Canadian Mining Assets

Information Bulletin

(published in January 2024)

Canada is home to almost half of the world’s publicly listed mining and mineral exploration companiesFootnote 1. Many of these companies have operations in Canada and abroad.

Canadian mining assets (CMAs) dataFootnote 2 reveal important insight into the breadth and depth of the global presence of Canadian mining and mineral exploration companies.

Find out more about CMAs:

- Overview

- Canadian mining assets, by region

- Canadian mining assets located abroad, by country

- Canadian mining assets, by company type

- Annual variations

- Use of statistics on Canadian mining assets located abroad

Overview

A total of 1,423 Canadian mining and exploration companies had CMAs valued at $320.2 billion in 2022, a 14.1% increase from $280.5 billion in 2021. Of these companies, 770 had CMAs located abroad worth $214.7 billion, which was up 11.7% from the 2021 value of $192.2 billion.

In 2022, Canadian companies were present in 98 foreign countries and mining assets abroad accounted for about two thirds of the total value of CMAs.

Significant fluctuations of exchange rates affect the value of CMAs held by companies that report their financial results in US dollars, which account for about 80% of the total value of CMAs. A depreciation of the value of the Canadian dollar against the US dollar between 2021 and 2022 had an upwards impact of 5.3% on the value of CMAs.

Canadian mining assets, by region

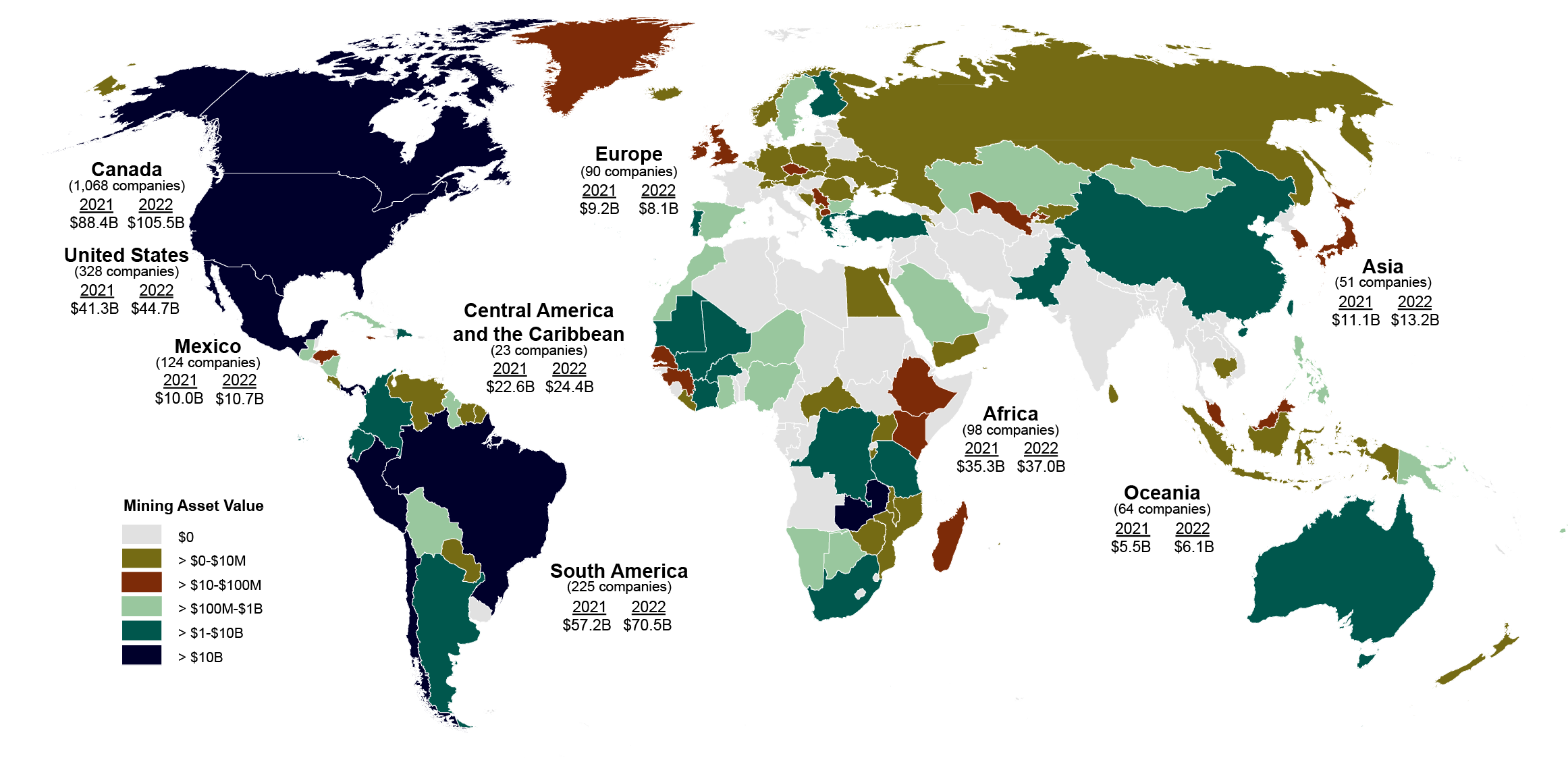

In 2022, CMAs increased in all regions except Europe. Figure 1 provides a detailed geographic breakdown of mining asset values and Table 1 displays the value and percentage variation of CMAs by region between 2021 and 2022.

Figure 1: Geographic distribution of CMAs, 2022 (p)

(1,423 companies with $320.2 billion in mining and mineral exploration assets)

Text version

In this world map, countries are colour-coded according to a range of values for CMAs (for example, countries in brown have CMAs in the range of $10 million to $100 million). For each region and for Canada, the United States and Mexico, the 2021 and 2022 CMAs values are listed along with the number of Canadian-based companies with assets in that region or country. Refer to Table 1 for the specific values in each region.

Source: Natural Resources Canada.

(p) preliminary, M million, B billion.

Note: Asset totals may be different because of rounding.

Company totals may be different because companies can be active in multiple jurisdictions.

| Region | 2021 | 2022 (p) | Change | Change |

|---|---|---|---|---|

| ($ billions) | (%) | |||

| Africa | 35.3 | 37.0 | 1.7 | 4.9 |

| Americas (except Canada) | 131.1 | 150.3 | 19.2 | 14.7 |

| Asia | 11.1 | 13.2 | 2.0 | 18.3 |

| Europe | 9.2 | 8.1 | -1.1 | -11.5 |

| Oceania | 5.5 | 6.1 | 0.6 | 11.6 |

| Total for CMAs abroad | 192.2 | 214.7 | 22.6 | 11.7 |

| Canada | 88.4 | 105.5 | 17.1 | 19.4 |

| Total for CMAs | 280.5 | 320.2 | 39.7 | 14.1 |

Source: Natural Resources Canada.

(p) preliminary.

Note: Totals may be different because of rounding.

Africa was the region with the second-highest value of CMAs and that value increased by 4.9% to $37.0 billion in 2022. Several countries incurred notable increases in CMAs, including the Democratic Republic of the Congo (+$469.2 million), Mali (+$488.6 million), South Africa (+$327.6 million), Tanzania (+$370.2 million) and Zambia (+$622.1 million). These increases were partly offset by decreases in Burkina Faso (-$324.8 million), Ghana (-$406.1 million) and Namibia (-$229.5 million). Noteworthy events contributing to these changes included:

- Burkina Faso: Trevali Mining, which owned and operated the Perkoa zinc mine, filed for bankruptcy in August 2022.

- Democratic Republic of the Congo: Ivanhoe Mines is redeveloping the former producing Kipushi zinc project and expanding operations at the Kamoa-Kakula copper complex.

- Ghana: Golden Star Resources, which owned and operated the Wassa gold mine, was acquired by Chifeng Jilong Gold of China.

- Namibia: Trevali Mining, which owned part of the Gergarub zinc project, filed for bankruptcy.

- South Africa: Ivanhoe Mines is developing the Platreef platinum project.

The majority of CMAs abroad (70.0%) were located in the Western Hemisphere (the Americas except Canada), where the value of assets increased by 14.7% to $150.3 billion in 2022. A large portion of the value was situated in the regions of Latin America and the Caribbean, which accounted for half (49.2%) of CMAs abroad with a value of $105.6 billion in 2022, up 17.6% from the previous year. Notable increases occurred in Argentina (+$1.0 billion), Brazil (+$1.2 billion), Chile (+$10.8 billion), the Dominican Republic (+$0.7 billion), Mexico (+$0.7 billion), Panama (+$0.8 billion) and Peru (+$0.8 billion), while a decline occurred in Suriname (-$0.8 billion). Contributing factors included:

- Argentina: Lundin Mining acquired Josemaria Resources and its Josemaria copper-gold project.

- Brazil: Ero Copper is building the Tucumã copper mine and Sigma Lithium is developing the Grota do Cirilo lithium project.

- Chile: Teck Resources and its partners continued to develop the large Quebrada Blanca Phase 2 copper mine, focusing on pre-operational testing and commissioning in 2022. Capstone Mining and Mantos Copper (private) merged to create Capstone Copper, which owns and operates the Mantos Blancos copper-silver mine and 70% of the Mantoverde copper-gold mine.

- Dominican Republic: Barrick Gold and its partner Newmont (United States) advanced the plant expansion and mine life extension project at the Pueblo Viejo gold mine.

- Peru: Sandstorm acquired a net profit interest in the Antamina copper mine.

- Suriname: Iamgold sold its interest in the Rosebel Gold Mines to Zijin Mining of China.

The United States remained the top country by value for CMAs abroad in 2022, accounting for 20.8% of the total. The cumulative value of CMAs in the United States was $44.7 billion in 2022, which is 8.3% higher compared to the 2021 cumulative value. Increases in the value of CMAs occurred for many of the more than 300 Canadian companies that are present in the United States.

The value of CMAs located in Asia increased by 18.3% to $13.2 billion in 2022. The increase was partly attributable to the reconstitution of Barrick Gold’s (50%) Reko Diq copper-gold project in Pakistan. The project had been stalled since 2011 due to a dispute with the Pakistani Government over licensing.

In Europe, the value of CMAs declined by 11.5% to $8.1 billion in 2022. The decline was partly attributable to the sale of Kinross Gold’s Kupol gold mine in Russia following the invasion of Ukraine by Russia. Eldorado Gold’s impairment charge related to the Certej gold-silver project in Romania and plans to sell the asset also contributed to the decline of the value of CMAs in Europe.

CMAs located in Oceania increased by 11.6% to $6.1 billion in 2022. The value of CMAs is concentrated in Australia, where 59 companies had CMAs that collectively accounted for 84% of the value in the region in 2022.

The value of CMAs in Canada experienced a significant 19.4% increase to $105.5 billion in 2022. Notable contributions to the increase include the merger of two large Canadian firms, Agnico Eagle Mines and Kirkland Lake Gold. The combined company, which continued under the name Agnico Eagle Mines, also made significant investments at its Canadian assets, primarily at the Detour Lake, Canadian Malartic and Meliadine mines. The acquisition of Great Bear Resources and its flagship Dixie gold project in Ontario by Kinross Gold also contributed to the gains.

Canadian mining assets located abroad, by country

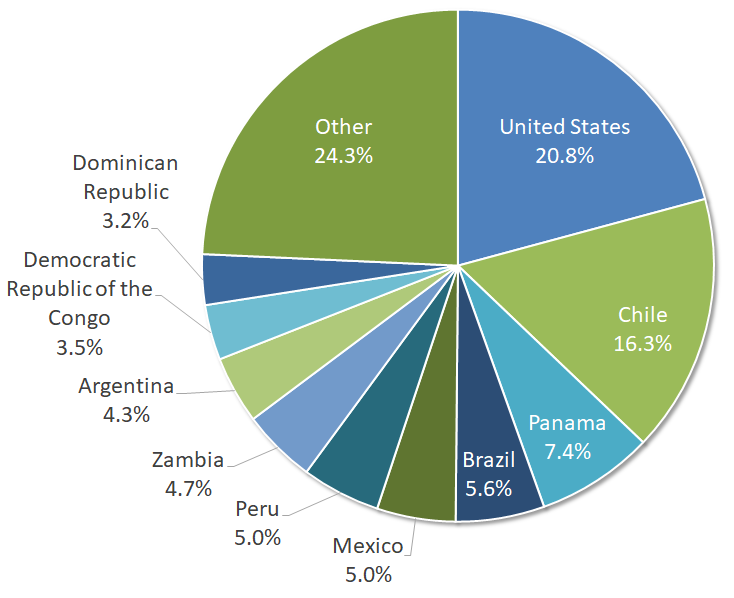

About three quarters (75.7%) of the total value of CMAs abroad was located in the top 10 countries. Country rankings remained unchanged between 2021 and 2022, apart from the Dominican Republic taking the tenth spot from Mali. Figure 2 shows the 2022 distribution of CMAs abroad for the top 10 countries.

Figure 2: Percentage of CMAs abroad, by country, 2022 (p)

Text version

This pie chart shows the 10 leading countries with CMAs abroad in 2022. The top country is the United States (20.8%), followed by Chile (16.3%), Panama (7.4%), Brazil (5.6%), Mexico (5.0%), Peru (5.0%), Zambia (4.7%), Argentina (4.3%), the Democratic Republic of the Congo (3.5%) and the Dominican Republic (3.2%).

Source: Natural Resources Canada.

(p) preliminary.

Canadian mining assets, by company type

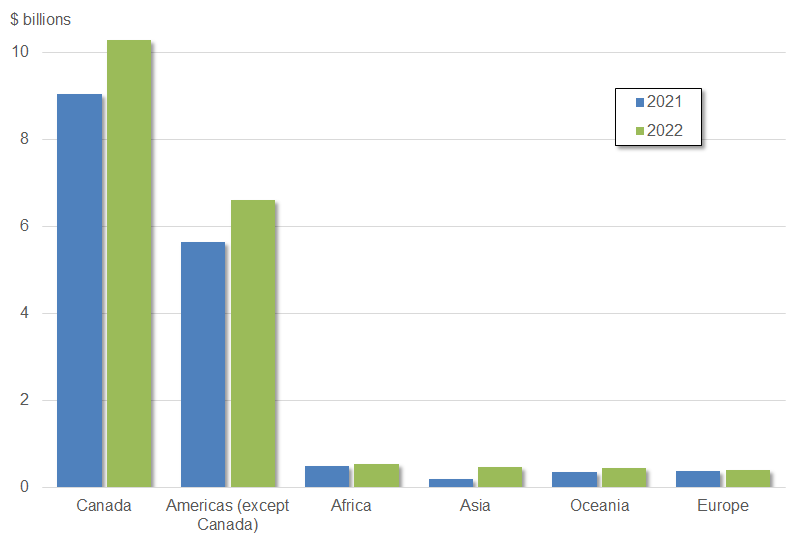

In 2022, the overall value of CMAs held by junior companiesFootnote 3 increased by 16.2% to $18.8 billion. The number of junior companies slightly decreased from 1,265 to 1,257. The increase in the value of CMAs held by junior companies was due to a few companies advancing projects towards production and favourable financing conditions brought on by high mineral and metal prices.

The largest share of assets held by junior companies was located in Canada (54.8%), followed by the Americas (except Canada) (35.2%). Figure 3 provides an overview of the total value of CMAs held by junior companies, by region.

Junior companies accounted for a large share of the total number of companies (88.3%), but a much lower share of the total value of CMAs (5.9%) in 2022. Senior companies accounted for a much larger share of the value of CMAs (94.1%) because of the high values associated with the mines they own and operate.

Figure 3: CMAs of junior companies, by region, 2021 and 2022 (p)

Text version

This column chart shows the geographic distribution of CMAs of junior companies in 2021 and 2022. In Canada, they were valued at approximately $10 billion in 2022 and $9 billion in 2021. In the Americas (except Canada), they were worth $7 billion in 2022 and $6 billion in 2021. In Africa, they were worth $555 million in 2022 and $498 million in 2021. In Asia, they were worth $479 million in 2022 and $205 million in 2021. In Oceania, they were worth $452 million in 2022 and $374 million in 2021. In Europe, they were worth $403 million in 2022 and $391 million in 2021.

Source: Natural Resources Canada.

(p) preliminary.

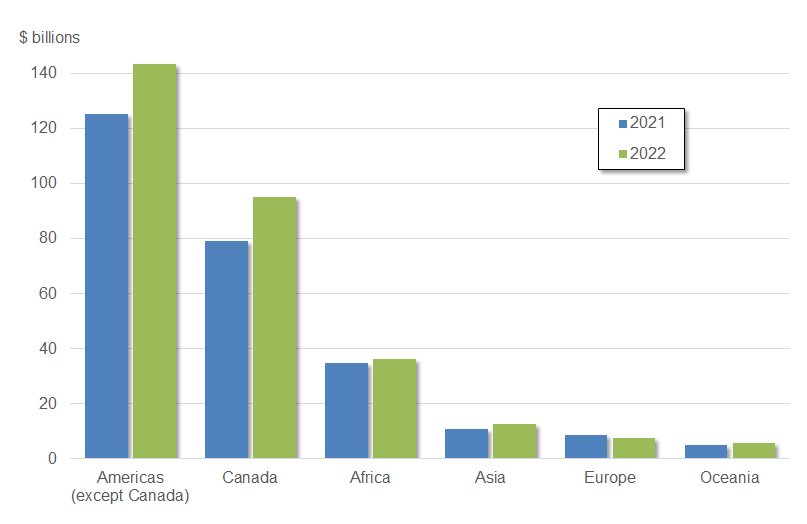

In 2022, the total value of CMAs held by senior companiesFootnote 3 increased by 14.0% to $301.5 billion. Over two thirds of the total value of CMAs were concentrated in the top 10 senior companies, with a cumulative CMAs value of $215.4 billion.

Relative to junior companies, senior companies held a smaller proportion of CMAs values in Canada (31.6%) and a higher proportion in the rest of the Americas (47.7%). Figure 4 provides an overview of the total value of CMAs held by senior companies, by region.

Figure 4: CMAs of senior companies, by region, 2021 and 2022 (p)

Text version

This column chart shows the geographic distribution of CMAs of senior companies in 2021 and 2022. In the Americas (except Canada), they were valued at approximately $143.7 billion in 2022 and $125.5 billion in 2021. In Canada, they were worth $95 billion in 2022 and $79 billion in 2021. In Africa, they were worth $36 billion in 2022 and $35 billion in 2021. In Asia, they were worth $13 billion in 2022 and $11 billion in 2021. In Europe, they were worth $8 billion in 2022 and $9 billion in 2021. In Oceania, they were worth $6 billion in 2022 and $5 billion in 2021.

Source: Natural Resources Canada.

(p) preliminary.

Annual variations

Variations of the value of CMAs can be caused by numerous factors and events. A significant portion of additions to the value of assets results from mergers, acquisitions and mine development. Reductions in the value of assets held by companies result mostly from sales, asset impairment expensesFootnote 4, write-offs, depreciation, depletion and mine closures. Changes in exchange rates, accounting methods and relocation of company headquarters also contribute to annual variations.

Use of statistics on Canadian mining assets located abroad

Data on CMAs abroad provide a picture of the global presence of Canada’s mining and exploration companies and the scope of that presence in any given country. Some care is required when consulting the value of CMAs in a country. CMAs abroad, as tracked by Natural Resources Canada, differ from Canadian direct investment abroad (CDIA) figures estimated by Statistics Canada. CDIA is based on foreign direct investment as defined internationally, which is based on national systems of accounts. CMAs abroad are based on financial accounting standards applied by Canadian public companies and auditors. Table 2 outlines the principal differences between these approaches.

| CDIA | CMAs abroad |

|---|---|

| Source of financing must be Canadian | Source of financing is immaterial |

| All assets and liabilities are examined | Only non-current mining asset values are examined |

| Based on first destination (investment destined for Mexico through a U.S. subsidiary is allocated to the United States) | Based on final destination (the transaction in the left column would be considered CMAs located abroad in Mexico) |

| Canadian company: incorporated in Canada with foreign affiliates | Canadian company: headquarters in Canada and not foreign controlled |

| Limited data by region for mining | CMAs abroad data by country |

Source: Natural Resources Canada.

Annex 1: Canadian Mining Assets (CMAs), by Country and Region, 2021 and 2022 (p)

Note

All amounts are in Canadian dollars.

Page details

- Date modified: