Canadian Mineral Exploration Information Bulletin

Published in June 2023

Mineral exploration plays a key role in ensuring the long-term viability of Canada’s mining industry. It discovers and develops mineral deposits that may become mines that provide the minerals and metals used in many products we use in our daily lives. The deposits are often in remote and northern communities and establishing the mines creates local jobs.

Learn about the latest trends in mineral exploration in Canada:

Overview

Following a decrease in spending on exploration and deposit appraisalsFootnote 1 in 2020, activities rebounded in 2021 as spending surged 72% to $3.8 billion. The trend continued in 2022, reaching the second-highest level of exploration spending on record, at $4.1 billion.

There was little change in the number of mineral exploration projects and companies between 2021 and 2022; projects increased 0.9% to 2,169, and companies increased 0.1% to 779.

However, surface diamond drilling increased significantly in 2022, by 9.7% from 6.5 to 7.1 million metres. The increase was attributable mostly to precious and base metal projects operated by junior exploration companies.

These three increases occurred in conjunction with high mineral and metal prices and positive equity markets that were driven partly by the anticipated surge in demand for the clean energy transition. Global commitments toward net-zero emissions will require vast amounts of the minerals and metals used in technologies such as electric vehicles (EV), wind turbines, solar panels, energy storage and distribution networks.

Growing EV markets have placed significant pressure on the supply chains of the metals used in the vehicle batteries, including graphite, nickel, lithium and cobalt. According to the International Energy Agency, demand for some energy transition minerals is anticipated to increase more than twentyfold by 2040. This reality is reflected in spending on exploration and development for battery metals, which has surged over the past two years.

As well, the Russian invasion of Ukraine substantially increased mineral and metal prices as economies around the world tried to secure alternative sources of supply. In early 2022, several metal prices (e.g. nickel and aluminum) reached unprecedented highs after Russia invaded Ukraine.

Russia is a major producer of precious, base and industrial metals and has significant metals trade with Europe and Asia. Supply chain disruptions and economic sanctions. contributed to an increase in prices for several commodities, including palladium, nickel, aluminum and potash.

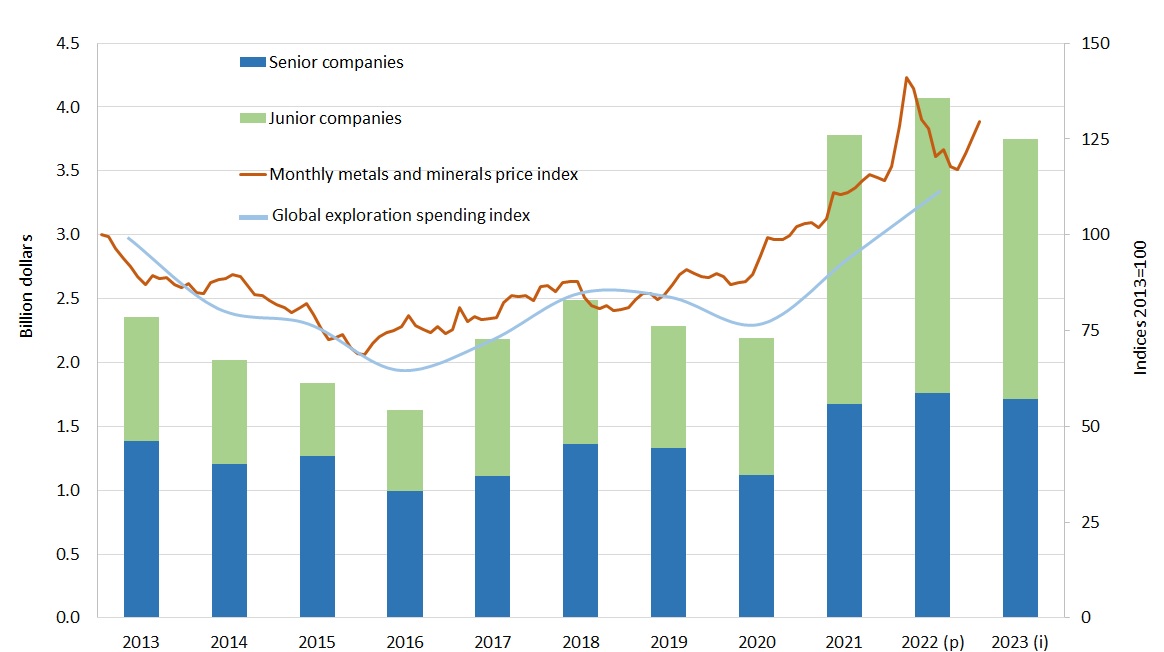

How much money is spent on mineral exploration and deposit appraisal activities depends largely on market conditions and commodity prices. Figure 1 shows how expenditure variations in Canada and globally have been consistent with price trends over the past decade and the recent peaks.

Figure 1. Expenditures, by company type and spending and price index, 2013–2023

Sources: Natural Resources Canada, Institut de la statistique du Québec, Bank of Canada, S&P Global Market Intelligence

p = preliminary expenditures, si = spending intentions

Figure 1 — Text version

This bar chart shows exploration and deposit appraisal expenditures by type of company from 2013 to 2023. Each bar is divided into two segments: one for senior companies and one for junior companies. A line graph depicting the Bank of Canada’s metals and minerals price index is superimposed over the bar graph. A second line graph shows the global exploration spending index. The combined chart shows the strong correlation between metal and mineral prices and exploration and deposit appraisal spending.

Metal and mineral prices reached a cyclical peak in the early 2010s, driven by rapid growth in China and other emerging market economies. Prices subsequently decreased as supply outpaced demand. Prices began to recover in 2016 and continued into 2019 but abruptly shifted for most metals in early 2020 because of the economic lockdowns implemented in response to the COVID-19 pandemic. Metal prices recovered later in the year and have continued to increase, especially for base and clean energy metals, as EV sales continued to increase.

In 2023, spending intentions for mineral exploration and deposit appraisals are anticipated to decrease by 8% to $3.7 billion. The decline is happening in conjunction with a slowdown in equity markets, rising interest rates and the prospect of a recession. However, the anticipated level of spending for 2023 is high compared to historical standards.

Gold is expected to remain Canada’s leading export commodity but to a lesser degree as more spending is allocated to critical minerals.

- In 2023, spending intentions in the Other metals group, which includes lithium, cobalt and rare earth elements (REE), are anticipated to increase by 38%.

- Uranium and base metals (including the critical minerals copper, nickel and zinc) account for 32% of projected investments in 2023, up from 20% in 2020.

Exploration expenditures are anticipated to decline in most provinces and territories in 2023. The largest declines are expected for British Columbia (-33%) and Nunavut (-28%) because a few large projects are transitioning from exploration and deposit appraisal to construction.

Both junior exploration companies and senior mining companies planned to increase exploration spending in 2022, by 10% and 5%, respectively. Their expenditures are then expected to decline by 12% and 2%, respectively, in 2023.

Spending by junior companies is more volatile because they rely largely on equity markets and because their ability to spend is linked to broader market and economic conditions.

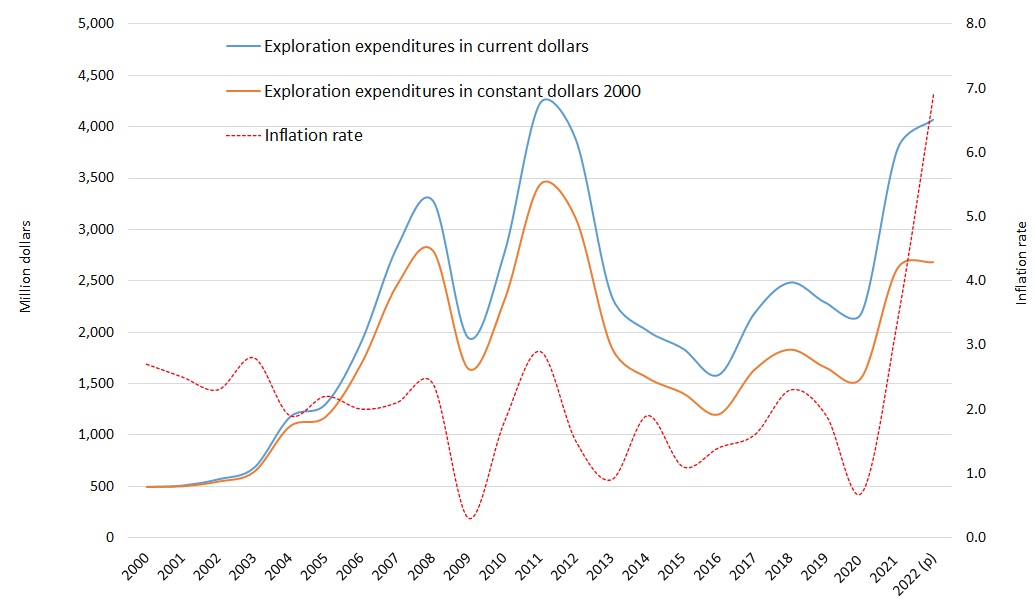

Although exploration spending is at historically high levels, operating and development costs are increasing and limiting the reach of each exploration dollar. A tight labour market, high fuel prices, general inflationary effects, and persistent supply chain constraints caused by the COVID-19 pandemic have combined to put pressure on the finances of mining and exploration companies in recent years. Canada’s consumer price index surged to 6.9% in 2022, a record in over 20 years.

The increased revenues from higher prices helped senior companies offset some of the impacts of rising costs. However, because junior companies do not generate revenue and rely mostly on equity financing, they remain susceptible to the impacts of inflationary costs, especially as equity markets decline.

Figure 2. Relationship between spending and inflation, 2000–2022 (p)

Sources: Natural Resources Canada, Institut de la statistique du Québec, Statistics Canada

Exploration expenditures increased by only 2% in 2022 instead of 8% when we take inflation into account.

Figure 2 — Text version

This line graph shows the trend in exploration expenditures in constant and current dollars in relation to the evolution of the inflation rate. The graph illustrates the impact of inflation on exploration and deposit appraisal expenditures.

Junior and senior companies

The number of junior companies is almost unchanged at 647 in 2022, but their combined spending increased by 9.5% to $2.3 billion, a 10-year high. The reported spending intentions of junior companies indicate a decline of about 12% to $2.0 billion in 2023, reflecting more difficult financing condition with rising interest rates and the prospects of a recession.

Canada is well known for its large contingent of junior companies, which usually have no operating revenue and rely on equity financing. They tend to be small and flexible and to specialize in higher-risk, early-stage exploration activities. Although some junior companies might develop a project on their own or with a partner, senior companies (producers) are traditionally more likely to bring a mine into production.

In 2022, junior exploration companies accounted for 76% of the active projects in Canada and 83% of the project operators.

Although junior companies are characterized as small and nimble, the 20 largest-spending junior companies had expenditures of over $20 million each and accounted for about 40% of the total expenditures by junior companies in 2022.

Expenditures by junior companies reached historic peaks exceeding $2 billion in 2007, 2008 and 2011 but fell to a 12‑year low of $576 million by 2015. Spending started to recover in 2016 and surged 70% to $1.1 billion in 2017. Spending remained stable until 2020, when values almost doubled, but has since exceeded $2 billion.

In 2022, exploration spending by junior companies reached $2.3 billion, the highest value since Natural Resources Canada began collecting data. It was 57% of the total exploration spending this year in Canada.

Because junior companies traditionally rely on financing raised through equity markets, their level of spending is affected by the broader market and economic conditions. Consequently, spending by junior companies is more volatile than that of senior companies, which have operating revenues that help sustain their exploration efforts.

Over the past decade, junior companies accounted for an average of 46% of total spending, but the proportion varied by year from 31% to 57%.

The distribution of spending between the company types is also affected by

- overall budget allocations

- the ability of a company to find financing

- a junior company selling a project to a senior company

- a junior company becoming a senior company because their project transitioned from the development phase to the production phase

These events can have a greater effect on the overall results when they involve a top-spending project or company.

In 2022, the number of senior companies remained unchanged at 132 whereas their combined spending increased by 5% to $1.8 billion. However, spending by senior companies is expected to decline by 2% in 2023 to $1.7 billion.

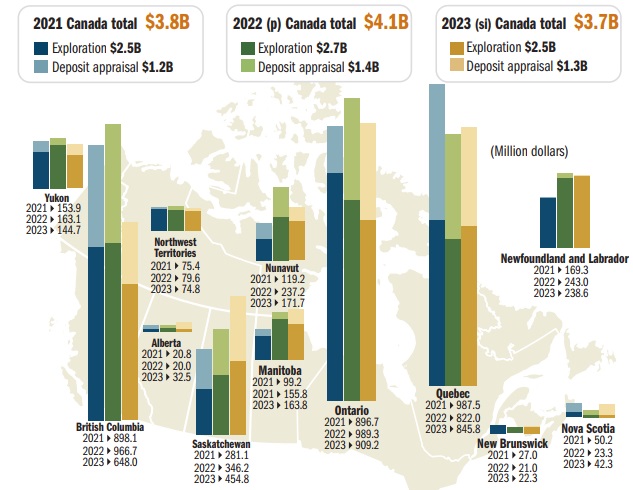

Provinces and territories

In 2022, Ontario had the highest exploration expenditures, followed by British Columbia and then Quebec. Aggregate spending in the three provinces accounted for about 70% of the total exploration expenditures for the year. The same three provinces are anticipated to continue to lead exploration spending in 2023.

Figure 3. Expenditures, by province and territory, 2021–2023

Sources: Natural Resources Canada, Institut de la statistique du Québec

B = billion, p = preliminary expenditures, si = spending intentions

Figure 3 — Text version

Bar charts are superimposed on a map of Canada to represent the expenditures for exploration and deposit appraisals by province and territory for the years 2021, 2022 and 2023. Each bar has one segment for exploration and another for deposit appraisals. The top spending jurisdictions in 2023 are expected to be Ontario ($909 million), Quebec ($846 million) and British Columbia ($648 million).

Exploration spending decreased in only four jurisdictions in 2022: Nova Scotia (-54%), New Brunswick (-22%), Quebec (-17%), and Alberta (-4%). The largest spending increases in terms of dollars were in Nunavut (+$118 million), Ontario (+$93 million), Newfoundland and Labrador (+$74 million), British Columbia (+$69 million), Saskatchewan (+$65 million) and Manitoba (+$57 million). These contributions are attributable largely to higher activity targeting critical minerals, including copper, nickel, uranium and lithium projects. The most significant increases in terms of percentage were in Nunavut (+99%), Manitoba (+57%), Newfoundland and Labrador (+44%) and Saskatchewan (+23%).

Although the exploration spending in 2023 is expected to decrease overall in Canada, expenditures are expected to grow for half the provinces and territories. Sustained high mineral and metal prices are likely to contribute to increased spending, most notably in:

- Nova Scotia (+81%), targeting mostly precious metals

- Alberta (+63%), targeting mostly other metals and coal

- Saskatchewan (+31%), targeting mostly uranium

- New Brunswick (+6%), targeting mostly for precious metals

- Manitoba (+5%), targeting mostly base, precious and other metals

Decreases in exploration spending are anticipated in British Colombia (-33%), Nunavut (-28%) and Yukon (-11%). As projects get closer to making a decision about going into production, they tend to increase spending and that accounts for a larger portion of the overall total. When projects start construction, total spending can decrease. This is the case in British Columbia and Nunavut in 2023, where several projects have moved from spending on deposit appraisals to developing mine complexes.

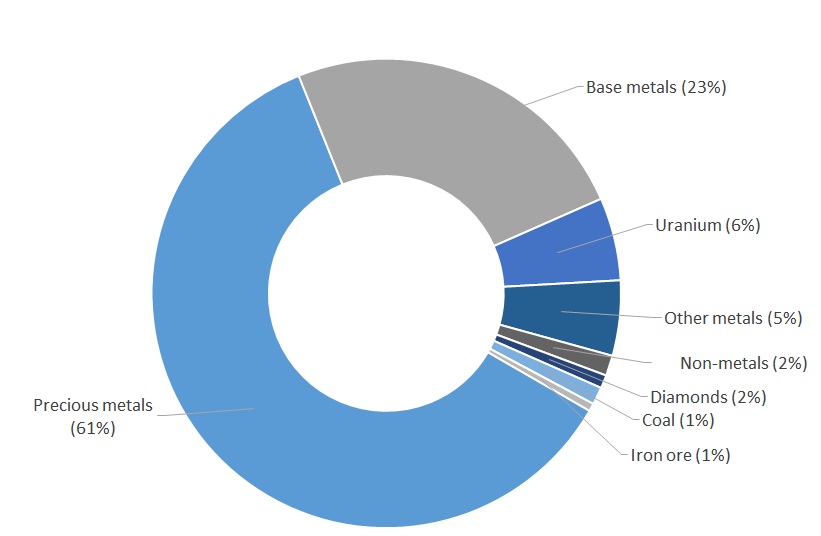

Mineral commoditiesFootnote 2

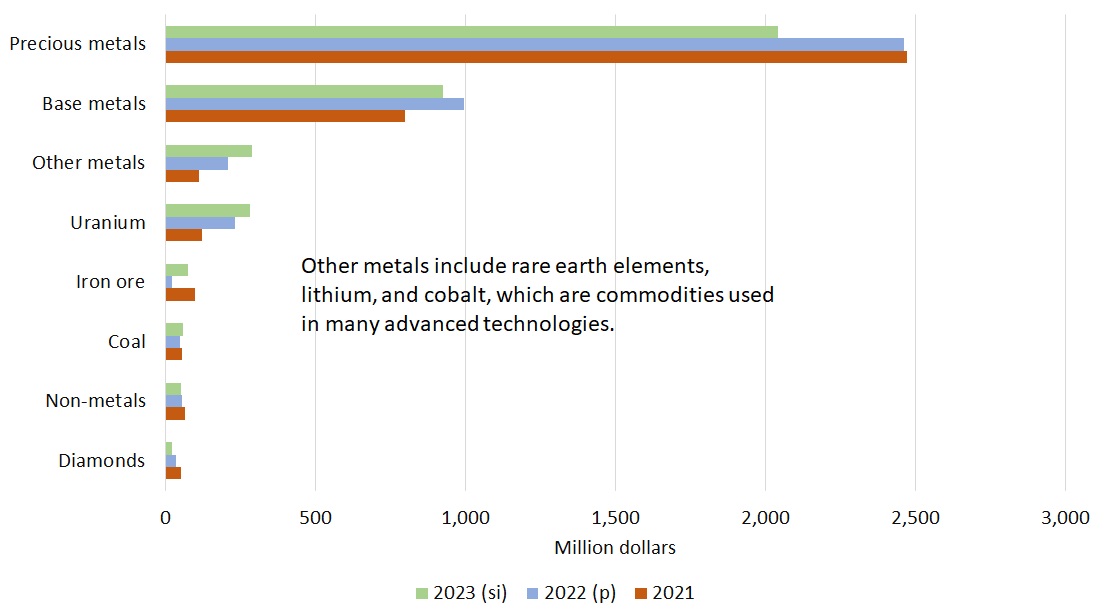

Precious metals (mainly gold) remained the leading commodity group in 2022, accounting for 61% of the spending, down from 65% the year before. Less was spent on precious metals in favour of critical metals. This trend is anticipated to continue in 2023, with the proportion of spending on precious metals expected to decline to 54% of the total spending.

Despite the decline, precious metals continue to be the most sought-after commodity group in every Canadian jurisdiction in 2022, except for Manitoba, Saskatchewan and Alberta.

Uncertainty caused by the COVID-19 pandemic raised prices to record levels of over US$2,000 per ounce by mid-2020. Gold prices subsequently receded as economies slowly reopened, but the Russian invasion of Ukraine and the economic uncertainty that ensued pushed gold prices briefly past US$2,000 per ounce again in early 2022. Since then, prices have fluctuated between $1,700 and $2,000 per ounce.

In 2023, spending on precious metals is expected to decrease by 17%, with notable declines in British Columbia (-$233 million), Nunavut (-$87 million), Quebec (-$40 million) and Ontario (-$35 million). The decline in 2023 might be tempered by rising inflation, the prospect of a recession, and the status of gold as a hedge against inflation and a safe-haven commodity during uncertain economic periods.

Figure 4. Expenditures, by commodity group, 2022 (p)

Sources: Natural Resources Canada, Institut de la statistique du Québec

p = preliminary expenditures

Figure 4 — Text version

This pie chart shows exploration and deposit appraisal expenditures by commodity group for the year 2022 (p). In 2022, expenditures for exploration and deposit appraisals for the precious metals group was 61% of the total, followed by base metals (23%), uranium (6%), other metals (5%), non-metals (2%), diamonds (2%), coal (1%) and iron ore (1%).

In relation to exploration, base metals (copper, lead, nickel and zinc) are the second-most important commodity group, accounting for 24% of total spending in 2022.

In addition, exploration and deposit appraisal expenditures for base metals increased significantly in 2022 to $996 million (25%), and spending is expected to remain close to the same level in 2023. Exploration spending that targets base metals has been paralleling prices for these commodities and trending upward since 2017.

Thanks to a recovery in uranium markets, spending on exploration and deposit appraisal activities jumped 90% to $232 million in 2022. Spending is expected to surge another 21% in 2023 to $281 million, the highest level in more than 10 years. Most of the spending on uranium exploration in Canada was in Saskatchewan.

Other metals, including cobalt, lithium and rare earth elements, have received a lot of attention in recent years because of their use in advanced technologies and energy storage. Spending on exploration and deposit appraisal activities for other metals has matched changes in cobalt and lithium prices, which were up in 2017 and 2018 but decreased in 2019 and through most of 2020 because of abundant supply.

However, the price of battery minerals changed at the end of 2020 and started a recovery based on strong anticipated demand from the global transition to a green economy. The price of carbonate lithium, which was around $12,000 per tonne at the beginning of 2021, reached more than $100,000 per tonne by the end of 2022.

Spending on exploration and deposit appraisal activities for other metals was up 87% in 2022 to $211 million and is anticipated to increase by another 38% in 2023 to $290 million.

Figure 5. Expenditures, by mineral commodity, 2021–2023

Sources: Natural Resources Canada, Institut de la statistique du Québec

p = preliminary expenditures, si = spending intentions

Figure 5 — Text version

This bar chart shows expenditures for exploration and deposit appraisals by mineral commodity from 2021 to 2023. For each year, there are bars for precious metals, base metals, other metals, uranium, iron ore, coal, non-metals, and diamonds. Expenditures for precious metals, including gold, dramatically exceed those on all other commodity groups throughout the period.

In 2022, 37 of the 63 active lithium projects were in Quebec. Exploration activities for lithium were also conducted in Ontario, Alberta, Saskatchewan, Manitoba, the Northwest Territories and Newfoundland and Labrador. Most projects that reported cobalt as one of their primary commodities were in Quebec or Ontario, followed by New Brunswick, Saskatchewan, British Columbia, Newfoundland and Labrador and the Northwest Territories. Cobalt is usually sought in combination with other commodities because it is produced mostly as a co-product of base metal mining in Canada.

Expenditures for exploration and deposit appraisals for non‑metals (mainly potash) decreased by 12% to $57 million in 2022. Spending in this category has been on a downward trend since reaching a peak of $314 million in 2012. Potash prices reached an eight‑year low in 2020 but prices surged after the Russian invasion of Ukraine.

Canada is the top global producer of potash, followed by Russia and Belarus. Spending intentions for 2023 are expected to decline by a further 10% to $52 million. Although potash may not elicit a large portion of the exploration spending because Canada’s deposits are well known, large investments have been made in mine construction over the last decade, leading to increased production capacity. In 2021, the BHP mining company approved development of the Jansen Stage 1 potash project in Saskatchewan. Production is anticipated to start in late 2026.

The COVID-19 pandemic exacerbated an already challenging diamond market, reducing related spending on exploration and deposit appraisal activities by 29% in 2022 to a 20‑year low of $37 million. Saskatchewan is the second-largest jurisdiction in exploration spending in 2022 after the Northwest Territories, contributing 29% of total diamond exploration spending in Canada. Spending intentions in 2023 are expected to decline further to a low of $23 million.

Expenditures for exploration and deposit appraisals for coal (metallurgical and thermal) decreased by 12% to $49 million in 2022, the fifth consecutive drop. However, exploration spending intentions for 2023 are expected to increase 20% to $59 million, mainly because of exploration for metallurgical coal in British Columbia.

Spending on exploration and development activities for iron ore increased briefly in 2021, especially in Quebec, reaching an eight-year high of $98 million. In the previous decade, expenditures had peaked at $359 million in 2012 and decreased to just $9 million in 2017. Although in 2022 expenditures declined sharply to $22 million, spending is anticipated to increase to $76 million in 2023. The increase comes as prices started to recover in early 2023. Most of Canada's iron ore projects are in Quebec, Nunavut, and Newfoundland and Labrador.

In March 2021, the Government of Canada released its list of 31 critical minerals that are considered vital for the sustainable economic success of Canada and its allies. Since then, the Government of Canada has made substantial financial commitments in budgets and launched The Canadian Critical Minerals Strategy. Provinces and territories also consider critical minerals development to be a strategic priority. Several jurisdictions have developed critical minerals strategies, while others are in the process of developing policies or are actively promoting this sector.

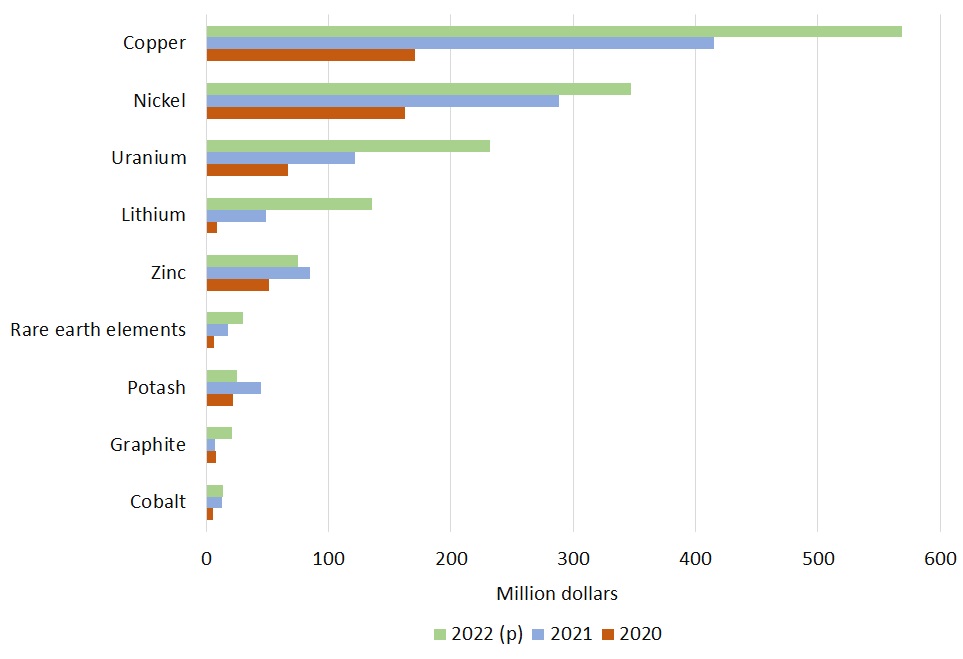

In 2022, $1.5 billion was spent on exploration and deposit appraisals for critical minerals (except helium). This is 36% of the total spending for all minerals. These expenditures for critical minerals increased by 38% between 2021 and 2022, mostly because of increased spending on copper, nickel, uranium and lithium. Base metals (copper, nickel and zinc) and uranium accounted for the bulk of the spending at 83%.

Although spending intentions for 2023 are not available for critical minerals as a distinct group of commodities, we expect that expenditures will continue to increase in 2023, with growth observed for the groups that include critical minerals such as “other metals,” base metals and uranium.

Figure 6. Expenditures, by major critical minerals, 2020–2022 (p)

Sources: Natural Resources Canada, Institut de la statistique du Québec

Figure 6 — Text version

This bar chart shows expenditures for exploration and deposit appraisals for major critical minerals from 2020 to 2022. For each year, there are bars for copper, nickel, uranium, lithium, zinc, rare earth elements, potash, graphite, and cobalt.

Work phases are parts of the stages of exploration and development:

- Explorationincludes grassroots (early) exploration until it is confirmed that the project is economically feasible.

- Deposit appraisal turns into detailed work included in feasibility studies, which inform a production decision.

- Mine complex development (not covered in this report) includes the construction of mines, plants and associated infrastructure.

On‑mine‑site activities offer insight on efforts by producing companies to extend the life of existing operations.

Work phases

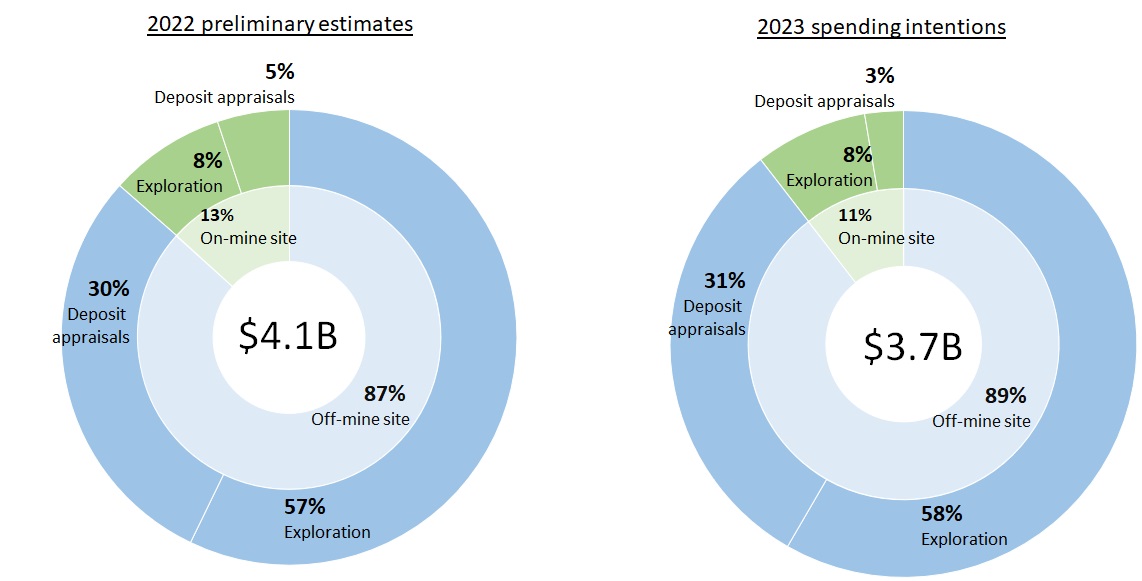

In 2022, total expenditures for exploration and deposit appraisals increased for projects that are not on the site of a producing mine (off-mine sites). However, they decreased at locations with a producing mine (on-mine site):

- Off‑mine‑site expenditures

- exploration - increased by 7%

- deposit appraisals - increased by 20%

- On‑mine‑site expenditures

- exploration - decreased by 11%

- deposit appraisals - decreased by 11%

Off‑mine‑site exploration spending increased $146 million to $2.3 billion in 2022. Only four jurisdictions had decreases: New Brunswick, Nova Scotia, the Northwest Territories and Quebec. Notable increases were in Manitoba (+$33 million), Newfoundland and Labrador (+$52 million), Nunavut (+$35 million), Ontario (+$26 million), and Saskatchewan (+$43 million).

On‑mine‑site exploration spending decreased by $43 million to $334 million in 2022. The most notable decrease was in Ontario (-$113 million). However, large increases occurred in Nunavut (+$36 million) and Manitoba (+$24 million).

Spending intentions for 2023 include a 12% decrease in exploration spending for on-mine sites to $295 million and a 52% decrease in deposit appraisal spending for on-mine sites to $100 million. Expenditures for exploration and deposit appraisals for off-mine sites are anticipated to decrease in 2023 by 6% and 3%, respectively.

Figure 7. Expenditures, by on-mine and off-mine sites, 2022–2023

Sources: Natural Resources Canada, Institut de la statistique du Québec

B = billion

Figure 7 — Text version

These two pie charts show expenditures for exploration and deposit appraisals for on-mine and off-mine sites for 2022 and 2023. For each year, most of the spending was for exploration.

Notes

- Totals may be different because of rounding.

- Values are in Canadian dollars.

Page details

- Date modified: