2017–2018 Departmental Results Report

The Honourable Amarjeet Sohi, P.C., M.P.

Minister of Natural Resources

© Her Majesty the Queen in Right of Canada, as represented by the Minister of Natural Resources, 2018

Cat. No. M2-15E-PDF

ISSN 2561-1674

Aussi disponible en français sous le titre : Rapport sur les résultats ministériels, Ressources naturelles Canada : 2017-2018

Copies are available through NRCan’s website.

Table of Contents

- Minister’s message

- Results at a glance

- Raison d’être, mandate and role: who we are and what we do

- Operating context and key risks

- Results: what we achieved

- Programs

- Program 1.1: Market Access and Diversification

- Program 1.2: Innovation for New Products and Processes

- Program 1.3: Investment in Natural Resource Sectors

- Program 1.4: Statutory Programs – Atlantic Offshore

- Program 2.1: Energy-Efficient Practices and Low-Carbon Energy Sources

- Program 2.2: Technology Innovation

- Program 2.3: Responsible Natural Resource Management

- Program 3.1: Protection for Canadians and Natural Resources

- Program 3.2: Landmass Information

- Internal Services

- Programs

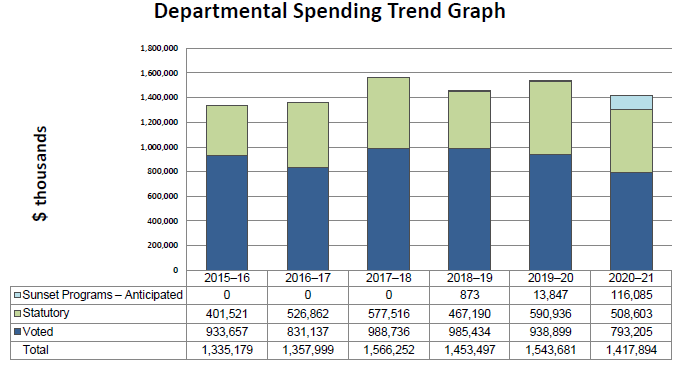

- Analysis of trends in spending and human resources

- Supplementary information

- Appendix: Definitions

Minister’s message

I’m delighted to present the 2017-2018 Departmental Results Report for Natural Resources Canada (NRCan). The following pages reflect a year of significant achievement in helping Canadians embrace the opportunities of a low-carbon future.

Central to those efforts was Generation Energy, the largest conversation about energy in our history. Canadians told us they want a future of clean, affordable and reliable energy – one that respects Indigenous rights, protects the environment and grows our economy. That vision is reflected in the policies we presented and will continue to inform our efforts in the year ahead.

The legislation introduced to modernize the National Energy Board is a prime example of positioning Canadians to succeed. It will transform how we assess major resource projects - whether a new mine, dam or pipeline - while protecting the environment and providing certainty to investors.

To make Canada a global leader in the use of sustainable biomass, we helped develop the Forest Bioeconomy Framework. This will decarbonize the economy as a whole and create economic opportunities and job creation in rural and Indigenous communities.

As Canada continues to renew its nation-to-nation relationship with Indigenous Peoples, we are supporting improved capacity in areas such as environmental stewardship and forest management.

Over the past year, our department launched discussions on the Canadian Minerals and Metals Plan – a plan that prepares for the mining industry of the future, where emissions are lower and productivity is higher; where there are more Indigenous-owned companies and more women in every type of job.

To make it easier for Canadians to develop their clean tech ideas, we created a single point of access to all government funding and services. And women entrepreneurs were encouraged to share their innovations through a new prize-based Women in Cleantech challenge.

The department introduced several new programs to build the green infrastructure of tomorrow – everything from smart grids and alternative fuel charging stations to more energy efficient buildings. We also made important strides in helping rural and remote communities use cleaner, healthier forms of energy. And communities across the country were given new tools to help them adapt to climate change.

Internationally, NRCan continued to expand global markets for our resources, including liquefied natural gas, creating new opportunities for Canadian producers.

As the world moves toward a low-carbon future, NRCan will continue to play a key role, supporting Canada’s natural resource sectors as they make our traditional energy even cleaner, develop renewables, promote energy efficiency, provide key minerals and metals and bring exciting new wood products to market.

It’s an exciting time to be part of Natural Resources Canada and I look forward to continuing this important work for Canadians.

The Honourable Amarjeet Sohi, P.C., M.P.

Minister of Natural Resources

Results at a glance

Canada’s natural resources play a critical role in the transition to a low-carbon future and remain an important source of jobs, prosperity and opportunity, accounting for 17% of all economic activity. To improve the quality of life for all Canadians, Natural Resources Canada (NRCan) advances the sustainable development of these resources through its programs, world-class research and development, as well as domestic and international engagement.

In 2017-18, NRCan made significant progress on delivering results for Canadians and meeting the Minister’s Mandate Letter Commitments in five priority areas highlighted below.

Priority

Economic Growth through Innovation

Canada’s vision for a clean, innovative economy balances both economic growth and environmental protection through natural resource sectors that are stronger, more sustainable and more competitive. In 2017-18, NRCan:

- Helped meet Canada’s climate change goals, create jobs, and Canadian companies commercialize and expand their access to global markets by investing in innovative clean technologies through the Clean Growth Program ($155 million over four years). To grow projects or companies, NRCan launched the Clean Growth Hub jointly with Innovation, Science and Economic Development Canada to provide a whole-of-government focal point for access to programs, services and funding (engaged with over 200 companies as of March 2018).

- Helped find marketable breakthrough solutions to environmental challenges while at the same time promoting gender equality by launching the Women in Cleantech Challenge, the first of NRCan’s five prize-based competitions under the Impact Canada initiative.

- Advanced Government of Canada priorities in forest sector innovation and growth with targeted investments, including through the Indigenous Forestry Initiative (IFI) (additional $10 million) and the Forest Innovation Program (funded 17 projects, valued at $1.2 million). These investments were reinforced by the release of Canada’s Forest Bioeconomy Framework by the Canadian Council of Forest Ministers and by NRCan’s innovative forest research which supports economic development and the shift to the emerging bio-economy.

- Addressed mining issues from spurring innovation to providing regulatory certainty and support a diverse workforce, including for Indigenous peoples, by initiating the Canadian Minerals and Metals Plan with provincial mining ministers. NRCan also helped to reduce energy consumption and greenhouse gas emissions through the Green Mining Innovation Program for improved productivity and competitiveness.

- Supported efforts to advance the global competitiveness of Canada’s liquefied natural gas and offshore sectors by convening a Joint Working Group on oil and gas competitiveness with provinces.

- Helped develop economic growth strategies to support long-term resource competitiveness by co-leading the creation of the Clean Technology and Resources of the Future Economic Strategy Tables.

Priority

Effective Action on Climate Change

Effective action on climate change means reducing our greenhouse gas emissions while growing our economy and making informed decisions to adapt to a changing climate. In 2017-18, NRCan:

- Continued implementation of more than half of the 50 actions under the Pan Canadian Framework on Clean Growth and Climate Change (PCF) and worked with provinces and territories on actions under the Canadian Energy Strategy (CES). This includes launching five Green Infrastructure programs: Clean Energy for Rural and Remote Communities (including partnering with Indigenous communities), Emerging Renewable Power (such as, solar, biomass, tidal), Smart Grids, Electric Vehicle and Alternative Fuel Infrastructure, and Energy Efficient Buildings.

- Spearheaded the Generation Energy dialogue to produce a vision for a prosperous energy future that balances environmental and economic interests. This dialogue was the largest, most diverse conversation about energy in Canada’s history, with more than 380,000 Canadians and international experts participating.

- Expanded the ENERGY STAR® program to include industry and buildings for enhanced energy efficiency, reduced costs, and increased competitiveness. NRCan is also introducing new energy efficiency standards to reduce differences that exist between federal and provincial regulations.

- Hosted a successful meeting to prepare for the Clean Energy Ministerial (CEM) and Mission Innovation (MI) which was held in Europe in May and which Canada will host in 2019.

Priority

Increase Trade, Growth and Foreign Direct Investment in the Natural Resources Sector

NRCan worked closely with domestic and international partners to promote trade and investment, support greater access to foreign markets and maintain Canada’s overall natural resources advantage. In 2017-18, NRCan:

- Helped restore Canadians’ confidence in how major resource projects are reviewed, protect the environment and provide certainty to businesses and investors by contributing to the Government of Canada’s comprehensive review of environmental and regulatory processes, working closely with other government departments on legislation that will modernize the National Energy Board by establishing a new Canadian Energy Regulator and creating the Impact Assessment Agency of Canada.

- Provided ongoing support to renegotiating NAFTA and NRCan also made significant progress promoting Canada’s energy sector through the Canada-Mexico Partnership, which led to increased participation by Indigenous communities and generated ideas for improving the consultation process. Agreement on enhanced energy integration and collaboration was reached at the North American Energy Ministerial in November.

- Strengthened bilateral cooperation with China through a large trade mission in June 2017. The mission resulted in signed trade agreements worth close to $100 million, including for integrating zero-emission motors on Chinese city buses and developing solar seasonal storage for district heating systems. The Canada-India Ministerial Energy Dialogue was expanded to include electricity, energy efficiency, and renewable energy.

- Advanced foreign investment in Canada’s natural resource sectors and strengthened market access by leading over 20 trade and investment missions in 2017-18. NRCan also supported the G7 Energy Ministerial, the International Energy Forum and the International Atomic Energy Agency by sharing best practices and expertise and enhancing science and technology collaboration.

Priority

Advance Reconciliation and Enhance Economic Outcomes in Indigenous Communities

A renewed relationship with Indigenous peoples includes improving economic opportunities in communities and ensuring that they benefit from natural resource projects. In 2017-18, NRCan:

- Co-developed and implemented Indigenous Advisory and Monitoring Committees to help oversee the Trans Mountain Expansion and Line 3 Replacement projects. The first of their kind, these Committees approved contribution agreements worth over $11 million and their work has informed government and regulatory policies.

- Advanced economic development for Indigenous communities through improving access to federal programs and services related to pipeline projects by launching the Economic Pathways Partnership pilot.

- Promoted increased Indigenous participation in Generation Energy, the Energy and Mines Ministers’ Conference and the Canadian Council of Forest Ministers meeting.

- Moved forward in helping to reduce the reliance of rural and remote communities on diesel fuel for heat and power by launching the Clean Energy for Rural and Remote Communities program in February 2018 that provides funding to clean energy projects in those communities ($218 million over six years).

- Supported economic development projects of 35 Indigenous communities and regional organizations in the areas of environmental stewardship, forest resource management and use, and participation in the forest bioeconomy by funding 30 projects under the Indigenous Forestry Initiative (IFI) as part of Canada’s Softwood Lumber Action Plan (SLAP).

- Advanced the participation of Indigenous peoples in the mining industry, addressed competitiveness challenges, and raised the level of the mining industry’s economic contribution in regions across the country by developing the Canadian Minerals and Metals Plan in August 2017 (which is targeted for release in 2019).

Priority

Greater Safety and Security for Canadians

The Department contributed to the protection of Canadians, Canada’s infrastructure and the environment by providing critical tools to help fight natural disasters and protect Canada’s oceans and lands. In 2017-18, NRCan:

- Released a new satellite monitoring system for tracking fires, upgraded 50 seismic stations to monitor earthquakes and enhanced the Emergency Geomatics Service to improve situational awareness during floods and wildfires.

- Assisted in safeguarding our coasts and oceans from oil spills by contributing essential research to the Government of Canada’s Oceans Protection Plan as well as key mapping data for the moratorium on tanker traffic along British Columbia’s north coast. NRCan also continued its work on advancing regulations under the Pipeline Safety Act.

- Contributed geoscience knowledge and advice to environmental impact assessments to help reduce adverse environmental effects and ensure proper mitigation measures were in place for 53 development projects (e.g., mining, oil and gas, nuclear projects).

- Helped minimize forest loss through research on the Spruce Budworm and Mountain Pine Beetle that continue to threaten millions of hectares of North American forests, including through an innovative early intervention strategy for controlling the spruce budworm.

| 2017-18 Actual Spending | 2017-18 Actual Full-Time Equivalents |

|---|---|

| $1,566 million | 3,980 |

For more information on Natural Resources Canada’s plans, priorities and results achieved, see the “Results: what we achieved” section of this report.

Raison d’être, mandate and role: who we are and what we do

Raison d’être

NRCan works to improve the quality of life of Canadians by ensuring that our natural resources are developed sustainably, providing a source of jobs, prosperity and opportunity, while preserving our environment and respecting our communities and Indigenous peoples.

Mandate and role

Text version

Map locating NRCan offices and laboratories in Canada.

The Minister of Natural Resources has responsibilities in relation to more than 30 acts of Parliament. The Minister’s core powers, duties and functions are set forth in the Department of Natural Resources Act, the Resources and Technical Surveys Act, the Forestry Act, the Energy Efficiency Act and the Extractive Sector Transparency Measures Act. The Department also works in areas of shared responsibilities with provinces, which includes the environment, public safety, economic development, science and technology, and consultations with Indigenous peoples. To fulfil its responsibilities, the Department relies on a number of instruments (e.g. policy, regulation, statutory transfers, grants and contributions) and key activities (e.g. science and technology, partnerships and communications).

NRCan has offices and laboratories across the country. About one-third of our employees are located in the National Capital Region, with the remainder working in regional offices: Atlantic Canada, Quebec, Ontario, the Western and Pacific Regions and Northern Canada.

For more general information about the Department, see the “Supplementary information” section of this report. For more information on the Department’s mandate, see the NRCan website.

Operating context and key risks

Operating context

Canada’s wealth of natural resources, which include renewable and non-renewable energy, minerals and metals, and forests, are key to our economic prosperity and provide Canadians with good jobs and business opportunities. In 2017, Canada’s natural resource sectors accounted for approximately 17% of Canada’s nominal gross domestic product and directly or indirectly provided 1.8 million jobs.

NRCan works to advance the prosperity of Canada’s natural resource sectors while also achieving environmental results such as reduced greenhouse gas (GHG) emissions through sustainable practices. In fulfilling its mandate, the Department faced a number of domestic and global challenges in 2017–18.

First, the emergence of large and growing export markets for natural resources, such as China and India, is increasing the overall demand for natural resources and putting positive pressure on commodity prices. Together with demand from the United States, which continues to be generally strong, and specific measures on our softwood lumber exports, this upward trend in demand gives Canada opportunities for increasing our exports and driving further economic growth and job creation.

Secondly, as Canada's natural resource industries work to gain their share of the growing global market, they face an evolving competitive landscape marked by cyclical downturns in pricing, changing supply and demand patterns in the United States and beyond, and regulatory changes and new policy approaches to climate change and carbon pricing. In response, in 2017–18, NRCan worked with international partners to promote investment in Canada’s natural resource sectors and collaborated with Canadian industry to research, develop and test innovative approaches, diversify products and services, and leverage knowledge and clean technologies to ensure we stay competitive. In addition, the Department continued to work to ensure that the right structures are in place—including resource management systems, environmental and regulatory regimes, and accessible public geoscience—to support Canada’s competitive advantage in the natural resource sectors.

Thirdly, 2017–18 saw a continued increase in competition in natural resource markets worldwide, accompanied by a greater emphasis on sustainability and environmental stewardship among international governments. NRCan took steps to ensure Canada has sustainable, cleaner, and competitive natural resource sectors to drive towards a low carbon future. Through its scientific research and partnerships, the department continued to support innovation in the development of clean technologies.

Also in support of the transition to a low-carbon future, NRCan continued its efforts to minimize the carbon footprint of conventional energy sources by supporting initiatives to increase the supply of clean and renewable energy and by promoting energy efficiency. The Department engaged Canadians in a national dialogue called Generation Energy and helped establish the Generation Energy Council to make recommendations to accelerate Canada’s transition to a competitive, reliable, affordable, low-carbon energy future.

Lastly, climate change continued to affect the sustainability and competitiveness of our natural resource sectors (e.g., contributing to the increased threat of wildfires and destructive pests that can have devastating effects on Canada’s forest sector). Through its risk management programs, NRCan helped to manage climate-related and other threats and emergencies.

Key risks

NRCan monitors its risks on an ongoing basis to ensure that it can effectively deliver its mandate. The following table outlines the Department’s key external risks and mitigation strategies identified in the 2017–18 Departmental Plan. While these risks do not lend themselves to being fully addressed in the short term, as highlighted below, the Department made progress in responding to these risks.

| Risks | Mitigating strategy | Link to the Department’s programs | Link to mandate letter commitments or to government-wide and Departmental priorities |

|---|---|---|---|

| Climate Change and Adaptation Mitigation | |||

| If energy and natural resource decisions do not support Canada’s transition to a low carbon economy and adoption of adequate adaptation measures, Canada’s climate change commitment to reduce GHG emissions by 30 % may not be met, the competiveness of our natural resource sectors may be undermined and communities may become increasingly vulnerable to the impacts of climate change. | In 2017–18, NRCan’s risk responses included:

|

1.1 Market Access and Diversification 2.1 Energy-Efficient Practices and Low-Carbon Energy Sources 2.2 Technology Innovation 3.1 Protection for Canadians and Natural Resources |

Government Priorities: Mandate Letter: Develop a Canadian energy strategy with provinces and territories Make strategic investments in the clean technology sector |

| Clean Technology and Innovation in the Natural Resource Sectors | |||

| Lack of innovation may reduce job creation and economic growth in Canada’s natural resource industries and clean technology sector | In 2017–18, NRCan managed this risk by:

|

1.2 Innovation for New Products and Processes 2.1 Energy-Efficient Practices and Lower-Carbon Energy Sources 2.2 Technology Innovation |

Government Priorities: NRCan Mandate Letter: Make strategic investments in the clean technology sector Enhance Canada’s tax measures to generate and attract more clean technology investments |

| Energy Infrastructure | |||

| If the public and Indigenous peoples do not have confidence in Canada’s ability to expand its infrastructure in a safe and environmentally sound manner, then Canada’s ability to grow its economy, increase interconnectedness, and diversify markets may be limited. | In 2017–18, NRCan’s risk responses included:

|

1.1 Market Access and Diversification 1.3 Investment in Natural Resource Sectors 2.2 Technology Innovation 2.3 Responsible Natural Resource Management 3.1 Protection for Canadians and Natural Resources |

Government Priorities: NRCan Mandate Letter: Modernize the National Energy Board Review Canada’s environmental assessment processes |

In 2017-18, NRCan monitored its risk environment, including the global and domestic context within which the Department operated, and implemented strategies to reduce the impact of risks on Canadians, the Department and stakeholders.

The Department worked to reduce the impact of climate change on Canadians, their communities and the environment. NRCan also fostered the development of innovative solutions to the most pressing environmental issues in support of the transition to a low-carbon economy. Lastly, the Department supported environmentally sound approaches to building and improving the secure infrastructure needed for transporting Canada’s energy resources to domestic and international markets, an essential element in maintaining public trust and confidence, including among Indigenous communities.

Results: what we achieved

Programs

Program 1.1: Market Access and Diversification

Description

Canada’s natural resource sectors face two key barriers to market access and diversification: 1) trade and policy barriers, and 2) lack of awareness of Canada’s natural resource products and public confidence. The objectives of this program are to break down those barriers and support the development and expansion of markets for Canadian natural resource products by making information available to Canadians, supporting negotiations to reduce trade barriers, and ensuring that regulations are up to date. This helps maintain natural resource sectors’ access to existing markets and increases their access to new market segments.

Results

In 2017–18, the Department delivered a range of policies and outreach activities to address barriers to market access and diversification, support the development and expansion of Canada’s natural resource products, and bolster public confidence in the natural resource sectors.

NRCan supported market access and diversification of Canada’s natural resource sectors by:

The Canadian Minerals and Metals Plan

As a world leader in mining, Canada’s minerals and metals sector provides 596,000 direct and indirect jobs and contributes 3% to Canada’s GDP. Canadian mining companies abroad also have $171 billion in assets across 102 countries. Accordingly, it is important that Canada’s mining industry continues to have a competitive advantage at home and abroad that attracts investment and encourages partnerships to develop mining projects positioning mineral development for long-term success.

To further build Canada’s brand on the world stage and realize the industry’s potential at home, NRCan, along with provincial and territorial Ministers responsible for mining, committed in August of 2017 to develop a Canadian Minerals and Metals Plan.

The Plan, targeted for release in 2019, aims to address competitiveness challenges, raise the level of the mining industry’s economic contribution in regions across the country, advance the participation of Indigenous peoples, and increase attractiveness to foreign investment. The Plan is intended to align with national priorities by looking at clean and inclusive growth, environmental and regulatory efficiency and predictability, innovation, healthy communities, progressive trade, and a renewed relationship with Indigenous peoples.

- Supporting the Minister’s participation in the G7 Energy Ministerial, the Clean Energy Ministerial, Mission Innovation , and the International Energy Agency Ministerial. As a leader in the transition to a low-carbon economy, NRCan highlighted opportunities for investment and trade with Canada. To advance Canada’s nuclear energy sector NRCan also participated in a number of meetings, committees and initiatives led by the International Atomic Energy Agency (IAEA), including the IAEA annual General Conference, the International Group of Experts on Nuclear Liability, as well as co-chairing the Uranium Group meetings.

- Leading over 20 trade and investment promotion missions with key international partners, such as the United States, China, Japan, and Mexico. For example, NRCan led a ministerial mission to China in June 2017, which resulted in commercial agreements totalling close to $100 million worth of investments;

- Strengthening bilateral cooperation in China and India. Specifically, in China, NRCan enhanced cooperation on energy, eco-cities, sustainable mineral resource science and research through a series of Memoranda of Understanding (MOU); reached an agreement with China to launch the Ministerial Dialogue on Clean Energy under the Canada–China Joint Statement on Climate Change and Clean Growth and launched a Canada–China Track II Energy Dialogue. In India, NRCan expanded the Terms of Reference for the Canada–India Ministerial Energy Dialogue to include electricity, energy efficiency, and renewable energy;

- Promoting Canada’s energy sector by offering Canada’s best practices on Indigenous community engagement through the Canada–Mexico Partnership and playing a significant role in the establishment of the France–Canada Climate and Environment Partnership, which was announced by both countries at the One Planet Summit in Paris in December 2017;

- Collaborating with Global Affairs Canada to develop a new process to recognize foreign quality assurance systems in the South Korean market and provide science support to the Canadian Food Inspection Agency in order for Canadian phytosanitary certificates to meet Malaysian import requirements;

- Establishing a Raw Material Dialogue with the European Union, under the Canada–European Union Free Trade Agreement in order to facilitate market access for raw material goods, services, and investments. This dialogue entered into force in September 2017;

- Providing on-going technical advice to the renegotiation of NAFTA, including on issues related to energy, dispute settlement mechanisms, investment, environment and rules of origin. Also, at the North American Energy Ministerial in November 2017, Canada, the U.S. and Mexico agreed to continue to advance North American energy integration by collaborating in the areas of security (including energy infrastructure security), reliability and responsibility, trade and investment development, and diversifying energy resources;

- Convening a Joint Working Group on oil and gas competitiveness to examine issues affecting the competitiveness of the upstream oil and gas industry in Canada, build a common understanding of the factors that influence investment, promote Canada’s comparative advantages, and discuss opportunities to promote the Canadian energy brand. Specifically, Canada has been working closely with provinces, following a commitment by Energy and Mines Ministers to study barriers to oil and gas competitiveness, including the Government of British Columbia, on concrete options both levels of government can take to ensure the global competitiveness of Canada’s liquefied natural gas and offshore sectors;

- Providing funding to WoodWORKS! programs to increase the use of wood products in Canada’s construction market through the Expanding Market Opportunities Program. Specifically, the programs influenced 238 projects to use wood over traditional materials, creating an incremental $163 million of direct wood products sales; provided training to over 24,000 professionals; expanded wood-based construction in the mid-rise (five to six storeys) market; and supported the construction of the Brock Commons, a tall wood building at the University of British Columbia; and

- Facilitating the forest sector’s capacity to diversify offshore wood markets in China, Japan and other key offshore markets. Specifically, NRCan supported the call for proposals to establish the second Sino-Canadian Eco-District Initiative and China’s first modern tall wood demonstration building with the goal both to improve the capacity of Canada’s construction industry to build with wood and to showcase wood construction to stakeholders. In Japan, NRCan supported wood residential and non-residential construction training to over 750 participants with the aim to build 2,289 residential wood units over the next five years. NRCan also increased offshore outreach, technical support, and marketing activities by providing an additional $3 million annually through the Softwood Lumber Action Plan, which reinforces Canada’s presence in China, Japan, South Korea and India.

In 2017–18, the Department delivered a range of policy and outreach activities to make information available to Canadians, engage Canadians on the future of natural resources, bolster public confidence in Canada’s natural resource sectors, and improve relationships with, and outcomes for, Indigenous peoples. For example, NRCan:

Mandate Letter Commitment

Modernize the National Energy Board (NEB)

For nearly 60 years, the NEB has been responsible for regulating approximately 73,000 km of international and interprovincial pipelines 1,400 km of international power lines, and the import and export of energy in Canada.

In May 2017, after extensive public engagement, the Expert Panel on the Modernization of the NEB released its report with recommendations and advice on the NEB’s governance and structure, mandate and future opportunities, decision-making roles, compliance, enforcement and ongoing monitoring, engagement with Indigenous peoples and public participation responsibilities.

Subsequently, as announced in February 2018 and under the purview of the Canadian Energy Regulator Act, the Government proposed to create the new Canadian Energy Regulator, replacing the NEB, to continue to evolve and adapt to changing times.

This new Regulator will have the independence and the proper accountability to oversee a strong, safe and sustainable Canadian energy sector, while addressing economic and climate change goals, regaining public trust and supporting reconciliation with Indigenous peoples.

- Launched Generation Energy. This was the largest national conversation about energy in Canada’s history, engaging more than 380,000 Canadians and international experts both in person and online. Over six months, youth, Indigenous peoples, energy experts, academia, industry stakeholders, and the public shared their vision of how Canada could meet climate goals, create jobs, and keep energy affordable. This information will be instrumental in building the new energy vision for Canada;

- Improved the energy information it collects and shares, and revamped its Energy Fact Book, providing a solid foundation for Canadians to understand and discuss important developments across the energy sector;

- In partnership with Indigenous communities, co-developed and implemented Indigenous Advisory and Monitoring Committees. These Committees bring together Indigenous and government representatives to review and monitor the environmental, safety and socio-economic issues related to the Trans Mountain Expansion Project (TMX) and the Line 3 Replacement Program (Line 3). Through their work, and with over $11 million in contribution funding committed by March 31, 2018, the committees have reviewed proponent plans and reports, conducted monitoring, enhanced Indigenous community capacity, and begun to inform government and regulator policies and processes;

- Launched the Economic Pathways Partnership (EPP) pilot for the TMX and Line 3 projects with six workshops held across the four western provinces to connect representatives from over 125 Indigenous communities, organizations and businesses with proponents, federal departments, service providers and others to support their economic development interests. The EPP is a whole-of-government approach that makes it easier for Indigenous groups to access existing federal programs and services that help them participate in opportunities related to pipeline projects, and advance their broader economic development interests;

- Addressed Indigenous priorities and interests related to energy infrastructure development by working collaboratively with Indigenous communities and other federal departments, and by providing $11.7 million in support for 57 projects related to jobs and economic growth, environmental action, fish habitat restoration, and engagement through the Strategic Partnerships Initiative – West Coast Energy Infrastructure Initiative;

- Continued its work on advancing regulations under the Pipeline Safety Act;

- Administered (ongoing) the Export and Import of Rough Diamonds Act to ensure that Canada is in compliance with the international Kimberley Process Certification Scheme to secure Canada’s diamond exports as an ethical source of valuable minerals; and

- Helped deliver 450 annual reports that identified over $20 billion in payments to nearly 1,000 governments in Canada and abroad to ensure that Canada meets its obligations under the Extractive Sector Transparency Measures Act. These products contributed to Canada’s international commitments to increased transparency and deterring corruption in the extractive sector.

Finally, NRCan has made progress towards modernizing the National Energy Board (NEB). NRCan has been instrumental in providing expertise and engaging with Indigenous groups, industry associations, environmental groups and other stakeholders to develop new policies and regulations. In parallel, NRCan contributed to important milestones in the Government’s review of the environmental and regulatory processes in order to rebuild public trust in the resource development decision-making process. The Government tabled proposed legislation in February 2018 that will establish a new impact assessment and regulatory system, including the proposed Impact Assessment Act and the Canadian Energy Regulator Act. These legislative and policy reforms were informed by an expert panel report, a federal discussion paper, parliamentary studies, and almost two years of consultations with Indigenous peoples, industry, provinces and territories, non-governmental organizations, academia, and the public. The approach proposed by this new impact and regulatory system is founded on a commitment to change how the federal government works with Indigenous peoples, for example, by setting the full recognition of Indigenous rights and interests as the basis of partnership from the outset and by creating opportunities for Indigenous partnerships and co-development in project monitoring and traditional knowledge integration.

| Expected results | Performance indicators | Target | Date to achieve target | 2017–18 Actual results | 2016–17 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| Natural resource sectors have increased access to existing markets | Natural resource sectors have access to markets as defined by exports of energy products, mineral and metal products and forest products | Meet or exceed baseline of ten-year average of Canada's share of United States and global imports | March 31, 2018 | Results: Achieved In 2017-18, Canada’s share of U.S. Natural Resource Imports for 2017-18 was 25.2%, above the target of 23.7%, the 10-year baseline average from 2007-2016. The overall value of American natural resource imports from Canada in 2017 was $172.3 billion, below the 2008 value of $197.2 billion. In terms of global imports, Canada’s share amounted to 4.4%, in line with the 10-year baseline average of 4.4% from 2007-2016.Footnote 1 |

Results: Achieved In 2016–17, Canada's share of American natural resource imports was 23.8%, a minor variation against the 10-year baseline average 23.7%. |

Results: Achieved In 2015–16, Canada’s share of American natural resource imports was 25.1% (1.5% above the 10-year 2005–14 baseline average of 23.6%). The overall value of American natural resource imports from Canada in 2015 was $164.3 billion, above the 2006 figure of $95.2 billion. |

| Natural resource sectors have increased access to new market segments | Natural resource sectors have access to new market segments as defined by exports of energy products, mineral and metal products and forest products | Meet or exceed baseline of ten-year average of Canada’s share of China and India’s imports | March 31, 2018 | Results: Achieved In 2017-18, Canada’s share of Chinese natural resource imports was 1.4% , close to the target of 1.7% (10-year baseline average from 2007- 2016).Footnote 2 Canada’s share of India’s Imports rose to 1.2%, well above the target of 0.6%, the10-year baseline average from 2007-2016.The value of India’s imports from Canada was $4 billion in 2017-18.Footnote 3 |

Results: Achieved In 2016-17, Canada's share of Chinese natural resource imports was 1.6%, close to the 10-year baseline average of 1.7% (2007-16). The overall value of Chinese natural resource imports from Canada in 2016 was $7.7 billion, above the 2007 value of $6.0 billion. |

Results: Achieved In 2015-16, Canada’s share of Chinese natural resources imports was 1.7%, stable against the 10-year (2005-14) baseline average. The overall value of Chinese natural resource imports from Canada in 2015 was $11.6 billion, nearly three times the 2006 figure of $4.3 billion. |

| 2017–18 Main Estimates | 2017–18 Planned spending | 2017–18 Total authorities available for use | 2017–18 Actual spending (authorities used) |

2017–18 Difference (actual minus planned) |

|---|---|---|---|---|

| 60,190,597 | 60,190,597 | 82,822,778 | 69,193,650 | 9,003,053 |

The increase between Planned spending and Actual spending is mainly attributed to additional funding received during the year through Supplementary Estimates for the Softwood Lumber Action Plan and the Indigenous Advisory and Monitoring Committees for Energy Infrastructure projects, as well as wage increases due to collective bargaining.

| 2017–18 Planned | 2017–18 Actual | 2017–18 Difference (actual minus planned) |

|---|---|---|

| 267 | 304 | 37 |

The increase between Planned FTEs and Actual FTEs is mainly attributed to the hiring related to funding received through Supplementary Estimates.

Information on NRCan’s lower-level programs is available in the GC InfoBase.

Program 1.2: Innovation for New Products and Processes

Description

Optimizing the use of Canada's natural resources and the processes by which they are developed would improve the productivity and competitiveness of natural resource sectors. The objective of this program is to maximize productivity and competitiveness by encouraging the adoption of new technologies and processes and the development of new products. These objectives are achieved by conducting and supporting research and development and by delivering frameworks and policies for, and demonstrations of, new applications, technologies, processes, and products.

Results

In 2017–18, NRCan advanced the development and implementation of new innovative technologies, processes and tools to enhance sustainability and promote economic growth. This was achieved in collaboration with provincial and territorial governments, Indigenous peoples, industry and other stakeholders.

In the forest sector, NRCan supported economic growth through innovation by:

- Facilitating the Canadian Council of Forest Ministers in ratifying a Forest Bioeconomy Framework for Canada in September 2017. The Framework’s objective is to promote economic growth through the development of sustainably managed forest-based resources into innovative value-added products and services;

- Supporting economic development for Indigenous peoples by funding 30 projects under the Indigenous Forestry Initiative (IFI)as part of Canada’s Softwood Lumber Action Plan (SLAP). In 2017–18, the SLAP provided an additional $10 million to the IFI to support forest-based economic development and clean growth technology across Canada. This funding supported economic development projects of 35 Indigenous communities and regional organizations in the areas of environmental stewardship, forest resource management and use, and participation in the forest bioeconomy;

- Selecting proposals for the Investments in Forest Industry Transformation Program that will help recipients develop innovative technologies in forest product facilities across Canada, thus increasing the forest product sector’s economic and environmental sustainability and competitiveness. The program received $55 million in 2017;

- Supporting research, development and technology transfer activities in Canada’s forest sector to advance Government of Canada priorities in forest sector innovation and growth, NRCan funded 17 projects, valued at $1.2 million, under the Forest Innovation Program (FIP);

- Providing research funding to FPInnovations, through the FIP to enable the building of a large-scale Thermal mechanical pulp (TMP)-Bio Plant on the site of a Resolute Forest Products mill in Thunder Bay, Ontario. TMP-Bio is a game-changing technology that converts wood chips traditionally used in newsprint production into sugar and lignin and has the potential to position the Canadian forest industry as a key player in the bioeconomy;

- Co-leading a biomass harvesting research project, focusing on the effects of biomass harvesting in partial harvest systems on stand-level productivity and biodiversity with the Ontario Ministry of Natural Resources and Forestry and the Canadian Wood Fibre Centre; and

- Collaborating on the NSERC Collaborative Research and Development project, AWARE, that uses Enhanced Forest Inventory to improve forest sector productivity and the sustainable management of forest values such as timber, water, and habitat. AWARE involves seven industrial partners, five provincial government partners, and researchers and graduate students from nine Canadian universities.

In the mining sector, NRCan participated in initiatives that increased productivity, improved efficiency and protected the environment by:

- Demonstrating five technologies to increase productivity, including synthetic hoist cables, a performance evaluation of new mining equipment (MinRail), a plasma torch for mine use for rock breaking without explosives, sensors for soft rock deformation, and the beginning of field-testing of a new rock bolt sensor for monitoring bolt rock integrity; and

- Developing new, patent-pending technologies to decrease capital and operating costs, and environmental impacts, including two processes to produce ferrochrome from chromite ore and a purification process for rare earth element recovery.

In the area of geospatial data, NRCan encouraged the adoption of innovative technologies by:

- Delivering a new geospatial tool that allowed future RADARSAT Constellation Mission (RCM) users to stimulate the entire spectrum of data provided by the three-satellite configuration. This tool has permitted government, industry, and academia to have access to greater coverage of Canada’s landscape to facilitate maritime surveillance, disaster management and ecosystem monitoring;

- Advancing Spatial Data Infrastructure (SDI) by enabling agreements on technology standards, institutional arrangements, and policies that will assist in the discovery and use of geospatial information. This includes developing and releasing national guidelines on the acquisition of airborne LiDAR imagery, used by government and industry to measure landscapes, forests and human-built infrastructure down to the centimetre-scale;

- Completing projects related to Smart Cities and Sensor Web – the Internet of Things through the GeoConnections contribution agreements program.

- Developing a Strategic Framework on Geospatial Information and Services for disasters, which was adopted by the United Nations Global Geospatial Information Management Committee of Experts.

| Expected results | Performance indicators | Target | Date to achieve target | 2017-18 Actual results | 2016–17 Actual results | 2015–16 Actual results | |

|---|---|---|---|---|---|---|---|

| Natural resource sectors increase production of new products and processes | Number of new products and processes resulting from NRCan information | 2 per year | March 31, 2018 | Results: Achieved

|

Results: Achieved

|

Results: Achieved Two new products were developed based on NRCan information:

|

|

| - | R&D expenditures in natural resource sectors, specifically total intramural R&D expenditures in energy, mining and forest sectors |

Meet or exceed a rolling ten-year baseline average of Canada's total intramural R&D expenditures in energy, mining and forestry sectors. |

March 31, 2018 |

Results: Not Achieved |

Results: Not AvailableFootnote 4 |

Results: Achieved In 2015, business enterprise R&D expense intentions for the energy, mining and forest sectors were $2.1 billion, slightly below the 2006 figure of $2.3 billion. However, these natural resource sector intentions accounted for 13.3% of total industry R&D spending, slightly above the 10-year baseline average of 12.0%. |

|

| Methodologies, policies, strategies, plans and standards are collaboratively used by governments and private sector organizations in the development of new innovative and value-added geospatial applications | Number of formally adopted methodologies, policies, strategies, plans and standards generated from collaborative activities and participation | Increase in the number of methodologies, polices, strategies, plans and standards generated from collaborative activities and participation in 2016-17 and compared to the 2015-16 baseline year | March 31, 2018 | Results: Achieved Six new tools were developed:

|

Results: Achieved Three new tools were developed. This number will be used as the baseline for future reporting years. |

Results: Not available Performance indicator did not exist in 2015-16 |

|

| 2017–18 Main Estimates |

2017–18 Planned spending |

2017–18 Total authorities available for use |

2017–18 Actual spending (authorities used) |

2017–18 Difference (actual minus planned) |

|---|---|---|---|---|

| 109,154,844 | 109,154,844 | 119,804,678 | 118,506,415 | 9,351,571 |

The increase between Planned spending and Actual spending is mainly attributed to additional funding received during the year through Supplementary Estimates for the Softwood Lumber Action Plan as well as wage increases due to collective bargaining.

| 2017–18 Planned | 2017–18 Actual | 2017–18 Difference (actual minus planned) |

|---|---|---|

| 289 | 334 | 45 |

The increase between Planned FTEs and Actual FTEs is mainly attributed to the hiring related to funding received through Supplementary Estimates.

Information on NRCan’s lower-level programs is available in the GC InfoBase.

Program 1.3: Investment in Natural Resource Sectors

Description

Investing in the development of natural resources is costly and risky due to inherent uncertainties in the potential economic viability of natural resource projects. Many factors must be considered when deciding whether to develop a natural resource project. In some cases, limited information may make it difficult for investors and/or companies to assess potential opportunities. The objective of this Program is to encourage investment in the natural resource sectors by increasing industry's knowledge of opportunities, regulations and obligations. This ensures that a more accurate assessment of the expected benefits of an investment can be made and subsequently compared to its costs and risks, thereby allowing for a more comprehensive investment decision. This objective is achieved by providing funding and information on the factors that determine the potential economic viability of natural resource projects.

Results

In 2017–18, NRCan facilitated investment in the energy, forestry, and mining sectors by continuing to support regulatory reform aimed at addressing impact assessment of major development projects in a manner that protects our environment, respects Indigenous rights, and rebuilds public trust—all while ensuring good projects go ahead and our energy resources get to markets responsibly.

On June 20, 2016, the Government of Canada launched a comprehensive review of environmental and regulatory processes, including a review of the Canadian Environmental Assessment Act, the National Energy Board Act, the Fisheries Act, and the Navigation Protection Act, that culminated in the tabling of legislation in February of 2018. NRCan worked closely with other government departments to prepare new and amended environmental and regulatory legislation, which progressed to the Standing Committee on Environment and Sustainable Development by the end of the 2017–18 fiscal year. Key milestones in 2017–18 for NRCan included:

Mandate Letter Commitment

Review Canada’s environmental assessment processes

In February 2018, the Government tabled proposed legislation that will build a new impact assessment and regulatory system for Canada. The new system ensures that the environment, human health and the rights of Indigenous peoples are protected, while also providing certainty to businesses.

These reforms were developed by talking with the public early on and working with Indigenous people at every stage of the process. A discussion paper on government-proposed changes was released in June 2017 and engagement included over 100 meetings and over 1,000 written comments. As a consequence, legislation was tabled on February 8, 2018. The new assessment and regulatory system proposed in the legislation is based upon the best available science and Indigenous knowledge; and one assessment for one project, with the scale of assessment aligned with the scale of the potential impacts of the project.

NRCan continues to implement the Government of Canada’s approach to using an environmentally sound, efficient and consistent process to develop and transport our energy resources to domestic and international markets in a manner that will help build public trust and confidence and diversify our market access.

- Contributing to the creation of better rules for the review of major projects, and establishment of the Impact Assessment Agency of Canada and the Canadian Energy Regulator;

- Providing leadership across the federal government by chairing the Major Projects Deputy Ministers’ Committee to ensure effective collaboration, communication and coordination between departments and agencies. In 2017–18, the Committee provided overarching project management and accountability to facilitate improvements to the regulatory system for major resource projects in Canada;

- Approving five major resource projects: NGTL Towerbirch Expansion Project, Scotian Basin Exploration Drilling Project, Kemess Underground Gold/Copper Mine, Sisson Tungsten and Molybdenum Mine, and Murray River Coal; and

- Continuing to implement the Government’s Interim Strategy for Pipelines and other National Energy Board Reviews, including the Sisson Tungsten and Molybdenum Mine Project. This project underwent a rigorous federal environmental assessment and a provincial environmental impact review based on scientific evidence and benefitting from extensive consultation with Indigenous groups and the public, including the consideration of traditional knowledge from Indigenous peoples.

To allow for more comprehensive investment decisions NRCan made information available to industry and potential investors in the mineral sector and the public that increases awareness of opportunities, regulations, and obligations of natural resource projects. Specifically, NRCan:

- Published 429 Geo-Mapping for Energy and Minerals (GEM) products, which were accessed and downloaded 12,750 times, an 87% increase in uptake for 2017–18. At two international industry exploration conferences in Vancouver and Toronto, Targeted Geoscience Initiative (TGI),released two key milestone reports synthesizing new results from over 40 projects, which were subsequently downloaded 3,690 times. Geoscience for New Energy Supply Program published eighteen reports in 2017–18 to support assessment and investment decision-making on new energy exploration opportunities;

- Established collaboration between the Geological Survey of Canada and Quebec and Newfoundland and Labrador scientific agencies to:

- Support mineral exploration in northern Quebec and Labrador (Hudson–Ungava) by producing a digital atlas of lake sediment geochemical data; and

- Identify new gold and base metal exploration targets in the same area through the creation of surficial geology and geochemistry maps.

- Signed a Memorandum of Understanding with Statistics Canada to transform the Minerals and Metals Production Statistics Program into a shared delivery model and improve how NRCan collects and publishes statistics on mineral exploration, development, and production in Canada.

| Expected results | Performance indicators | Target | Date to achieve target | 2017–18 Actual results | 2016–17 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| Natural resource sectors have increased investment | Growth of energy sector capital expenditures (average of past 5 years) compared to growth in overall capital expenditures in Canada (average of past 5 years) | The past 5-year average growth rate of energy sector capital expenditures is equal to or greater than the past 5-year average growth rate in total capital expenditures in Canada | March 31, 2018 | Results: Not Achieved In 2017, energy sector capital expenditures were $75 billion. Over the past five years (2012–2017), energy sector capital expenditure declined by an average annual rate of 3.4%. This is below the average annual growth rate of -1.0% in the Canadian economy as a whole. This decline continues to reflect the oil price collapse of 2015, which had a significant impact on the industry, and need for infrastructure. |

Results: Not Achieved In 2016, energy sector capital expenditures were $74 billion. Over the past five years (2011–16), energy sector capital expenditure declined by an average annual rate of 1.6%. This is below the average annual growth rate of 0.3% in the Canadian economy as a whole and is likely due, in part, to lower commodity prices which have led natural resource producers in Canada and globally to lower investment. |

Results: Achieved In 2015, energy sector capital expenditures were $89.5 billion. Over the past five years (2010–15), energy sector capital expenditures grew by an average annual rate of 5.7%. This is above the average annual growth rate of 3% in the Canadian economy as a whole. |

| - | Growth of forest sector capital expenditures (average of past 5 years) compared to growth in overall capital expenditures in Canada (average of past 5 years) | The past 5-year average growth rate of forest sector capital expenditures is equal to or greater than the past 5-year average growth rate in total capital expenditures in Canada | March 31, 2018 | Results: Achieved In 2017, forest sector capital expenditures were $2 billion. Over the past five years (2012–2017), forest sector capital expenditure increased by an average annual rate of 9.4%. This is above the average annual growth rate of -1.0% in the Canadian economy as a whole. |

Results: Not Achieved In 2016, forest sector capital expenditures were $13 billion. Over the past five years (2011–16), forest sector capital expenditure declined by an average annual rate of 5.2%.This is below the average annual growth rate of 0.3%in the Canadian economy as a whole and is likely due, in part, to lower commodity prices which have led natural resource producers in Canada and globally to lower investment. |

Results: Achieved In 2015, forest sector capital expenditures were $2.7 billion. Over the past five years (2010–15), forest sector capital expenditures grew by an average annual rate of 14.8%. This is above the average annual growth rate of 3% in the Canadian economy as a whole. |

| - | Growth of minerals and metals sector capital expenditures (average of past 5 years) compared to growth in overall capital expenditures in Canada (average of past 5 years) | The past 5-year average growth rate of minerals and metals sector capital expenditures is equal to or greater than the past 5-year average growth rate in total capital expenditures in Canada | March 31, 2018 | Results: Not Achieved In 2017, minerals and metals sector capital expenditures were $12 billion. Over the past five years (2012–2017), minerals and metals sector capital expenditure declined by an average annual rate of 12%. This is below the average annual growth rate of -1.0% in the Canadian economy as a whole. Investment in minerals and metals is impacted by, in part, commodity prices. |

Results: Achieved In 2016, minerals and metals sector capital expenditures were $13 billion. Over the past five years (2011–16), minerals and metals sector capital expenditure grew by an average annual rate of 6.7%.This is above the average annual growth rate of 0.3% in the Canadian economy as a whole. |

Results: Achieved In 2015, minerals and metals sector capital expenditures were $14.9 billion. Over the past five years (2010-15), minerals and metals capital expenditures grew by an average annual rate of 3.5%. This is above the average annual growth rate of 3% in the Canadian economy as a whole. |

| 2017–18 Main Estimates |

2017–18 Planned spending |

2017–18 Total authorities available for use |

2017–18 Actual spending (authorities used) |

2017–18 Difference (actual minus planned) |

|---|---|---|---|---|

| 73,163,653 | 73,163,653 | 79,038,507 | 79,038,129 | 5,874,476 |

The increase between Planned spending and Actual spending is mainly attributed to wage increases due to collective bargaining. The increase is also explained by a realignment of real property expenditures related to special purpose buildings and the Federal Infrastructure Initiative to the appropriate program, in line with TBS guidelines.

| 2017–18 Planned | 2017–18 Actual | 2017–18 Difference (actual minus planned) |

|---|---|---|

| 395 | 417 | 22 |

Information on NRCan’s lower-level programs is available in the GC InfoBase.

Program 1.4: Statutory Programs – Atlantic Offshore

Description

Through this Program, NRCan monitors and facilitates payment disbursal agreements and transfer payments under the Atlantic Offshore Accord Acts. The Program includes the following: Canada-Newfoundland and Labrador Offshore Petroleum Board; Payments to the Newfoundland Offshore Petroleum Resource Revenue Fund; Payments to the Nova Scotia Offshore Revenue Account; Nova Scotia Crown Share Adjustment Payment; and Canada-Nova Scotia Offshore Petroleum Board.

Results

NRCan met its target on the timeliness and accuracy of offshore payments in 2017–18 and 100% of payments were made on time.

The Canada–Newfoundland and Labrador Atlantic Accord Implementation Act and the Canada–Nova Scotia Offshore Petroleum Accord Implementation Act provide that the benefits of revenues from the Canada–Newfoundland and Labrador and the Canada–Nova Scotia offshore areas flow to the provinces as if the resources were on land.

NRCan collects royalties, interests and penalties arising from production in the Canada–Newfoundland and Labrador offshore area and the Canada–Nova Scotia offshore area and transfers equivalent sums as well as corporate income taxes and other required payments to the two provincial governments pursuant to the Canada-Newfoundland and Labrador Atlantic Accord Implementation Act and the Canada-Nova Scotia Offshore Petroleum Accord Implementation Act.

NRCan also administers the federal contributions to the operating budgets of the Canada–Newfoundland and Labrador Offshore Petroleum Board and the Canada–Nova Scotia Offshore Petroleum Board.

The Department anticipated and prepared the necessary materials for payments to be processed within the prescribed time period to both Nova Scotia and Newfoundland and Labrador as required under the Canada–Newfoundland and Labrador Atlantic Accord Implementation Act and the Canada–Nova Scotia Offshore Petroleum Resources Accord Implementation Act.

| Expected results | Performance indicators | Target | Date to achieve target | 2017–18 Actual results | 2016–17 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| Statutory requirements relating to offshore petroleum payments in Nova Scotia and Newfoundland and Labrador are managed in a timely manner | Percentage of offshore payments processed in a timely manner | 100% | Ongoing | Results: Achieved NRCan anticipated and pro-actively prepared the necessary materials for 100% of payments to be processed in a timely manner |

Results: Achieved NRCan anticipated and pro-actively prepared the necessary materials for 100% of payments to be processed in a timely manner |

Results: Achieved NRCan anticipated and pro-actively prepared the necessary materials for 100% of payments to be processed in a timely manner |

| Statutory requirements relating to offshore petroleum payments in Nova Scotia and Newfoundland and Labrador are managed in an accurate manner | Percentage of offshore payments processed in an accurate manner | 100% | Ongoing | Results: Achieved NRCan anticipated and pro-actively prepared the necessary materials for 100% of payments to be processed in an accurate manner |

Results: Achieved NRCan anticipated and pro-actively prepared the necessary materials for 100% of payments to be processed in an accurate manner |

Results: Achieved NRCan anticipated and pro-actively prepared the necessary materials for 100% of payments to be processed in an accurate manner |

| 2017–18 Main Estimates |

2017–18 Planned spending |

2017–18 Total authorities available for use |

2017–18 Actual spending (authorities used) |

2017–18 Difference (actual minus planned) |

|---|---|---|---|---|

| 408,998,253 | 408,998,253 | 524,634,823 | 524,634,823 | 115,636,570 |

The increase between Planned spending and Actual spending is attributed to a reassessment of royalties paid from prior years resulting in a one-time payment. This was offset by reduced statutory payments under the Atlantic Offshore Accord Acts for royalties related to 2017-18, mainly as a result of lower production and pricing from what was planned.

| 2017–18 Planned | 2017–18 Actual | 2017–18 Difference (actual minus planned) |

|---|---|---|

| 0 | 0 | 0 |

Information on NRCan’s lower-level programs is available in the GC InfoBase.

Program 2.1: Energy-Efficient Practices and Low-Carbon Energy Sources

Description

Canada’s energy markets are defined by the decisions of energy consumers and producers. However, there are multiple barriers to the adoption of energy-efficient practices and implementation of low-carbon energy sources, including a lack of awareness of available options and their benefits, insufficient capacity for adoption (e.g. regulatory frameworks, codes and standards), and financial risk. The objective of this Program is to address these barriers by encouraging and enabling energy consumers and producers to adopt cleaner and more energy-efficient technologies, products, services and practices. These objectives are achieved through education and outreach activities, targeted incentives, and regulatory interventions that keep pace with technological changes.

Results

In 2017–18, NRCan invested in cleaner transportation, improved energy efficiency and strengthened strategic partnerships to advance the longer-term decarbonization of the Canadian economy.

To support the transition to a clean transportation system and to make low-carbon vehicles more attractive to Canadians, NRCan:

Pan-Canadian Framework on Clean Growth and Climate Change

The Pan-Canadian Framework on Clean Growth and Climate Change (PCF) is Canada’s plan to meet our emissions reduction targets, grow the economy, and build resilience to adapt to a changing climate. The plan was developed with the provinces and territories and in consultation with Indigenous peoples, who continue to be involved as the plan is implemented. NRCan leads on almost half of the more than 50 concrete actions under the Framework, representing action across all sectors of the economy. In 2017–2018, NRCan launched a number of programs under the PCF, including:

- Modernizing electricity systems: $100 million toward smart grid utility-led deployment and demonstration projects to reduce GHG emissions, better utilize existing electricity assets and foster innovation and clean jobs. A call for proposals was launched in 2018.

- Making new buildings more energy efficient: $99 million to develop net-zero energy ready building codes that will increase energy efficiency, including funding for RD&D projects, in collaboration with provinces and territories.

- Deploying electric vehicle and alternative fuel Infrastructure: $16.4 million for Phase I of the Electric Vehicle and Alternative Fuel Infrastructure Deployment Initiative, which led to the installation of 43 electrical vehicle chargers and one natural gas refueling station as of March 2018.

- Invested $62.5 million over two years starting in 2016-2017 under Phase I of the Electric Vehicle and Alternative Fuel Infrastructure Initiative, supporting the deployment of 102 electric fast chargers, seven natural gas and three hydrogen refueling stations as well as the demonstration of more than 200 next generation electric vehicle charging stations;

- Launched Phase II of the Electric Vehicle and Alternative Fuel Infrastructure Initiative,Footnote 5 an additional $120 million over four years starting in 2018-19, supporting the development of up to 900 new electric fast chargers, 15 natural gas and 12 hydrogen refuelling stations by 2024;

- Held the Low-Carbon Pathways for Road Freight Workshop, a multi-stakeholder consultation with over 100 stakeholders to encourage fuel-efficient best practices for freight and to discuss proposed actions for further GHG emission reductions; and

- Supported tire testing to inform the development of minimum efficiency standards for light-duty vehicle replacement tires in collaboration with Transport Canada and the National Highway Traffic Safety Administration.

To help the construction industry improve the energy efficiency of buildings and homes the Department invested in key initiatives by:

- Sponsoring the Building Owners and Managers Association of Canada’s Net Zero Challenge, which recognizes high performance buildings on the path to net zero;

- Launching the ENERGY STAR certification® and “who will be the first” challenge for commercial and institutional buildings;

- Releasing the Build Smart – Canada’s Buildings Strategy, to improve how homes and buildings are designed, renovated and constructed, and to improve the energy efficiency of the appliances and equipment they use;

- Collaborating with provinces and territories to develop and adopt increasingly stringent model building codes, with the goal that provinces and territories reach “net-zero energy ready” (NZER) by 2030 for new buildings;

- Signing a six-year Memorandum of Understanding with the National Research Council to develop a NZER model code for buildings and houses as well as a new model energy code for existing buildings and houses by 2022;

- Launching the Greening Government Operations initiative, an enhanced suite of technical advisory services for federal organizations seeking energy and GHG reductions from their building and fleet operations; and

- Implementing eight multi-sectoral projects that drive demand for energy efficiency and energy conservation in the residential building sector.

NRCan worked with provincial and territorial governments and industry stakeholders to improve the efficiency of energy-using equipment used in buildings and homes, specifically by:

Endorsing, at the August 2017 Energy and Mines Ministers’ Conference:

Mandate Letter Commitment

Canadian Energy Strategy (CES)

NRCan is working collaboratively with provincial and territorial governments on advancing the CES to maximize social, environmental and economic benefits from the energy sector. Collectively, we are building a future where there is greater energy conservation, more use of clean energy and innovative technologies, reduced diesel use in remote and off-grid communities and greater access to international markets.

In 2017, NRCan launched Generation Energy, a nation-wide dialogue with stakeholders, experts and individual Canadians to envision what a low-carbon energy future would look like over the course of a generation. Building on the results of that dialogue, the Minister of Natural Resources formed the Generation Energy Council to prepare a report in order to answer crucial questions about Canada’s energy future.

Along with working through the Energy and Mines Ministers’ Conference and the Pan-Pacific Framework mechanism, federal, provincial and territorial representatives will also use recommendations from the Generation Energy Council to deliver on actions outlined in the Canadian Energy Strategy.

Moving forward, First Ministers reaffirmed the importance of energy to Canada’s economy and demonstrated the need for energy and climate policies to go hand in hand.

- The market transformation strategies for energy-using equipment in the building sector to define goals to increase the energy performance of key equipment to 2030 and beyond; and

- The Encouraging Market Transformation through Collaboration on Energy Efficiency Standards to define action plans for how federal, provincial and territorial governments can collaborate to support market transformation and achieve greater harmonization on energy efficiency standards.

NRCan also developed and received Royal Assent for amendments to modernize the Energy Efficiency Act.

NRCan worked with Canadian industry and North American partners to improve industrial energy efficiency, drive competitiveness, and accelerate the uptake of energy management systems, specifically by:

- Providing financial and technical assistance to Canadian companies for energy management projects through NRCan’s Industrial Energy Management Program;

- Expanding the ISO 50001 energy management program to provide support to commercial and institutional sectors. There are now over 160 ISO 50001 certified sites across Canada’s industrial, commercial, and institutional sectors.

- Helping businesses track, analyze and improve energy use by launching new initiatives, such as the ENERGY STAR Challenge for Industry, ENERGY STAR for Industry Certification, and five ENERGY STAR Energy Performance Indicators for integrated steel, automotive, and commercial baking sectors.

- Supporting Canadian leadership of the Clean Energy Ministerial Energy Management Working Group to continue to strengthen alignment with North American and other governments to advance industrial energy management and ISO 50001 adoption worldwide.

NRCan also updated and introduced new energy efficiency standards under Canada’s Energy Efficiency Regulations to align standards and to reduce regulatory differences that exist between federal and provincial regulations.

In 2017–18, to support the transition to low-carbon sources in clean electricity, NRCan strengthened dialogue with provinces, territories, and utilities by:

Experimentation at NRCan:

Finding out what works and why is the basis for evidence-based policy making.

NRCan is using experimentation to explore, establish and test hypotheses that inform and improve policies, services and tools, including through randomized controlled trials.

Last year, NRCan worked with Treasury Board of Canada Secretariat (TBS) and other government departments to co-created the Experimentation Maturity Model to provide a framework to support ongoing conversations about departmental experimentation. Moreover, in 2017–18, NRCan joined the first cohort of departments participating in Experimentation Works, a Government of Canada–wide initiative to train public servants in experimentation by supporting and showcasing actual experiments from start to finish. As part of the initiative and in support of the Energy-Efficient Practices and Low-Carbon Energy Sources Program (2.1), NRCan began designing two experiments to systematically test:

- Types of message frames to determine their effectiveness in nudging homeowners to learn more about home energy audits and;

- How EnerGuide labelling could more clearly communicate energy efficiency ratings to Canadians.

- Working together to determine the most promising electricity infrastructure projects that will reduce greenhouse gases through regional dialogues under the Regional Electricity Cooperation and Strategic Infrastructure Initiative. The findings, which will be publicly available in 2018, will provide an evidence base to inform investment decisions on electricity infrastructure and support efforts to increase access to affordable, clean, and reliable supplies of energy for all Canadians, as part of the Canadian Energy Strategy;

- Supporting the production of renewable energy under the ecoENERGY for Renewable Power Program through 104 funded projects; and

- Supporting sustainable community development to encourage investment in environmental municipal projects by collaborating with ECCC to provide $125 million to the Federation of Canadian Municipalities’ Green Municipal Fund.

NRCan also worked with international governments to:

- Develop the SmartWay Transport Partnership with Brazil, which is designed to help freight carriers and shippers reduce fuel costs while transporting goods in the cleanest, most efficient way possible; and

- Advance women’s participation in the clean energy revolution by contributing to the development of the inaugural Clean Energy Education and Empowerment (C3E) data pamphlet, which was drafted in collaboration with Sweden, Italy, and the International Energy Agency (IEA) and launched at the IEA Ministerial in November 2017.

Finally, in response to the Deputy Ministers Task Force Mandate Letter on Public Sector Innovation, NRCan is integrating experimentation into the way we design and deliver policies, programs, and services for Canadians. In 2017–18, the Department used experimentation as a platform to collaborate with partners and stakeholders, co-create new possibilities, and test hypotheses to understand what works to advance energy efficiency and a low-carbon transitions.

| Expected results | Performance indicators | Target | Date to achieve target | 2017–18 Actual results | 2016–17 Actual results |

2015–16 Actual results |

|---|---|---|---|---|---|---|

| Energy consumers and producers adopt environmentally responsible products and practices related to energy use and production | Canada's total annual energy savings due to efficiency (difference between energy use without energy efficiency improvements and energy use with energy efficiency improvements; the units are petajoules (PJ)) | Positive five-year trend in PJ saved | Ongoing | Results: Achieved From 1990 to 2015, energy efficiency in Canada improved 26.5%, which saved 1,766.1 PJ or $38.2 billion in energy and avoided 94.8 Mt of GHG emissions in 2015. Over the same period, total final energy demand in Canada increased 30%. It would have increased 55% without energy efficiency improvements. |

Results: Not AvailableFootnote 4 |

Results: Achieved From 2008 to 2013, energy efficiency savings in Canada showed a favorable trend. While total energy used by final consumers increased by 28% between 1990 and 2013, the increase without energy efficiency improvements would have been 51%. |

| - | Renewable electricity generation capacity in megawatts (MW) across Canada | Favourable 5-year trend in MW, as per 2007 baseline of 6,753 MW of installed capacity (excluding large hydro) | Now and ongoing | Results: On Track |