Natural Resources Canada Quarterly Financial Report (Unaudited) for the Quarter Ended June 30, 2020

Statement outlining results, risks and significant changes in operations, personnel and programs

1. Introduction

This quarterly financial report should be read in conjunction with the Main Estimates and any Supplementary Estimates approved in a given year by the date of this report. It has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by Treasury Board. This quarterly financial report has not been subject to an external audit or review.

1.1 Authority, Mandate and Programs

Natural Resources Canada (NRCan) works to improve the quality of life of Canadians by ensuring that our natural resources are developed sustainably, providing a source of jobs, prosperity, and opportunity, while preserving our environment and respecting our communities and Indigenous peoples.

Further details on NRCan’s authority, mandate and programs can be found in Part II of the Main Estimates.

1.2 Basis of Presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes NRCan’s spending authorities granted by Parliament, and those used by NRCan are consistent with the Main Estimates and Supplementary Estimates (A) for the 2020-21 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

NRCan uses the full accrual method of accounting to prepare and present its annual unaudited departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date Results

This Departmental Quarterly Financial Report reflects the results as of June 30, 2020, which include Main Estimates for which interim supply was released and Supplementary Estimates for which full supply was released. The details presented in this report focus on and compare the first quarter results of 2020-21 with those of 2019-20.

2.1 Authorities

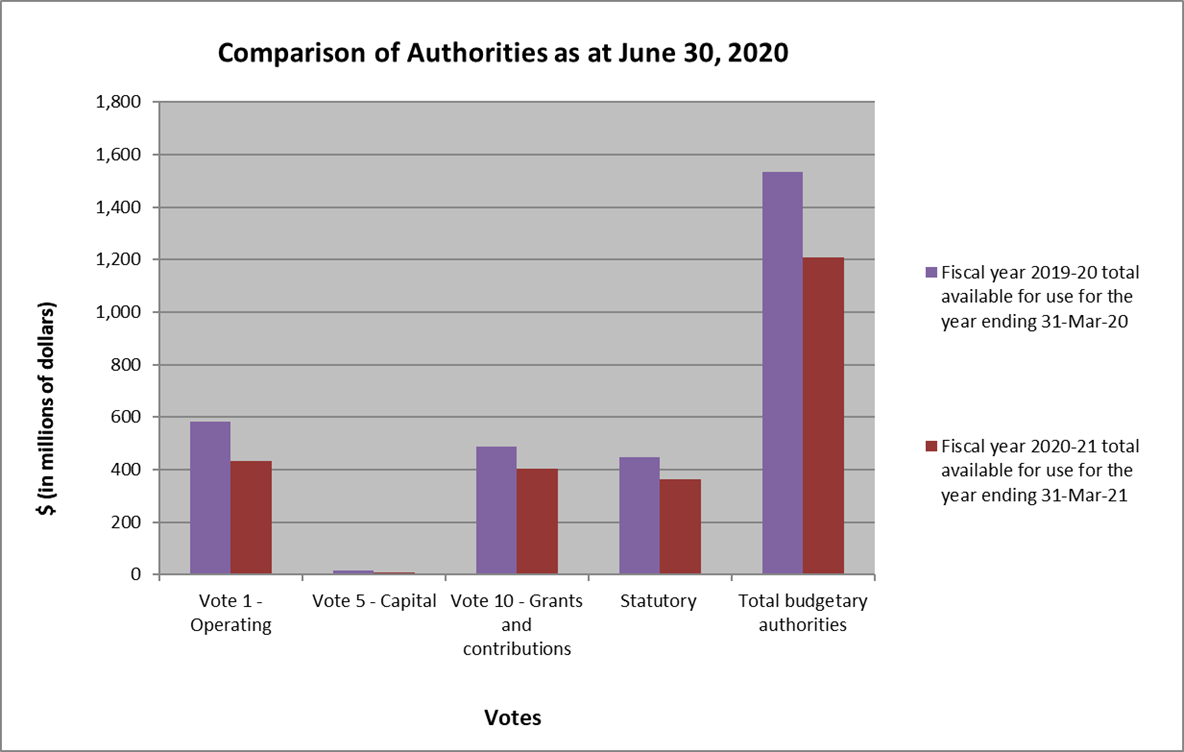

As per Table 1, presented at the end of this document, and on Graph 1 below, as at June 30, 2020, NRCan has authorities available for use of $1,208.3 million in 2020-21 compared to $1,532.2 million as of June 30, 2019, for a net decrease of $323.9 million or 21%.

Graph 1

Text Version

| (in millions of dollars) | Fiscal year 2019-20 | Fiscal year 2020-21 |

|---|---|---|

| total available for use for the year ending 31-Mar-20 | total available for use for the year ending 31-Mar-21 | |

| Vote 1 - Operating | 581 | 432 |

| Vote 5 - Capital | 14 | 9 |

| Vote 10 - Grants and contributions | 489 | 404 |

| Statutory | 447 | 363 |

| Total budgetary authorities | 1,532 | 1,208 |

The decrease of $323.9 million in authorities in 2020-21 compared to 2019-20 is explained by the availability of supply in 2020-21 as well as the net effect of fluctuations within Vote 1 operating expenditures, Vote 5 capital expenditures, Vote 10 grants and contributions, and statutory authorities, as per the following:

Changes to Voted and Statutory Authorities (2020-21 compared with 2019-20)

| (in $000s) | |

|---|---|

| Total available for use for the year ending March 31, 2020 | 1,532,214 |

| Vote 1 - Operating | |

| New funding for collective bargaining to cover wage increases for 2020-21 | 13,836 |

| New funding for Accommodation Measures for the Trans Mountain Expansion project | 6,720 |

| Increased funding for Ensuring Better Disaster Management Preparation Program | 4,465 |

| Decrease for the Trans Mountain Expansion Reconsideration Pipeline process as this phase of the program is completed | (12,637) |

| Decrease for the Geo-Mapping for Energy and Minerals initiative, pending renewal of funding later in 2020-21 |

(10,387) |

| Decrease for the Indigenous Partnerships Office-West, pending renewal of funding later in 2020-21 | (3,316) |

| Decrease for the Targeted Geoscience Initiative, pending renewal of funding later in 2020-21 | (3,253) |

| Decrease for the Major Project Management Office Initiative, pending renewal of funding later in 2020-21 | (3,325) |

| Various minor net decreases | (1,786) |

| Sub total Vote 1 - Operating | (9,683) |

| Vote 5 - Capital | |

|---|---|

| Increased funding for Ensuring Better Disaster Management Preparation Program | 3,225 |

| Decrease in proceeds from the sale of real property | (3,920) |

| Planned decrease in overall capital budget | (2,843) |

| Various minor net increases | 775 |

| Sub total Vote 5 - Capital | (2,763) |

| Vote 10 - Grants & Contributions | |

|---|---|

| Increased funding for the Green Infrastructure initiative | 33,477 |

| Increased funding for the Impact Canada Fund | 19,362 |

| Transfer from other government department for emergency order for the southern mountain population of woodland caribou | 11,400 |

| Transfer from other government department for energy efficiency programming in the automotive sector | 10,000 |

| Increased funding for Accommodation Measures for the Trans Mountain Expansion project | 9,800 |

| Decrease in year-over-year funding for the ecoENERGY for Renewable Power program as the program nears completion | (36,760) |

| Decrease in year-over-year funding for Advancing Clean Technology due to reprofiling of funding | (18,003) |

| Various minor net increases | (2,717) |

| Sub total Vote 10 - Grants & Contributions | 26,559 |

| Statutory | |

|---|---|

| Contribution to the Canada/Newfoundland Offshore Petroleum Board due to increased level of activity. | 1,712 |

| Minister of Natural Resources – Salary and motor car allowance | 2 |

| Newfoundland Offshore Petroleum Resource Revenue Fund adjustment, as it was forecasted at the time of Main Estimates that less revenue would be collected in 2020-21 than in 2019-20, due to fluctuations in oil prices, variances in production and a decrease in planned expenditures.* | (84,410) |

| Employee Benefit Plan (EBP) adjustments, due to salary adjustments in 2020-21 compared to 2019-20 | (1,149) |

| Sub total Statutory | (83,845) |

| Total decrease from previous year due to year-over-year changes | (69,732) |

| Reduced supply of the Main Estimates. Due to the COVID-19 pandemic and limited sessions in the spring for Parliament to study supply, the Standing Orders of the House of Commons were amended to extend the study period into the Fall. NRCan is expected to receive full supply for the 2020-21 Main Estimates in December 2020. | (254,142) |

| Total available for use for the year ending March 31, 2021 | 1,208,340 |

| * In order to establish the statutory authority to be presented in the Main Estimates, NRCan executes its economic forecasting model. The model assesses trends in oil and natural gas prices, production levels, anticipated provincial corporate income taxes, and currency rates, among other things. | |

2.2 Budgetary Expenditures by Standard Object

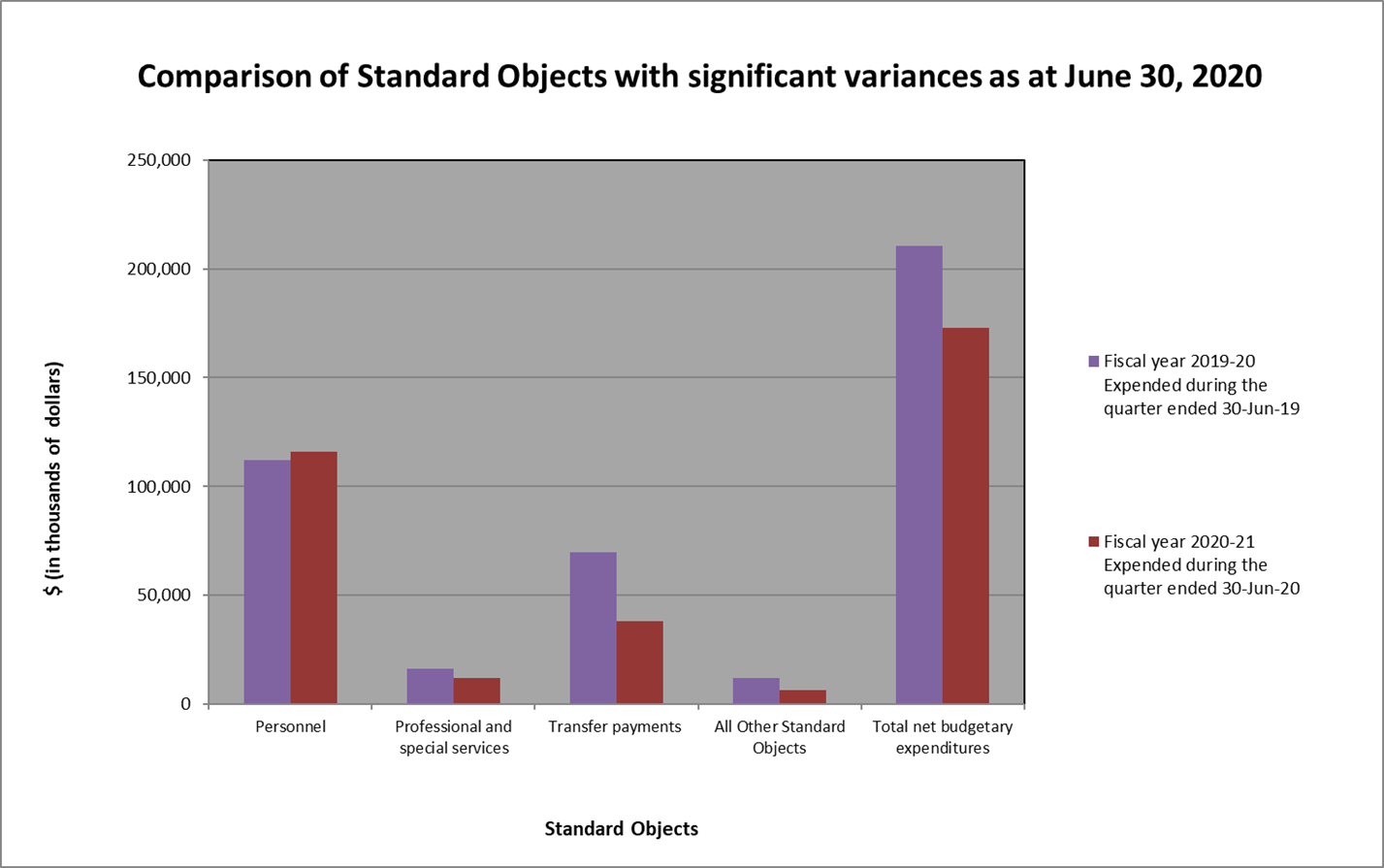

The spending for the quarter ending June 30, 2020 amounts to $172.8 million or 14% of total funding available for the fiscal year, compared to $210.4 million or 14% for the same quarter last year. This decrease of $37.6 million in spending is mainly related to a decrease in expenditures for professional and special services and transfer payments in 2020-21 compared to the same type of expenditures in 2019-20. Further analysis has been done on standard objects with significant expenses, as noted in Graph 2 below. Table 2 at the end of this document presents the spending for all standard objects.

Graph 2

Text Version

| (in thousands of dollars) | Fiscal year 2019-20 | Fiscal year 2020-21 |

|---|---|---|

| Expended during the quarter ended 30-Jun-19 | Expended during the quarter ended 30-Jun-20 | |

| Personnel | 112,320 | 115,972 |

| Professional and special services | 16,196 | 11,893 |

| Transfer payments | 69,965 | 38,303 |

| All Other Standard Objects | 11,883 | 6,628 |

| Total net budgetary expenditures | 210,364 | 172,796 |

Variance in Budgetary Expenditures by Standard Object (2020-21 compared with 2019-20)

| (in $000s) | ||

|---|---|---|

| Standard Object | Explanation | Variance between 2020-21 and 2019-20 Q1 expenditures April 1 to June 30 |

| Professional and special services | The decrease is mainly attributed to the impact of the COVID-19 pandemic causing delays or cancellations to the delivery of goods and services and procurement, as well as the timing of payments from one year to the next. | (4,304) |

| Transfer Payments | The decrease is mainly attributed to reduced offshore activity and a significant drop in oil prices compared to last year, which resulted in a reduction in transfers to the province of Newfoundland and Labrador. In addition, there was reduced contribution spending in Green Infrastructure programs due to the delay of projects as a result of the COVID-19 pandemic, and reduced spending in the ecoENERGY for Renewable Power program as it nears completion. | (31,662) |

| All Other Standard Objects | Minor increases and decreases within different standard objects. | (1,602) |

| Total Variance | (37,568) | |

3. Risks and Uncertainties

Natural resources are a long-standing source of Canadian economic growth and prosperity from coast to coast. They accounted for about 17% of Canada’s nominal Gross Domestic Product and supported 1.9 million jobs in 2019. During the first quarter of 2020-21, as with all sectors in the Canadian economy, the natural resources sector experienced a significant disruption due to the spread of COVID-19. During the height of the economic lockdown, gross domestic product in the natural resources sector decreased by approximately 15 per cent, and sector employment decreased by roughly 12 per cent. There are early indications that a recovery is underway, but typically well understood risks have given way to vague uncertainties. External economic forecasters have stressed that the shape of projected recoveries are highly contingent on stopping the spread of the pandemic and that projections are characterized by unusually high degrees of risk. Moreover, since Canada’s natural resources sector is export-intensive, its capacity to sustain a robust recovery could be determined, in part, by the spread of COVID-19 in destination markets.

NRCan recognizes that a solid understanding of its risk environment (both internal and external) is fundamental to the delivery of its mandate and fulfilment of its core responsibilities especially as it pertains to the first quarter of 2020-21. Risk management has equipped the department to respond proactively to change and uncertainty by defining and understanding its operating environment and the factors that drive risk. The focus of operational risk management was to develop an immediate response to risks related to the emerging COVID 19 public health crisis. Emerging risks during this time consisted largely of business continuity planning and addressing IM/IT systems to increase effective remote working capacity for the whole Department while maintaining security. NRCan has worked with central agencies and other government departments to develop targeted risk mitigation initiatives to address the impacts of COVID 19 on natural resource sectors.

NRCan will continue to monitor and integrate risk information into strategic and operational decision-making in support of Canada’s natural resource sectors during an unprecedented global pandemic.

4. Significant Changes in Relation to Operations, Personnel, Programs

No significant change in relation to operations, personnel or programs occurred during the first quarter of 2020-21. However, there has been an impact on how NRCan delivers its operations and programs, with the majority of employees working from home and reductions to field and laboratory work due to the COVID-19 pandemic.

Original signed by:

Christyne Tremblay

Deputy Minister

August 30, 2020

Ottawa, Canada

Original signed by:

Linda Hurdle, CPA, CA

Chief Financial Officer

August 25, 2020

Ottawa, Canada

| (in thousands of dollars) | Fiscal year 2020-21 | Fiscal year 2019-20 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2021* | Expended during the quarter ended June 30, 2020 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2020** | Expended during the quarter ended June 30, 2019 | Year-to-date used at quarter-end | |

| Vote 1 - Net Operating Expenditures | 432,404 | 119,950 | 119,950 | 581,296 | 125,132 | 125,132 |

| Vote 5 - Capital Expenditures | 8,706 | 242 | 242 | 14,371 | 700 | 700 |

| Vote 10 - Grants and Contributions | 403,727 | 21,927 | 21,927 | 489,199 | 27,059 | 27,059 |

| Statutory Payments | ||||||

| Minister of Natural Resources – Salary and motor car allowance | 89 | 22 | 22 | 88 | 22 | 22 |

| Contributions to employee benefit plans | 58,166 | 14,278 | 14,278 | 59,315 | 14,544 | 14,544 |

| Contribution to the Canada/Newfoundland Offshore Petroleum Board | 11,187 | - | - | 9,475 | - | - |

| Contribution to the Canada/Nova Scotia Offshore Petroleum Board | 4,305 | - | - | 4,305 | - | - |

| Payments to the Newfoundland Offshore Petroleum Resource Revenue Fund | 289,756 | 16,376 | 16,376 | 374,165 | 42,906 | 42,906 |

| Total Statutory Payments | 363,503 | 30,676 | 30,676 | 447,348 | 57,472 | 57,472 |

| Total Budgetary Authorities | 1,208,340 | 172,795 | 172,795 | 1,532,214 | 210,363 | 210,363 |

| * Total available for use includes only authorities available for use and granted by Parliament at quarter-end through the Main Estimates, for which interim supply of nine twelfths was released, and Supplementary Estimates (A), for which full supply was released. | ||||||

| ** Total available for use includes only authorities available for use and granted by Parliament at quarter-end through the Main Estimates, for which full supply was released, and Budget Implementation Vote, which reflects some measures announced in Budget 2019. | ||||||

| (in thousands of dollars) | Fiscal year 2020-21 | Fiscal year 2019-20 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2021 | Expended during the quarter ended June 30, 2020 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2020 | Expended during the quarter ended June 30, 2019 | Year-to-date used at quarter-end | |

| Budgetary Expenditures: | ||||||

| Personnel | 355,170 | 115,972 | 115,972 | 445,776 | 112,319 | 112,319 |

| Transportation and communication | 17,260 | 274 | 274 | 19,801 | 3,613 | 3,613 |

| Information | 7,851 | 483 | 483 | 9,938 | 1,229 | 1,229 |

| Professional and special services | 88,233 | 11,893 | 11,893 | 115,073 | 16,197 | 16,197 |

| Rentals | 14,563 | 3,204 | 3,204 | 20,881 | 5,474 | 5,474 |

| Repair and maintenance | 5,825 | 162 | 162 | 9,015 | 575 | 575 |

| Utilities, materials and supplies | 22,936 | 603 | 603 | 32,274 | 2,416 | 2,416 |

| Acquisition of land, buildings and works | 2,449 | - | - | 6,791 | 402 | 402 |

| Acquisition of machinery and equipment | 18,478 | 963 | 963 | 26,074 | 1,316 | 1,316 |

| Transfer payments | 708,974 | 38,303 | 38,303 | 877,144 | 69,965 | 69,965 |

| Other subsidies and payments | 5,184 | 4,312 | 4,312 | 7,088 | 972 | 972 |

| Total Budgetary Expenditures | 1,246,923 | 176,169 | 176,169 | 1,569,855 | 214,478 | 214,478 |

| Less: | ||||||

| Total Revenues Netted Against Expenditures | 38,583 | 3,374 | 3,374 | 37,641 | 4,115 | 4,115 |

| Total Net Budgetary Expenditures | 1,208,340 | 172,795 | 172,795 | 1,532,214 | 210,363 | 210,363 |

Page details

- Date modified: