $22.2 million for the payment to the Nova Scotia Offshore Revenue Account. These statutory payments mirror, for the most part, royalty revenues collected in relation to offshore oil and gas activity and fluctuate based on oil and gas prices and production levels; and

- $3 million for the ecoENERGY for Biofuels Producer Incentive mainly due to a declining incentive rate, which is part of the program design as the program itself is in its declining years.

The net increase of $138.2 million or 22.9% in expenditures for transfer payments between the year-to-date expenditures at the end of the third quarter of 2014-15 ($742.4 million) and 2013-14 ($604.2 million) is mainly related to the same reasons as above in addition to the following:

Increases:

- $173.7 million under the Atlantic Offshore Accord Acts, of which $133.7 million is for the payment to the Newfoundland Offshore Petroleum Resource Revenue Fund and $40 million for the payment to the Nova Scotia Offshore Revenue Account. These statutory payments mirror, for the most part, royalty revenues collected in relation to offshore oil and gas activity and fluctuate based on oil and gas prices and production levels; and

- $3.7 million for the Contribution to the Canada-Newfoundland and Labrador Offshore Petroleum Board and the Contribution to the Canada-Nova Scotia Offshore Petroleum Board.

Decreases:

- $12.9 million for the Crown Share Adjustment Payment for Nova Scotia Offshore Petroleum Board payment has been delayed to the fourth quarter in the current year.

In addition, the decrease of $1.9 million or 5.9% in expenditures between the year-to-date expenditures at the end of the third quarters of 2014-15 ($30.4 million) and 2013-14 ($32.3 million) for “Other subsidies and payments” is mainly due to a one-time transition payment of $12.6 million for implementing salary payment in arrears by the Government of Canada in 2014-15, offset by a reduction of $10.1 million related to the Incremental Cost Recovery accounts that are not being used in 2014-15 compared to 2013-14 due to an internal reporting change and $4.4 million related to the Interdepartmental Settlement Suspense Account in 2014-15.

3. Risks and Uncertainties

NRCan manages a number of risks, the most prominent of which are identified in its Corporate Risk Profile. The Department recognizes that a solid understanding of the risk environment is fundamental in achieving its strategic outcomes. Within the confines of its mandate and the levers at its disposition, along with the collaboration of its stakeholders, NRCan endeavours to respond to uncertainties and opportunities in the global and domestic contexts and their potential impacts on Canada’s natural resource sectors. NRCan also handles a range of operational risks.

Many of the risks from earlier in the year are persisting and have led domestic and global organizations (e.g., the Bank of Canada, the International Monetary Fund) to make downward revisions to their Canadian growth forecasts. These include financial market turbulence, several geopolitical conflicts and lower prices for many commodities, including oil. To varying degrees, these factors exert pressures on the supply and demand for natural resources which may persist in the short term. While the medium-term global demand for resources remains positive, Canada faces challenges and opportunities to maintain an attractive climate for resource development, including enabling infrastructure development, fostering greater public confidence in natural resource initiatives and ensuring industry resiliency in the face of heightened market volatility. These macro-economic challenges impact all levels of Canada’s resource industries and create uncertainties that may constrain their ability to execute on their business plans. The Department is mindful that these dynamics may affect the pace at which the Department’s projects conducted in partnership with external stakeholders and industry – including joint research, development and demonstration projects – can progress.

Internally, NRCan has mitigated financial risks by closely tracking program uptake, following best practices that comply with the Financial Administration Act and requesting the reprofiling of funds, as required, to ensure program objectives continue to be met. NRCan continues to pro-actively engage with central agencies to manage the financial uncertainty associated with the sunsetting of specific time-limited programs. NRCan also faces challenges in addressing the need to absorb costs related to collective bargaining as well as addressing mounting financial pressures resulting from its aging real property assets. NRCan mitigates its financial risks through scenario planning, the conduct of a monthly analysis of trends and forecasting in salary expenditures and non-salary expenditures, and comprehensive quarterly reviews. NRCan has also implemented several specific initiatives to address these challenges including the development of sector-specific plans to meet existing and anticipated sector financial pressures.

4. Significant Changes in Relation to Operations, Personnel, Programs

A number of promotions and transfers occurred at the Assistant Deputy Minister level, which impacted the Science and Policy Integration Sector and the Major Projects Management Office.

No other significant changes in relation to operations, personnel or programs occurred during the third quarter of 2014-15.

5. Budget 2012 Implementation

This section provides an overview of the savings measures announced in Budget 2012, which have been implemented to refocus government and programs, make it easier for Canadians and businesses to deal with their government, and modernize and reduce the back office.

NRCan’s budget was adjusted in 2012 to implement ongoing annual savings of $107 million by 2014-15, with additional annual savings of $5 million associated with the horizontal review of the International Assistance Envelope. In achieving these savings, NRCan has streamlined corporate support to ensure sustainability and achieve internal efficiencies; focused on core roles and alignment with Government priorities; focused on work that provides clear economic benefits and adapts to changing industry circumstances; and scaled back programs to maintain affordability. In the first year of implementation, NRCan achieved savings of $67.8 million. Savings increased to $84.7 million in 2013-14 and to $107 million in 2014-15 and for future years. In addition, annual savings of $5 million, which began in 2012-13, were achieved through the horizontal review of the International Assistance Envelope.

In implementing these changes, NRCan has made it a priority to treat its employees in an equitable, transparent and respectful manner. The transition to a smaller workforce is virtually complete and the Department is supporting a very small number of employees still engaged in the workforce adjustment process. A planning, monitoring and reporting framework for tracking implementation of Budget 2012 savings measures was developed, and progress on financial, HR and operational adjustments for specific savings initiatives was tracked on a quarterly basis since June 2013. During the fourth quarter of 2013-14, Assistant Deputy Ministers accountable for monitoring and reporting on Budget 2012 savings measures reported that all plans had been fully implemented.

Original Signed by

Bob Hamilton

Deputy Minister

February 25, 2015

Ottawa, Canada

Original Signed by

Kami Ramcharan, CMA

Chief Financial Officer

February 20, 2015

Ottawa, Canada

Table 1: Statement of Authorities (unaudited)

(in thousands of dollars)

| Fiscal year 2014-15 | Fiscal year 2013-14 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2015* |

Used during the quarter ended December 31, 2014 | Used year-to-date at quarter-end | Total available for use for the year ending March 31, 2014** |

Used during the quarter ended December 31, 2013 | Used year-to-date at quarter-end | |

| Vote 1 - Net Operating Expenditures | 915,223 | 175,453 | 524,939 | 869,372 | 179,162 | 538,069 |

| Vote 5 - Capital Expenditures | 16,280 | 3,174 | 8,286 | 28,795 | 4,579 | 10,858 |

| Vote 10 - Grants and Contributions | 450,039 | 71,695 | 170,417 | 608,828 | 93,131 | 196,771 |

| Statutory Payments | ||||||

| Minister of Natural Resources – Salary and motor car allowance |

80 | 20 | 60 | 79 | 19 | 59 |

| Contributions to employee benefit plans | 55,632 | 13,792 | 41,376 | 60,432 | 14,926 | 44,780 |

| Collection agency fees under sec 17.1 of the Financial Administration Act |

- | - | - | - | 4 | 5 |

| Spending of amounts equivalent to proceeds from disposal of surplus crown assets |

- | 88 | 96 | - | - | 28 |

| Canada Foundation for Sustainable Development Technology Grant |

79,338 | - | - | - | - | - |

| Contribution to the Canada/ Newfoundland Offshore Petroleum Board |

7,756 | 2,208 | 6,626 | 7,756 | -1,030 | 2,796 |

| Contribution to the Canada/Nova Scotia Offshore Petroleum Board |

3,550 | (89) | 1,894 | 3,550 | 111 | 1,987 |

| Payments to the Nova Scotia Offshore Revenue Account |

68,216 | 25,638 | 54,205 | 79,339 | 3,392 | 14,227 |

| Payments to the Newfoundland Offshore Petroleum Resource Revenue Fund |

1,199,509 | 134,406 | 509,320 | 1,142,062 | 167,592 | 375,601 |

| Crown Share Adjustment Payments for Nova Scotia Offshore Petroleum Resources |

14,394 | - | - | 22,460 | - | 12,856 |

| Total Statutory Payments | 1,428,476 | 176,062 | 613,578 | 1,315,678 | 185,014 | 452,339 |

| Total Budgetary Authorities | 2,810,018 | 426,385 | 1,317,219 | 2,822,673 | 461,886 | 1,198,036 |

* Total available for use includes only authorities available for use and granted by Parliament at quarter-end through the Main Estimates, Supplementary Estimates (A), Supplementary Estimates (B) as well as carry forward from fiscal year 2014-15 and does not reflect measures announced in Budget 2014.

** Total available for use includes only authorities available for use and granted by Parliament at quarter-end through the Main Estimates, Supplementary Estimates (A), Supplementary Estimates (B) as well as carry forward from fiscal year 2013-14 and does not reflect measures announced in Budget 2013.

Table 2: Budgetary Expenditures by Standard Object (unaudited)

(in thousands of dollars)

| Fiscal year 2014-15 | Fiscal year 2013-14 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2015* | Expended during the quarter ended December 31, 2014 | Year-to-date used at Quarter- end | Planned expenditures for the year ending March 31, 2014** | Expended during the quarter ended December 31, 2013 | Year-to-date used at Quarter-end | |

| Budgetary Expenditures: | ||||||

| Personnel | 395,052 | 99,369 | 309,093 | 408,374 | 105,112 | 329,527 |

| Transportation and communications | 27,118 | 3,446 | 9,117 | 40,007 | 3,668 | 10,012 |

| Information | 9,951 | 1,010 | 3,106 | 10,844 | -2,791 | 9,476 |

| Professional and special services | 475,625 | 80,481 | 201,947 | 400,079 | 75,711 | 193,809 |

| Rentals | 36,029 | 1,748 | 14,855 | 20,856 | 2,289 | 12,192 |

| Repair and maintenance | 5,794 | 1,107 | 1,920 | 7,781 | 648 | 1,556 |

| Utilities, materials and supplies | 29,077 | 3,771 | 9,827 | 32,685 | 4,192 | 10,045 |

| Acquisition of land, buildings and works | 7,001 | 73 | 299 | 25,717 | 222 | 274 |

| Acquisition of machinery and equipment | 28,400 | 3,217 | 9,578 | 36,542 | 5,219 | 13,240 |

| Transfer payments | 1,822,802 | 233,784 | 742,387 | 1,863,994 | 263,196 | 604,238 |

| Other subsidies and payments | 8,218 | 4,829 | 30,361 | 11,562 | 11,678 | 32,274 |

| Total Budgetary Expenditures | 2,845,067 | 432,835 | 1,332,490 | 2,858,441 | 469,144 | 1,216,643 |

| Less: | ||||||

| Total Revenues Netted Against Expenditures | 35,051 | 6,450 | 15,271 | 35,768 | 7,258 |

18,607 |

| Total Net Budgetary Expenditures | 2,810,018 | 426,385 | 1,317,219 | 2,822,673 | 461,886 |

1,198,036 |

* Planned expenditures do not reflect measures announced in Budget 2014.

** Planned expenditures do not reflect measures announced in Budget 2013.

Page details

- Date modified: