Diamond facts

Diamonds are best known as gemstones, even though only about 20% of the world's production by weight is used for jewellery. The other 80%, known as bort, is used in industrial and research applications where the unique properties of diamonds are required.

Key facts

- In 2019, Canada was the world's third largest producer of rough diamonds by value (12.5% of world production) and the third largest producer by volume (13.5% of world production).

- Canada's total primary exports of diamonds were valued at $2.21 billion in 2019.

Learn more about diamonds

Uses

Uses

As the hardest known material, diamonds have been used for centuries as an abrasive in cutting, drilling, grinding and polishing. This is the dominant industrial use for diamonds.

Diamonds also have the highest thermal conductivity of any material at room temperature and are used as a sink to dissipate heat in electronic devices such as computers and diode lamps.

Production

Production

Canadian mines produced 18.6 million carats of rough diamonds valued at $2.25 billion in 2019, representing a 20% decrease in volume and a 17% decrease in value over 2018.

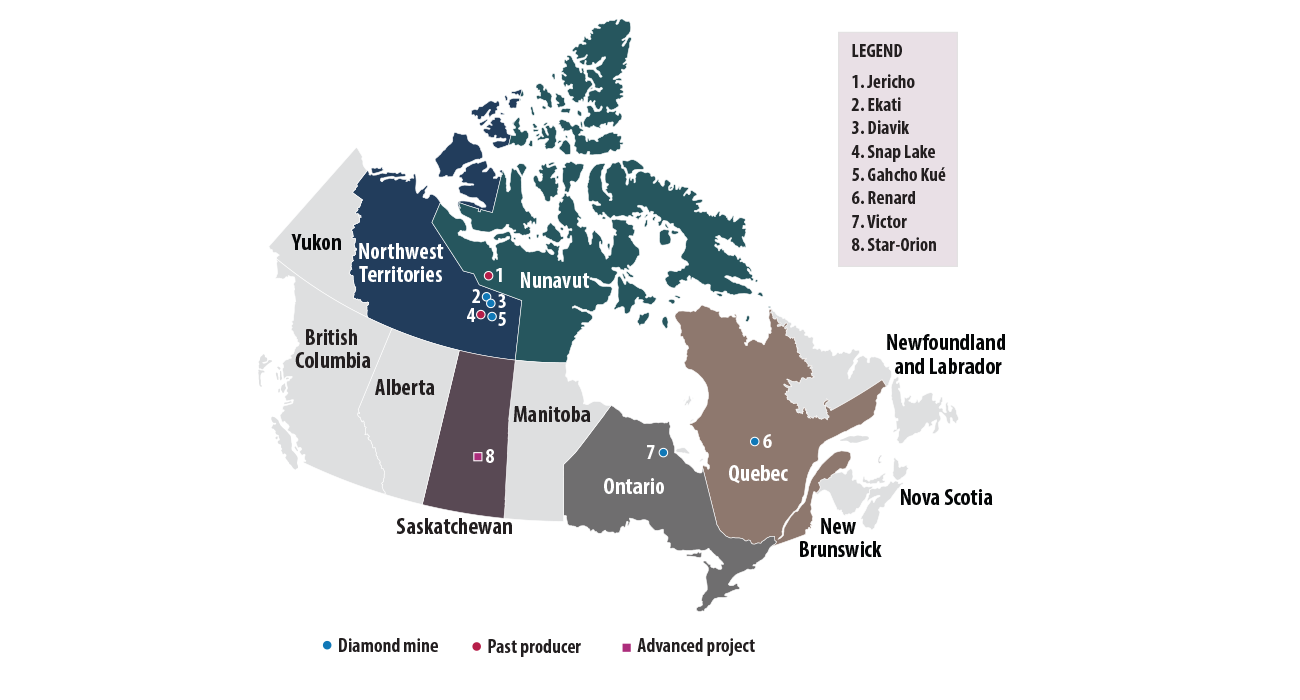

Diamond mines and advanced projects in Canada, 2019

Text version

This map of Canada shows the locations of five active diamond mines, two past-producing diamond mines and one advanced project, by province and territory. The Ekati, Diavik and Gahcho Kué mines are located about 300 kilometres northeast of Yellowknife in the Northwest Territories. The Victor mine is located in northern Ontario and the Renard mine, in north-central Quebec. The past-producing Snap Lake and Jericho mines are also located in the north – Snap Lake, near the diamond mines of the Northwest Territories, and Jericho, in Nunavut about 170 kilometres north of the Diavik mine. The advanced project is the Star-Orion South project, in central Saskatchewan.

Key factors concerning the decrease in volume:

- Four out of the five active diamond mines in Canada recorded decreases in production volume in 2019. Only the Renard mine in Quebec recorded an increase.

- Most of the decrease in volume of Canadian production is due to lower production at Ekati, where carat production dropped about 65% because of final depletion of the Misery open pit in mid 2018 and. As well, the replacement of most of Ekati’s high grade ore feed by lower grade ores from the Lynx and Sable open pits affected production.

- At Diavik, the number of carats recovered declined by about 8% because of decreased ore availability and a lower grade of ore from the underground operations,. However, the decrease was partly offset by higher volume and a higher grade of ore from the A21 open pit.

- At Gahcho Kué, about 2% fewer carats were recovered, primarily because of the mining and processing of lower grade ore from the 5034 Southwest Corridor (SWC). As well, the larger volumes of ore tonnes mined and treated from the 5034 Center Lobe, which has the lowest grade of the 5034 kimberlite, affected the yield.

- Mining ceased at Victor early in 2019, with the last economic ore processed in the second quarter, which explains the ~35% decrease in production volume at Ontario’s first and only diamond mine.

- The large increase (~47%) at the Renard mine is mainly due to the exploitation of a higher grade zone.

Key factors, that caused the decrease in value:

- The decrease in production volume at the three active diamond mines in the Northwest Territories, as well as the significant decrease in production from the high-value-per-carat Victor mine in northern Ontario

- Lower realized prices in a weak and challenging diamond market

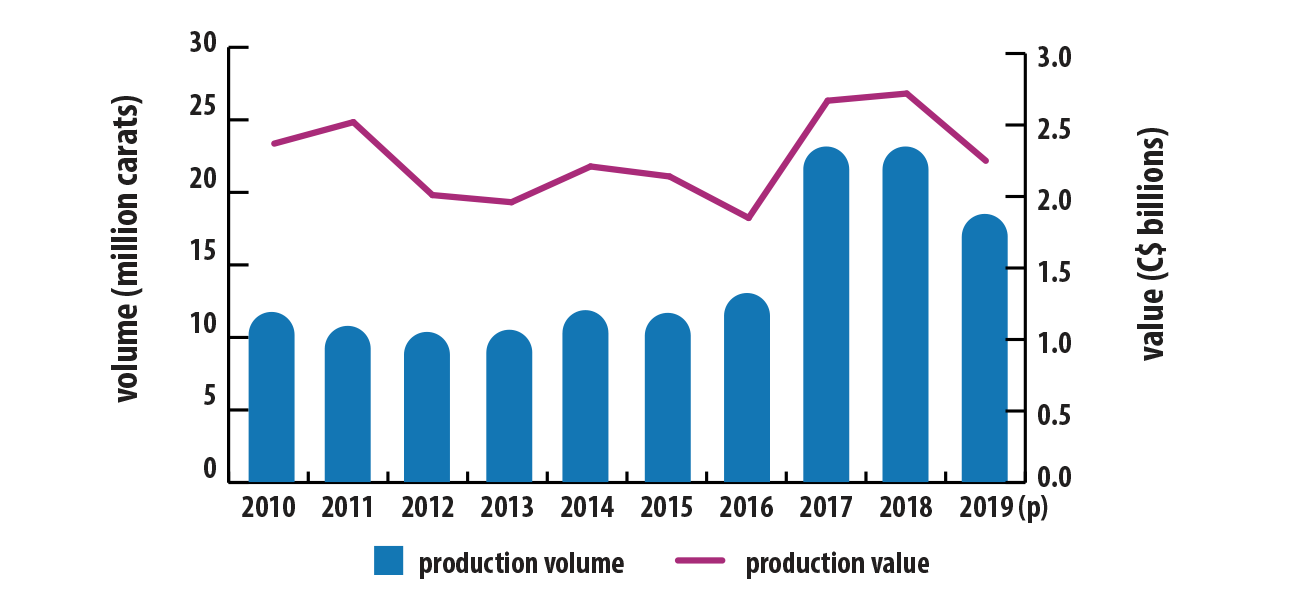

Canadian production of rough diamonds, 2010–2019 (p)

Text version

This bar graph shows the yearly volume of Canada's rough diamond production from 2010 to 2019. From 11.8 million carats in 2010, production volume fell and hovered around 10.6 million carats for the next three years. In 2014, production volume increased to 12.0 million carats, and then decreased slightly to 11.7 million in 2015 before increasing to 13.0 million carats in 2016. Production volume increased sharply to 23.2 million carats in 2017 and 2018, but then fell 20% to 18.6 million carats in 2019.

Superimposed on the bar graph is a line showing the value of Canada’s annual production of rough diamonds over the same period. From $2.37 billion and $2.52 billion in 2010 and 2011, respectively, the value of Canadian rough diamond production decreased to around $2.0 billion in 2012 and 2013, before increasing to $2.21 billion in 2014. Production value decreased slightly to $2.14 billion in 2015 and then further to $1.85 billion in 2016, before sharply increasing to a high of about $2.7 billion in 2017 and 2018. Production then fell 17% to $2.25 billion in 2019.

International context

International context

Find out more about rough diamond production on an international scale:

World production by country – Carat basis

Worldwide, seven countries accounted for 95% of rough diamond production by volume.

| Ranking | Country | Percentage |

|---|---|---|

| 1 | Russia | 32.8% |

| 2 | Botswana | 17.1% |

| 3 | Canada | 13.5% |

| 4 | Congo, D.R. | 10.2% |

| 5 | Australia | 9.4% |

| 6 | Angola | 6.6% |

| 7 | South Africa | 5.2% |

| 8 | Zimbabwe | 1.5% |

| 9 | Namibia | 1.5% |

| 10 | Lesotho | 0.8% |

| - | Other countries | 1.4% |

| Total | 100.0% |

World production by country – Value basis

Worldwide, six countries accounted for 91% of rough diamond production by value.

| Ranking | Country | Percentage |

|---|---|---|

| 1 | Russia | 30.3% |

| 2 | Botswana | 25.3% |

| 3 | Canada | 12.5% |

| 4 | Angola | 9.3% |

| 5 | Namibia | 7.4% |

| 6 | South Africa | 6.4% |

| 7 | Lesotho | 2.1% |

| 8 | Congo, D.R | 1.7% |

| 9 | Sierra Leone | 1.2% |

| 10 | Australia | 1.2% |

| - | Other countries | 2.5% |

| Total | 100.0% |

World production of rough diamonds, 2010–2019 (p)

.png)

Text version

This bar graph shows the yearly volume of the world’s rough diamond production from 2010 to 2019. From 2010 to 2016, production volume fluctuated between 122.8 and 129.8 million carats, before sharply increasing to a high of 150.9 million carats in 2017. Production volume then decreased slightly to 148.4 million carats in 2018, before falling 7% to 138.2 million carats in 2019.

Superimposed on the bar graph is a line showing the value of the world's annual production of rough diamonds, in United States dollars, over the same period. From a low of US$11.4 billion in 2010, world production value increased sharply to US$14.1 billion in 2011. The value then fell to US$12.6 billion in 2012, before rebounding to US$13.6 billion in 2013 and reaching a high of US$15.6 billion in 2014. The value of production then decreased, first to US$14.2 billion in 2015 and then further to US$12.3 billion in 2016. It rebounded to US$14.1 billion in 2017 and US$14.5 billion in 2018 before decreasing 6% to US$13.6 billion in 2019.

Trade

Trade

Exports

- Canada's total primary exports of diamonds were valued at $2.21 billion in 2019.

- The value of diamond exports decreased by 23% in 2019, mainly because of a decrease in the volume and value of the rough diamonds exported.

- Canada's most important diamond export items by value were unsorted rough diamonds, gem-quality rough diamonds and gem-quality cut diamonds.

- Exports were shipped mostly to India, Belgium and Botswana.

Imports

- The estimated value of Canada's total primary imports of diamonds was $466 million in 2019.

- The value of diamond imports decreased by 7% in 2019, mostly because of a decrease in the volume of gem-quality rough diamonds imported.

- The top import item by value was gem-quality cut diamonds, most exceeding 0.5 carats in weight, followed by gem-quality cut diamonds, most not exceeding 0.5 carats in weight, and by gem-quality rough diamonds.

Prices

Prices

There are no internationally set prices for rough gem-quality diamonds, as there are for many metals and other commodities. Mining companies hold “sights” at regular intervals to market their production. The prices reached at these sights are dictated by supply and demand for each of the many categories of diamonds.

Rough diamonds, average value per carat of world production, 2010–2019 (p)

Text version

This line graph shows the average value per carat of the world's rough diamond production from 2010 to 2019, according to statistics compiled by the Kimberley Process Certification Scheme. From US$88.79 in 2010, the average value per carat increased sharply to US$114.51 in 2011 before falling to US$98.82 in 2012 and then increasing in successive years to reach a high of US$124.59 in 2014. A three-year downward trend began in 2015, with the average value per carat dropping to US$93.59 by 2017, before rebounding to US$97.46 in 2018 and increasing a further 1% to US$98.23 in 2019.

Notes and sources

(p) preliminary

Totals may be different due to rounding.

Production

- Diamond mines and advanced projects in Canada, 2019

- Natural Resources Canada

- Canadian production of rough diamonds, 2010–2019 (p)

- Kimberley Process Certification Scheme

International context

- World production of rough diamonds, by country, carat basis, 2019 (p)

- Kimberley Process Certification Scheme

- World production of rough diamonds, by country, value basis, 2019 (p)

- Kimberley Process Certification Scheme

- World production of rough diamonds, 2019–2019 (p)

- Kimberley Process Certification Scheme

Trade

- Natural Resources Canada; Statistics Canada

- Mineral trade includes ores, concentrates, and semi- and final-fabricated mineral products

Prices

- Rough diamonds, average value per carat of world production, 2010–2019

- Kimberley Process Certification Scheme

Page details

- Date modified: