Mineral Trade

Information Bulletin

(Published in September 2023)

Canada is a trading nation, and its minerals and metals sector (or “minerals sector”) is an essential contributor to its success, supplying ores, concentrates, and semi-fabricated and fabricated metal and mineral productsFootnote 1 to over 100 countries.

Find out how Canada’s mineral trade is performing:

- Overview

- Trade by stage of processing

- Canada’s principal mineral trading partners

- Trade by commodity

- Trade by province and territory

- Tables

Overview

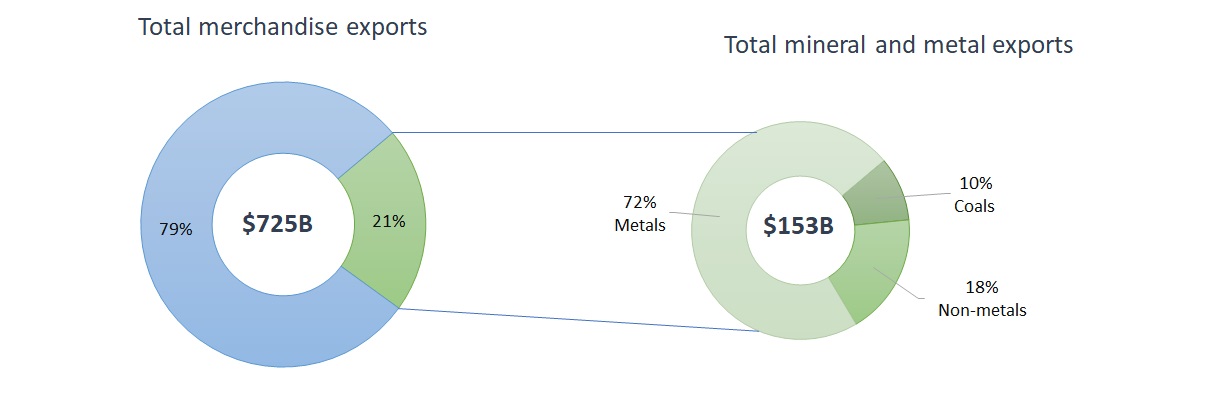

In 2022, Canada’s minerals and metals sector exportsFootnote 2 increased by 21% year-over-year (YoY), reaching $153.1 billion and accounting for 21% of all Canadian merchandise exports.

The increase is largely attributable to higher prices, which rose by 15% in 2022 according to the Bank of Canada’s metals and minerals price index.

Figure 1: Canadian mineral and metal exports as a percentage of total merchandise exports, 2022

Data table — Figure 1

| Sector | Exports ($ billion) |

|---|---|

| Mineral and metal exports | 153.1 |

| Metals | 110.7 |

| Non-metals | 27.8 |

| Coal | 14.6 |

| Other exports | 572.1 |

| Total merchandise exports | 725.0 |

Sources: Natural Resources Canada, Statistics Canada.

B = billion.

Rising metals and minerals prices was a key contributor to the increase in the value of mineral exports for the third consecutive year. The gradual recovery of economic activity following the COVID-19 pandemic, lingering supply chain issues, anticipated increase in demand related to the clean energy transition and Russia’s invasion of Ukraine contributed to higher prices for most metals.

In early 2022, the global price of several metals (e.g., nickel and aluminum) hit historical records following Russia’s invasion of Ukraine. The conflict caused substantial supply chain disruptions as economies around the world looked to secure alternative sources. Russia is a major producer of precious, base and industrial metals, and has significant metal trades with Europe and Asia.

Gold followed a different path that was heavily influenced by interest rates and broad economic conditions. Interest rates generally have an inverse influence on the price of gold. As such, the price of gold rose when interest rates were lowered in response to the economic slowdown caused by the COVID-19 pandemic. Then, gold prices declined as central banks rapidly increased interest rates to curtail high inflation in 2022, but prices changed course once again as recession fears emerged in the later part of the year. The price of gold peaked at $2,000 per ounce at the end of 2022 after reaching a low of $1,650 per ounce in October. Gold is Canada’s top mineral export and accounts for almost a quarter of the total value of mineral and metal exports.

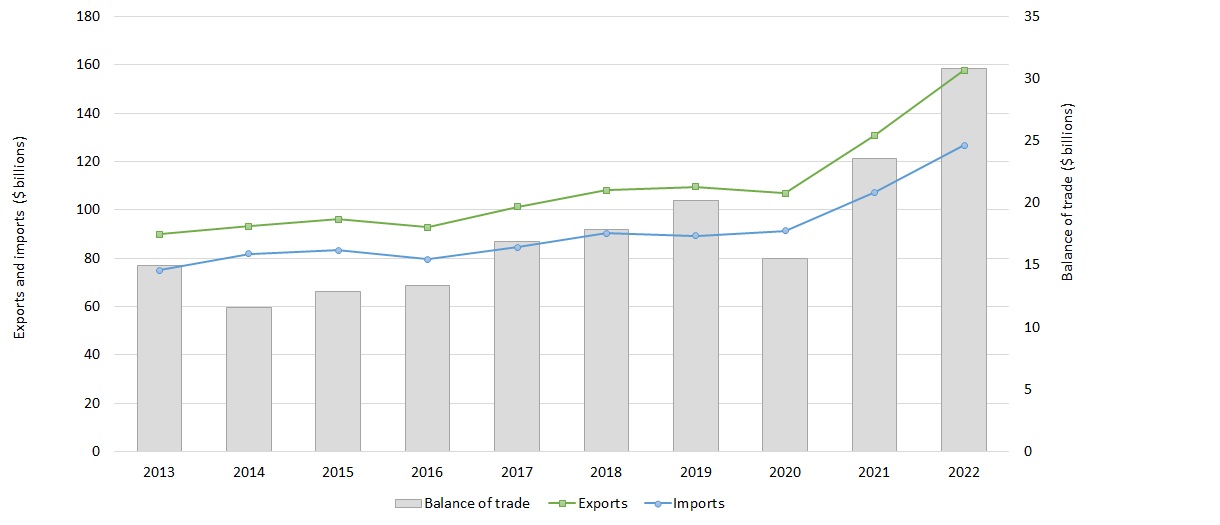

The value of mineral imports also increased, up 18% to $126.8 billion in 2022, representing 17% of Canada’s total merchandise imports.

The increase in trade values and the greater growth of exports compared to imports combined to propel Canada’s trade balance for minerals and metals up by 32% YoY to reach $31.0 billion in 2022, its highest value since 2008.

Figure 2: Mineral and metal trade ($ billions), 2013–22

Data table — Figure 2

| Year | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| 2013 | 86.9 | 90.0 | 75.0 | 15.0 |

| 2014 | 89.5 | 93.3 | 81.7 | 11.6 |

| 2015 | 91.9 | 96.1 | 83.2 | 12.9 |

| 2016 | 88.6 | 92.8 | 79.5 | 13.3 |

| 2017 | 97.3 | 101.3 | 84.4 | 16.9 |

| 2018 | 104.3 | 108.1 | 90.2 | 17.9 |

| 2019 | 106.0 | 109.6 | 89.4 | 20.2 |

| 2020 | 102.6 | 106.8 | 91.3 | 15.5 |

| 2021 | 127.0 | 130.8 | 107.3 | 23.5 |

| 2022 | 153.1 | 157.8 | 126.8 | 31.0 |

Note: Domestic exports are displayed in Figure 2. However, total exports (including re-exports) are used to calculate the balance of trade.

Sources: Natural Resources Canada, Statistics Canada.

Trade by stage of processing

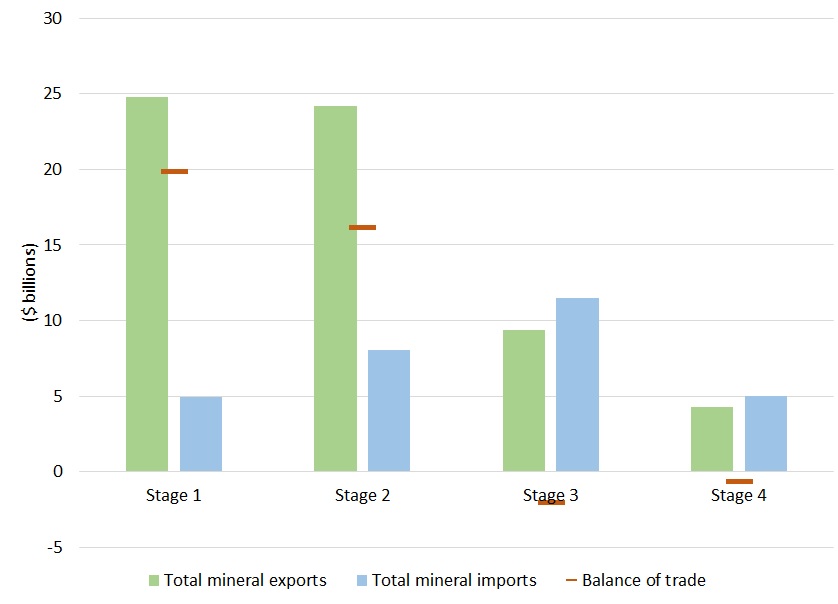

As shown in Figure 3, Canada exports a much larger value of mineral products for upstream stages 1 and 2 than what it imports. On the other hand, Canada imports a higher value of mineral products for downstream stages 3 and 4 than what it exports. The result is a positive trade balance upstream in the value chain and a negative trade balance further downstream, which reflects Canada’s significant geological endowment and strength in the mining and mineral processing industries relative to its manufacturing capacity.

In 2022, the trade balance for stages 1 and 2 products increased by 43% to $44.6 billion and by 12% to $23.9 billion, respectively.

Meanwhile, higher increases in the value of imports relative to exports for stages 3 and 4 mineral products resulted in lower trade balances, down 26% to -$9.7 billion and 30% to -$27.8 billion, respectively.

Mineral products are classified into four stages of processing:

Stage 1 (primary products) includes metal scrap and products from the mining industry, such as ores and concentrates

Stage 2 (smelting and refining products) includes products from metallurgical processes, which are relatively pure minerals, metals and alloys

Stage 3 (semi-fabricated products) includes semi-fabricated products that are input in other industries, such as wire, sheets, strips, tubes and flat rolls

Stage 4 (fabricated products) includes further processed products and final goods, such as metal structures and framing, hardware items, tools, cutlery and pipefittings

Figure 3: Mineral and metal trade by stage, 2022

Data table — Figure 3

| Stage | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| Stage 1 — Primary products | 58.4 | 58.5 | 13.9 | 44.6 |

| Stage 2 — Smelting and refining products | 46.2 | 46.3 | 22.5 | 23.9 |

| Stage 3 — Semi-fabricated products | 26.8 | 28.3 | 38.0 | -9.7 |

| Stage 4 — Fabricated products | 21.7 | 24.6 | 52.4 | -27.8 |

| Total minerals and metals | 153.1 | 157.8 | 126.8 | 31.0 |

Note: Total exports (including re-exports) are displayed in Figure 3. Total exports (including re-exports) are used to calculate the balance of trade.

Sources: Natural Resources Canada, Statistics Canada.

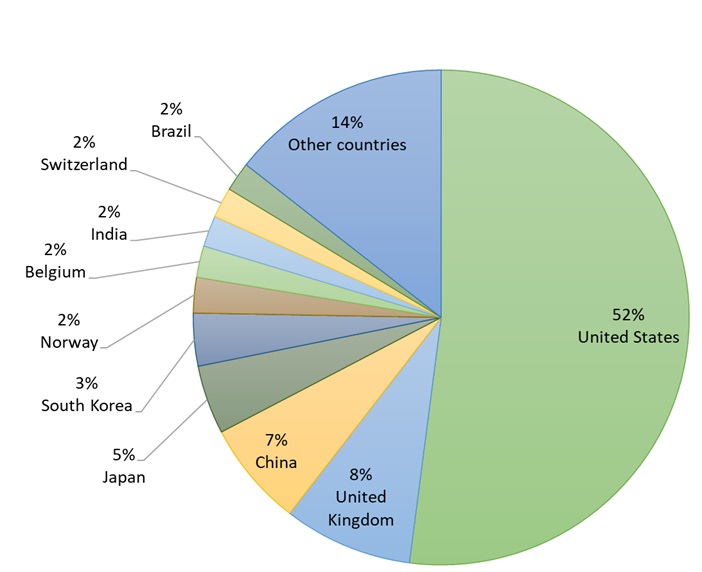

Canada’s principal mineral trading partners

The United States continued to be Canada’s principal destination for mineral commodities, accounting for 52% of exports in 2022. The following most important destinations were the United Kingdom (8%), China (7%), Japan (5%) and South Korea (3%). These five countries accounted for 75% of Canada’s mineral exports.

Figure 4: Canada’s mineral exports by country, 2022

Text version — Figure 4

This pie chart shows the United States as the leading destination for Canada’s mineral exports, accounting for 52% of the total, followed by the United Kingdom (8%), China (7%), Japan (5%), South Korea (3%), Norway (2%), Belgium (2%), India (2%), Switzerland (2%), Brazil (2%) and other countries (14%).

Sources: Natural Resources Canada, Statistics Canada.

Find out more about Canada’s top three mineral and metal export markets for 2022:

United States

- In 2022, bilateral mineral trade between Canada and the United States was valued at $135.5 billion, a 17% increase compared to the previous year.

- Canada maintained a positive trade balance for minerals and metals with the United States at $27.1 billion in 2022, an increase of 15% over the previous year.

- In 2022, the value of exports to the United States reached $79.6 billion, which represents an increase of 16% compared to the previous year.

- The value of mineral exports was split between upstream stages 1 and 2 products (46%) and downstream stages 3 and 4 products (54%).

- The top exports were:

- Iron and steel ($20.9 billion or 26% of the total)

- Aluminum ($16.8 billion or 21% of the total)

- Potash ($6.5 billion or 8% of the total)

- Copper ($4.9 billion or 6% of the total)

- Gold ($4.3 billion or 5% of the total)

- Canada is also an important supplier of critical minerals to the United States, including potash, tellurium, niobium and uranium.

- In 2022, Canada’s mineral imports from the United States increased by 17% to $56.0 billion.

- Stages 1 and 2 products accounted for 26% of the imports, while stages 3 and 4 products accounted for the bulk of the imports at 74%.

- The top imports were:

- Iron and steel ($16.6 billion or 30% of the total)

- Gold ($5.3 billion or 10% of the total)

- Aluminum ($4.2 billion or 8% of the total)

United Kingdom

- Bilateral mineral trade between Canada and the United Kingdom reached $13.8 billion in 2022, which is almost the same value as that of the previous year.

- Canada has a large positive trade balance for minerals and metals with the United Kingdom, which reached $12.2 billion in 2022.

- Canada’s mineral and metal exports to the United Kingdom increased by 3% to $12.9 billion in 2022.

- Gold ($11.8 billion) was the leading export, accounting for 91% of the value of mineral exports, followed by uranium ($488.4 million or 4% of the total) and iron ore ($226.5 million or 3% of the total).

- Gold accounted for 53% of Canada’s total merchandise exports value of $22.3 billion to the United Kingdom in 2022. Canada sold 5.1 million ounces of gold to the United Kingdom, accounting for 52% of Canada’s gold exports. Gold flows to the United Kingdom in part because of its role as a financial hub for global gold trade; international investors purchase and sell gold on the London Bullion Market Association.

- In 2022, Canada’s mineral imports from the United Kingdom declined by about 28% to $0.9 billion. Iron and steel are the primary metals imported from England, accounting for 38% of total imports.

China

- China is one of the largest global producers and consumers of many minerals and metals.

- In 2022, bilateral mineral trade between Canada and China was valued at $26.8 billion, an increase of 20% compared to last year.

- In 2022, Canada had a negative trade balance for minerals and metals of -$5.7 billion with China.

- The value of mineral exports to China increased by 11% to $10.5 billion in 2022.

- Mineral exports to China are predominantly stage 1 products, which accounted for 90% of the value in 2022.

- The top exports were:

- Coal ($3.5 billion or 33% of the total)

- Iron ore ($2.2 billion or 21% of the total)

- Copper ($1.6 billion or 15% of the total)

- Potash ($1.5 billion or 15% of the total)

- In 2022, Canada’s mineral imports from China increased by 26% to $16.2 billion.

- Mineral imports from China were predominantly stage 4 manufactured goods, which accounted for 70% of the value in 2022.

- The top imports were:

- Iron and steel ($5.8 billion or 36% of the total)

- Aluminum ($1.8 billion or 11% of the total)

- Glass ($853 million or 5% of the total)

Trade by commodity

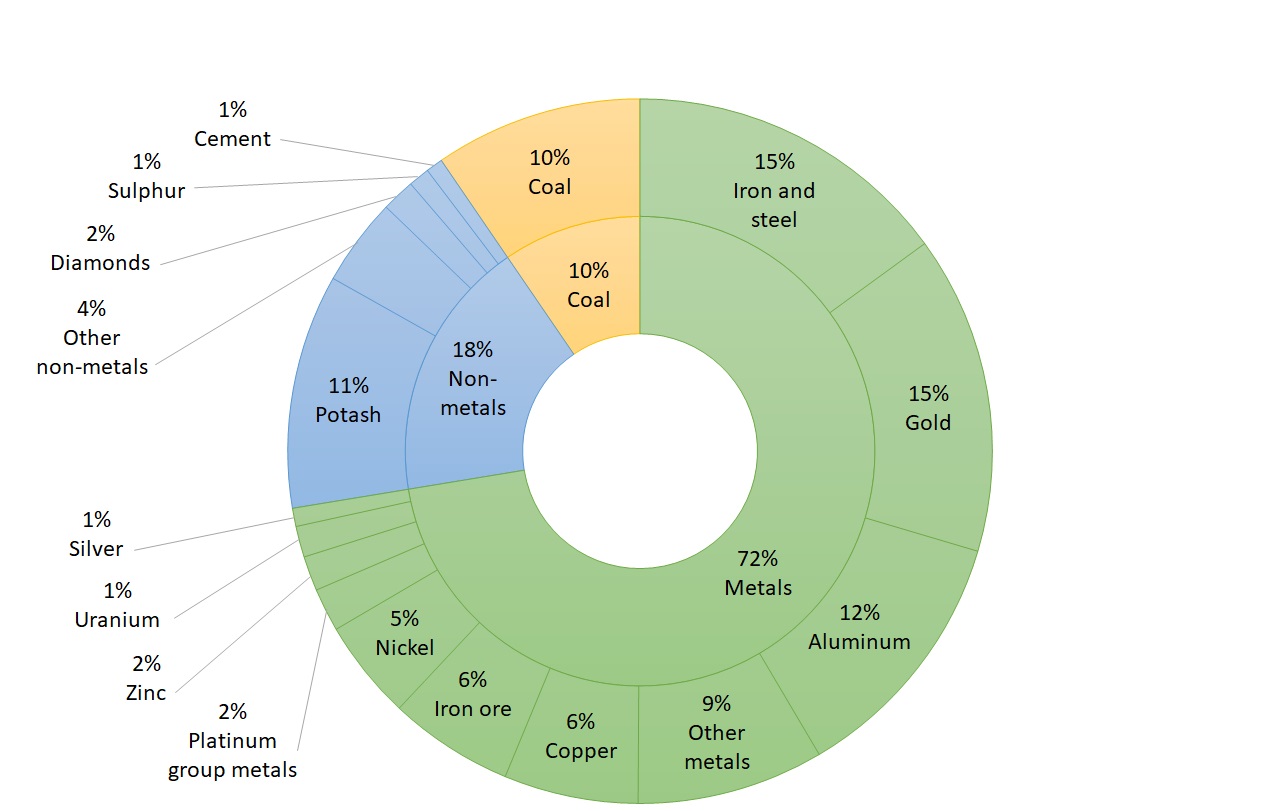

In 2022, all commodity groups recorded an increase in export value. Metals accounted for the largest share of the value at 72% of the total, followed by non-metals (18%) and coal (10%).

Figure 5: Mineral and metal exports by commodity, 2022

Data table — Figure 5

| Commodity | Domestic exports ($ billion) |

|---|---|

| Metals | 110,699 |

| Iron and steel | 22,889 |

| Gold | 22,339 |

| Aluminum | 18,230 |

| Copper | 9,412 |

| Iron ore | 8,777 |

| Nickel | 7,003 |

| Platinum group metals | 3,036 |

| Zinc | 2,440 |

| Uranium | 2,180 |

| Silver | 1,280 |

| Other metals | 13,113 |

| Non-metals | 27,837 |

| Potash | 16,436 |

| Diamonds | 2,572 |

| Sulphur | 1,486 |

| Cement | 1,185 |

| Other non-metals | 6,158 |

| Coal | 14,608 |

| Total | 153,144 |

Sources: Natural Resources Canada, Statistics Canada.

Metal products

In 2022, the value of exports of metal products increased by 8% compared to the previous year to reach $110.7 billion. However, Canada’s top exported metal commodities experienced mixed results. The value of exports for 2022:

- Increased for nickel (50%), aluminum (20%), uranium (17%), iron and steel (14%), silver (13%), gold (4%) and zinc (4%)

- Decreased for platinum group metals (-19%), iron ore (-13%) and copper (-5%)

Gains are generally attributable to higher prices as quantities remained relatively stable compared to last year.

The value of metal imports increased by 18% to $106.5 billion in 2022. Notable gains were observed for nickel (57%), zinc (30%), aluminum (24%), gold (21%), and iron and steel (19%). While prices had a notable impact on the overall increase of values of imports, quantities also increased for some commodities.

Non-metal products

The value of Canada’s exports of non-metal products increased by 65% to $27.8 billion in 2022. While most non-metal products experienced increases, the bulk of the gain can be attributed to diamonds and potash, which are also Canada’s leading non-metal exports in terms of value.

The value of potash exports increased by 130% to $16.4 billion in 2022, although the quantity decreased slightly by 1% to 21.5 million tonnes. During the COVID-19 pandemic, potash supplies were limited due to production disruptions. This situation was exacerbated when the international community imposed economic sanctions on Russia after it invaded Ukraine, prompting Russia to restrict exports of its fertilizers. As a result, the price of all types of fertilizers spiked in the spring of 2022. Russia is the second largest potash producer after Canada.

The value of diamond exports increased by 27% to $2.6 billion in 2022 although the quantity exported fell by 10% to 16.1 million carats.

An increase in the value and the quantity of imports was recorded for most non-metal commodities, the majority (91%) of which are stages 3 or 4 products. As a result, the total value of imports of non-metal products increased by 18% to $18.2 billion in 2022.

Coal and coke products

The value of exports of coal and coke products increased by 82% to $14.6 billion in 2022. This is associated with a notable increase in the price of metallurgical coal (used in steel manufacturing), which accounted for 88% of the value of exports of coal and coke products.

Canada exported 36.1 million tonnes of metallurgical coal in 2022, a 15% increase compared to the previous year.

Imports of coal and coke products experienced a 59% increase in value to $2.1 billion in 2022. Metallurgical coal accounts for more than one third of the value of the coal and coke products group. Both coal and coke increased in value in 2022, up 68% and 37%, respectively.

Critical minerals

In March 2021, the Government of Canada released its list of 31 critical minerals that are considered vital for the sustainable economic success of Canada and its allies. Since then, the Government of Canada has made substantial financial commitments in budgets and launched the Canadian Critical Minerals Strategy.

In 2022, the value of critical minerals exports increased by 31% compared to the previous year to reach $61.3 billion (Table 3). The increase was largely attributable to price increases most notably for potash, aluminum and nickel. In terms of export value, aluminum was first (30%), followed by potash (27%), copper (15%), nickel (11%), platinum group metals (5%), zinc (4%) and uranium (4%).

The value of critical minerals imports increased by 23% to $29.5 billion in 2022, mostly because of higher aluminum prices. Aluminum (including alumina for processing into aluminum) accounts for a large portion of the value of imports at 35%, followed by copper (20%), platinum group metals (12%), zinc (5%) and uranium (5%). Together, these minerals account for 80% of the value of critical minerals imports.

Canada is the world’s fourth largest producer and second largest exporter of aluminum. However, there are no bauxite mines in Canada, the main ingredient in aluminum production. The country’s refineries and smelters must import ores and refined alumina to produce aluminum. Brazil is Canada’s main supplier of alumina and bauxite, accounting for $2.1 billion in imports in 2022.

Stronger growth of the value of potash exports helped boost Canada’s critical minerals trade balance by 40% YoY, to $33.2 billion in 2022.

The United States was Canada’s most important trading partner for critical minerals in 2022 (Table 4). Trade amounted to $48.4 billion, up 21% from the previous year. The value of critical minerals exports to the United States reached $36.8 billion, representing 60% of total exports in this category. Canada, on the other hand, imported $11.6 billion from the United States, or 39% of the total value of critical minerals imports. Canada maintained a positive trade balance for critical minerals with the United States at $25.3 billion in 2022, an increase of 23% over the previous year.

In 2022, China was the second largest trading partner for critical minerals, with a total trade amount of $7.5 billion, followed by Brazil ($5.0 billion) and Norway ($3.0 billion). Canada’s imports of critical minerals from China were valued at $3.6 billion and exports, at $3.9 billion. The main critical minerals exported to China are copper ($1.6 billion) and potash ($1.5 billion), which together accounted for 79% of the total value of critical minerals exported to China. The main imports from China were aluminum ($1.8 billion, mostly stage 3 products) and magnesium ($609.6 million), which together accounted for two thirds of the total value of imports.

As shown in Figure 6, critical minerals exports are mostly stages 1 and 2 products, while stages 3 and 4 products account for less of the value of exports. This demonstrates Canada’s strength upstream in the critical minerals value chains.

Figure 6: Critical minerals trade by stage ($ billions), 2022

Data table — Figure 6

| Stage | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| Stage 1 — Primary products | 24.7 | 24.8 | 4.9 | 19.8 |

| Stage 2 — Smelting and refining products | 24.1 | 24.2 | 8.1 | 16.1 |

| Stage 3 — Semi-fabricated products | 8.6 | 9.4 | 11.5 | -2.1 |

| Stage 4 — Fabricated products | 3.9 | 4.3 | 5.0 | -0.7 |

| Total minerals and metals | 61.3 | 62.6 | 29.5 | 33.2 |

Note: Total exports (including re-exports) are displayed in Figure 6. Total exports (including re-exports) are used to calculate the balance of trade.

Sources: Natural Resources Canada, Statistics Canada.

Trade by province and territory

Most of Canada’s mineral commodity trade flows to and from Ontario and Quebec, as the two provinces accounted for 40% and 23% of exports, respectively. Similarly, Ontario accounted for 59% of imports based on the province of clearance and Quebec, for 17%. This is a function of large portions of mine outputs being processed in these jurisdictions before export and of the prevalence of manufacturing industries. It also reflects the importance of these two provinces as key points for Canadian imports of mineral products due to their proximity to major consumer markets.

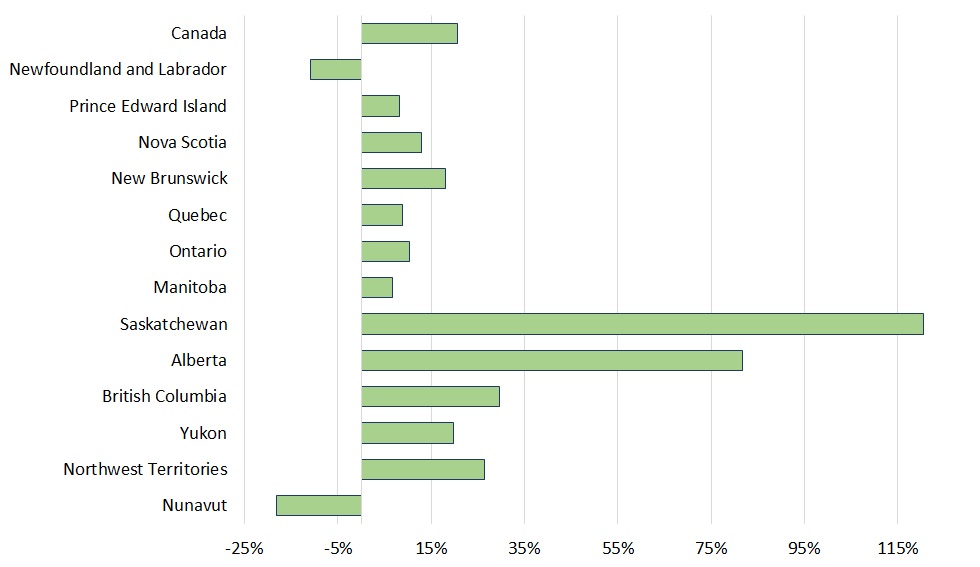

The value of mineral commodity exports increased in most provinces between 2021 and 2022, as shown in Figure 7. The most notable rise in percentage terms occurred in Saskatchewan (120%), Alberta (82%), British Columbia (30%), Northwest Territories (26%), Yukon (20%), New Brunswick (18%), Nova Scotia (13%), Ontario (10%) and Quebec (9%).

A notable increase in the value of mineral exports was reported for Saskatchewan in 2022, more than doubling from $8 billion in 2021 to $17.4 billion, followed by Ontario (+$5.8 billion), British Columbia (+$5.1 billion), Alberta (+$3.2 billion) and Quebec (+$2.8 billion).

In many cases, the increase is mainly attributable to one or two commodities:

- High metallurgical coal exports and prices were largely responsible for the increase in British Columbia and Alberta. Canada is the fourth largest global exporter of metallurgical coal, 99% of which comes from British Columbia.

- High potash prices were the leading contributor to the increase in Saskatchewan. Canada is the leading global producer and exporter of potash, almost all of which is mined in Saskatchewan.

- High diamond exports and prices were the leading causes of the increase in Ontario, Newfoundland and Labrador, and Alberta. Canada is the third largest global producer of rough diamonds, most of which come from mines in the Northwest Territories.

Figure 7: Variation of mineral export values between 2021 and 2022, by province and territory

Text version — Figure 7

This chart displays the variation of the value of mineral and metal exports between 2021 and 2022, by province and territory. The Saskatchewan experienced the greatest increase at 120%, followed by Alberta (82%), British Columbia (30%), Northwest Territories (26%), Yukon (20%), New Brunswick (18%), Nova Scotia (13%), Ontario (10%), Quebec (9%), Prince Edward Island (8%) and Manitoba (7%). Declines were recorded in Newfoundland and Labrador (-11%) and Nunavut (-18%). The overall value for Canada increased by 21%.

Sources: Natural Resources Canada, Statistics Canada.

Mineral commodity exports represented a significant proportion of total exports for many provinces and territories. They accounted for nearly all the merchandise exports from Canada’s three territories and over a quarter for Newfoundland and Labrador, Quebec, Ontario and British Columbia.

Tables

| Country | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| United States | 79,574 | 83,052 | 55,966 | 27,086 |

| United Kingdom | 12,868 | 13,126 | 904 | 12,223 |

| China | 10,526 | 10,569 | 16,241 | -5,672 |

| Japan | 6,899 | 6,915 | 1,820 | 5,095 |

| South Korea | 5,287 | 5,335 | 2,477 | 2,858 |

| Norway | 3,547 | 3,552 | 192 | 3,359 |

| Belgium | 3,291 | 3,302 | 669 | 2,633 |

| India | 3,132 | 3,146 | 2,105 | 1,041 |

| Switzerland | 3,039 | 3,044 | 928 | 2,116 |

| Brazil | 2,923 | 2,943 | 5,314 | -2,370 |

| Netherlands | 2,710 | 2,867 | 430 | 2,436 |

| Germany | 2,685 | 2,818 | 3,306 | -488 |

| Hong Kong | 2,160 | 2,185 | 112 | 2,073 |

| Mexico | 1,425 | 1,539 | 5,385 | -3,846 |

| Taiwan | 1,401 | 1,407 | 2,561 | -1,154 |

| Indonesia | 1,398 | 1,402 | 210 | 1,193 |

| Malaysia | 869 | 874 | 269 | 605 |

| France | 800 | 829 | 925 | -96 |

| Bangladesh | 685 | 685 | 1 | 683 |

| Spain | 680 | 687 | 725 | -38 |

| Other countries | 7,244 | 7,565 | 26,257 | -18,692 |

| Total | 153,144 | 157,843 | 126,797 | 31,046 |

Sources: Natural Resources Canada, Statistics Canada.

| Province and territory | Domestic mineral exports | Total mineral exports | Total mineral imports | Total domestic exports | Domestic mineral exports as a percentage of the total |

|---|---|---|---|---|---|

| Newfoundland and Labrador | 4,523,331 | 4,529,801 | 118,073 | 15,897,226 | 28.5% |

| Prince Edward Island | 18,544 | 19,318 | 32,330 | 1,988,569 | 0.9% |

| Nova Scotia | 482,561 | 494,712 | 1,043,705 | 6,586,912 | 7.3% |

| New Brunswick | 495,778 | 496,218 | 720,954 | 18,757,663 | 2.6% |

| Quebec | 34,610,996 | 34,823,827 | 22,137,262 | 110,977,181 | 31.2% |

| Ontario | 61,364,917 | 65,616,008 | 75,212,465 | 226,132,023 | 27.1% |

| Manitoba | 1,254,515 | 1,261,215 | 5,144,552 | 20,727,945 | 6.1% |

| Saskatchewan | 17,396,195 | 17,397,347 | 2,516,012 | 52,451,526 | 33.2% |

| Alberta | 7,036,347 | 7,086,505 | 5,708,774 | 204,965,848 | 3.4% |

| British Columbia | 22,105,882 | 22,263,658 | 14,160,373 | 64,901,308 | 34.1% |

| Yukon | 193,310 | 196,388 | 2,137 | 198,499 | 97.4% |

| Northwest Territories | 1,936,746 | 1,936,746 | 72 | 2,139,884 | 90.5% |

| Nunavut | 1,475,168 | 1,475,169 | 3 | 1,476,000 | 99.9% |

| Canada | 152,894,290 | 157,596,914 | 126,796,713 | 727,200,579 | 21.0% |

Sources: Natural Resources Canada, Statistics Canada.

| Critical mineral | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| Aluminum | 18,230,088 | 18,549,303 | 10,410,239 | 8,139,064 |

| Antimony | 19,083 | 19,573 | 39,877 | -20,304 |

| Bismuth | 1,290 | 1,768 | 2,709 | -941 |

| Chromium | 4,951 | 7,782 | 149,117 | -141,335 |

| Cobalt | 793,269 | 799,916 | 114,527 | 685,389 |

| Copper | 9,412,411 | 9,513,506 | 5,996,942 | 3,516,564 |

| Fluorspar | 17,912 | 18,131 | 128,744 | -110,613 |

| Germanium | 28,467 | 28,749 | 11,836 | 16,913 |

| Graphite | 85,797 | 94,640 | 839,360 | -744,720 |

| Lithium | 2,124 | 2,242 | 473,322 | -471,081 |

| Magnesium | 163,710 | 173,940 | 735,352 | -561,412 |

| Manganese | 2,013 | 27,543 | 537,287 | -509,744 |

| Molybdenum | 63,487 | 70,816 | 106,466 | -35,650 |

| Nickel | 7,003,473 | 7,075,721 | 1,462,573 | 5,613,148 |

| Niobium | 363,096 | 363,141 | 43,759 | 319,381 |

| Platinum group metals | 3,035,518 | 3,312,554 | 3,597,536 | -284,982 |

| Potash | 16,435,751 | 16,442,864 | 201,550 | 16,241,314 |

| Rare earth elements | 147 | 1,997 | 8,048 | -6,050 |

| Tantalum | 3,521 | 3,721 | 2,386 | 1,335 |

| Tellurium | 43,521 | 46,144 | 31,124 | 15,020 |

| Tin | 54,667 | 55,550 | 127,253 | -71,704 |

| Titanium | 167,597 | 179,834 | 339,983 | -160,149 |

| Tungsten | 48,934 | 51,794 | 59,743 | -7,949 |

| Uranium | 2,179,554 | 2,581,538 | 1,825,022 | 756,517 |

| Vanadium | 71,689 | 73,666 | 100,592 | -26,927 |

| Zinc | 2,440,342 | 2,483,091 | 1,836,001 | 647,091 |

| Other | 639,058 | 640,508 | 274,504 | 366,004 |

| Total | 61,311,470 | 62,620,031 | 29,455,852 | 33,164,178 |

Sources: Natural Resources Canada, Statistics Canada.

| Country | Domestic exports | Total exports | Total imports | Balance of trade |

|---|---|---|---|---|

| United States | 36,849.0 | 37,587.3 | 11,582.5 | 26,004.8 |

| China | 3,894.5 | 3,904.7 | 3,643.2 | 261.5 |

| Norway | 2,851.2 | 2,851.3 | 149.2 | 2,702.2 |

| Brazil | 2,707.3 | 2,714.4 | 2,302.4 | 412.0 |

| Japan | 1,760.1 | 1,760.8 | 98.2 | 1,662.6 |

| Indonesia | 1,316.3 | 1,316.9 | 60.2 | 1,256.6 |

| India | 1,313.5 | 1,314.8 | 324.6 | 990.2 |

| South Korea | 1,296.5 | 1,336.0 | 310.2 | 1,025.8 |

| Netherlands | 1,245.8 | 1,387.1 | 110.2 | 1,276.8 |

| Germany | 1,016.7 | 1,099.0 | 587.7 | 511.3 |

| Belgium | 967.1 | 968.3 | 415.4 | 553.0 |

| Malaysia | 787.8 | 789.9 | 107.9 | 682.0 |

| Bangladesh | 656.0 | 656.1 | 0.0 | 656.0 |

| United Kingdom | 642.4 | 847.9 | 160.5 | 687.3 |

| Mexico | 524.0 | 555.6 | 497.3 | 58.3 |

| Taiwan | 367.7 | 367.8 | 164.7 | 203.1 |

| Finland | 365.9 | 366.1 | 210.6 | 155.5 |

| Thailand | 330.7 | 330.9 | 65.8 | 265.1 |

| Italy | 201.0 | 201.5 | 396.9 | -195.4 |

| Switzerland | 170.9 | 171.7 | 101.8 | 69.9 |

| Other countries | 2,047.0 | 2,092.0 | 8,166.4 | -6,074.5 |

| Total | 61,311.5 | 62,620.0 | 29,455.9 | 33,164.2 |

Sources: Natural Resources Canada, Statistics Canada.

Page details

- Date modified: