Lithium facts

Lithium and its compounds enable clean energy and transportation through rechargeable batteries for electric vehicles. Lithium compounds are produced in a variety of forms including lithium carbonate (Li2CO3), lithium oxide (Li2O), and lithium hydroxide (LiOH).

Key facts

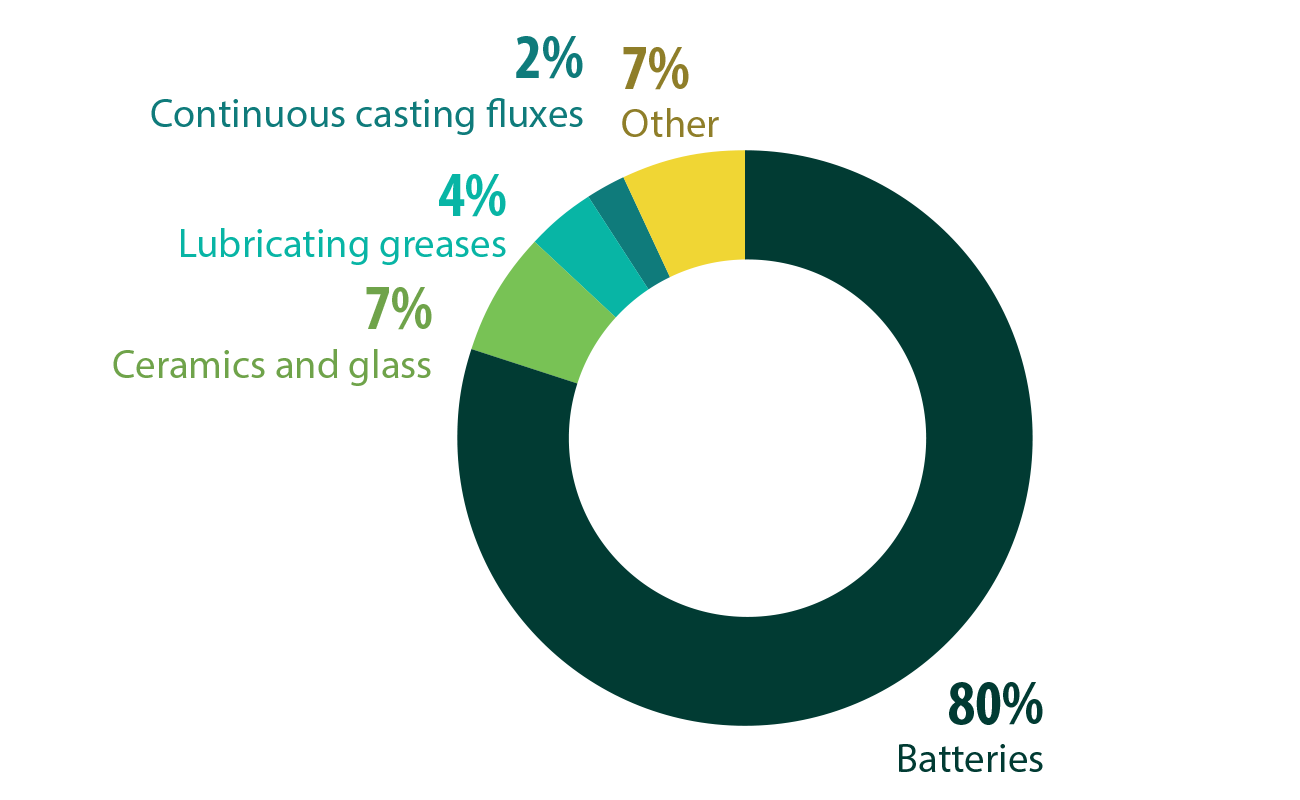

- Manufacturing of rechargeable batteries for electronics, electric vehicles, and grid storage is the largest global use for lithium, representing 80% of total demand.

- The Government of Canada has identified lithium as a critical mineral because it is a key material in the renewable energy transition.

- Canada currently produces lithium from two mines located in Manitoba and Quebec.

- Australia is the world’s largest lithium producer, accounting for nearly half of global production in 2022. Bolivia, Chile and Argentina (the “lithium triangle”) have the largest estimated resources, with nearly 50 million tonnes of lithium between the three countries.

Learn more about lithium

Uses

Uses

Lithium is a highly reactive metal that is used to make energy-dense rechargeable batteries for electronics, such as laptops, cell phones, electric vehicles, and grid storage. Demand for lithium-ion batteries has grown significantly in recent years, driving global exploration, and enabling new lithium projects to be considered. Batteries accounted for 80% of total demand in 2022.

Also used in glass products, lithium increases the durability, corrosion resistance, and thermal resistance for use at extreme temperatures. It is used in such items as glass-ceramic stovetops, glass containers, specialty glass, and fibreglass. Because of its natural properties, lithium contributes to improved process productivity and energy savings in glassmaking.

Lithium is a critical mineral for the energy transition and net-zero emissions will require greater reliance on both new and recycled sources of lithium for batteries.

Production

Production

Canada had limited lithium production from 2014 to 2020. Since 2021, the TANCO Mine in Manitoba has been producing lithium, which is exported for processing.

Several companies are currently working to develop lithium projects from traditional hard rock mining to unconventional sources such as oilfield brines and industrial wastewaters, in Ontario, Quebec, Alberta, Manitoba and Saskatchewan. These projects range from early exploration to a pre-production stage.

The North American Lithium mine near Val-d’Or, Quebec (formerly the Quebec Lithium mine) reached commercial production in early 2018 and shipped spodumene concentrate to refineries in China for processing into lithium carbonate. As prices of lithium products and spodumene concentrate fell sharply later that year, North American Lithium suspended production in 2019 and sought bankruptcy protection. It was acquired by Sayona Quebec in 2021 in a joint venture between Sayona Mining (Australia) and Piedmont Lithium (United States). The mine started limited production of lithium concentrate in March 2023, with a full commercial production targeted for Q3 2023. The new owners also plan to build a lithium hydroxide or lithium carbonate refinery.

After several years of exploration and construction, Nemaska Lithium produced its first spodumene concentrate at the Whabouchi Mine in Quebec in early 2017. The company suspended production in 2019, and the mine was put on care and maintenance. After seeking bankruptcy protection, Nemaska was acquired by the Pallinghurst Group in partnership with the Gouvernement du Québec and emerged from creditor protection in 2020. The company plans to restart the mine and build a lithium hydroxide refinery in Bécancour, Quebec. Prior to the startup of lithium hydroxide production at Nemaska’s Bécancour, Quebec, plant, the company will supply Ford with spodumene concentrate from its Whabouchi mine. Construction of the lithium hydroxide conversion plant is scheduled to begin in 2023.

Canada currently has an estimated 3.2 million tonnes of lithium oxides resources (measured and indicated) at hard rock deposits. Lithium brines in Alberta and Saskatchewan could increase these resources as technology and processing are advanced to extract lithium compounds economically from oil and gas fields, including from existing infrastructure and industrial wastewaters.

Canadian lithium projects, 2022-2023

Text version

This map shows the location and status of Canadian lithium projects and mines at the advanced or production stage.

Quebec

- The North American Lithium project is active at the initial production stage and expected to reach commercial production in Q3 2023.

- The Whabouchi project is active at the pre-production stage.

- The Authier project is active at the advanced stage.

- The James Bay project is active at the advanced stage.

- The Rose project is active at the advanced stage.

Ontario

- The Pakeagama Lake project is active at the advanced stage.

- The Separation Rapids project is active at the advanced stage.

- The Georgia Lake project is active at the advanced stage.

Manitoba

- Since 2021, the TANCO Mine in Manitoba has been producing lithium, which is exported for processing.

- The Thompson Brothers project is active at the advanced stage.

Saskatchewan

- The Prairie Lithium brine project is active at the advanced stage.

Alberta

- The Sturgeon Lake (Boardwalk) brine project is active at the advanced stage.

- The SBH Black Shale project is on hold at the advanced stage.

- The Clearwater brine project is active at the advanced stage.

International context

International context

Australia is the global leader in lithium production, with five mines accounting for nearly half of the lithium production in 2022. Brine operations in Chile and Argentina and mines in China accounted for most of the remaining forecasted production in 2022.

China is the global leader in lithium processing, with most of the processed products being used in battery production.

| Ranking | Country | Tonnes | Percentage of the total |

|---|---|---|---|

| 1 | Australia | 61,000 | 47.2% |

| 2 | Chile | 39,000 | 30.2% |

| 3 | China | 19,000 | 14.7% |

| 4 | Argentina | 6,200 | 4.8% |

| 5 | Brazil | 2,200 | 1.7% |

| 6 | Zimbabwe | 800 | 0.6% |

| 7 | Portugal | 600 | 0.5% |

| 8 | Canada | 500 | 0.4% |

| World total | 129,300 | 100.0% |

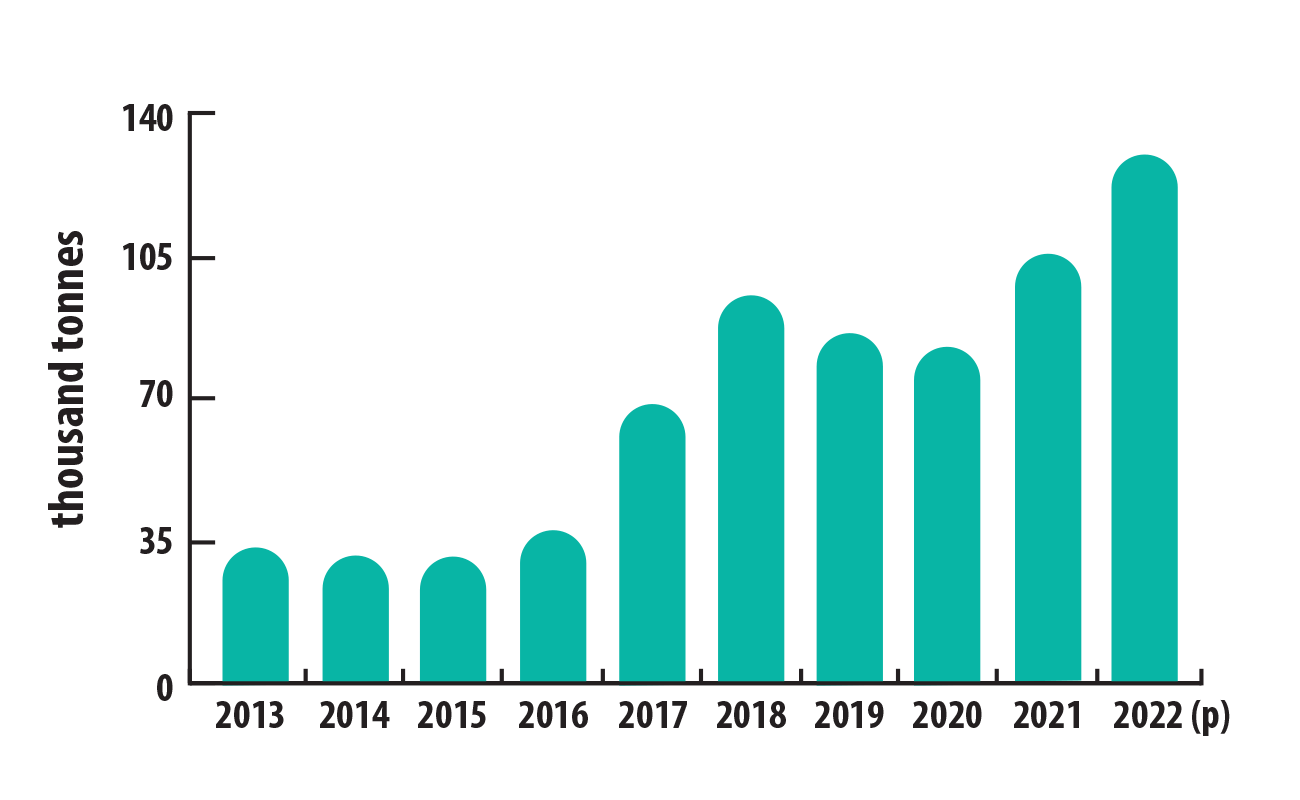

World mine production of lithium, 2013–2022 (p)

Text version

This bar graph shows the world’s annual mine production of lithium from 2013 to 2022. Lithium production was 34,000 tonnes in 2013 and stayed relatively steady until 2015 when it was 31,500 tonnes. After surging demand for lithium batteries to support the growing market for electronics, electric vehicles, and renewable energy storage, mine production increased in 2016 to 38,000 tonnes. Mine production increased significantly to 69,000 tonnes in 2017 and to 95,000 tonnes in 2018.

After the surplus of supply hit the market in 2017 and 2018, prices decreased, which lead to decreased production in 2019 and 2020 of 86,000 and 82,500 tonnes, respectively. The prices recovered in 2021, as did lithium demand, driving up production to a record high of over 104,000 tonnes. Worldwide lithium production in 2022 increased by 23% year-over-year to approximately 130,000 tonnes in response to strong demand from the lithium-ion battery market and increased prices of lithium.

World reserves

More than half of the estimated global lithium resources are located in the salt flats of Bolivia, Chile and Argentina, much of that in Bolivia. It is estimated that there are 98 million tonnes of lithium resources globally. Sociopolitical conditions have affected access to Bolivia’s resources while Chile and Argentina, which are more investor-friendly, are ranked first and third, respectively, for proven reserves.

Australia ranks second in the world for proven reserves with 6.2 million tonnes and first for production with 61,000 tonnes produced in 2022. Chile accounted for 40% of global lithium reserves in 2022, whereas Canada ranked sixth in the world with 4% of reserves at 930,000 tonnes.

| Ranking | Country | Lithium content (tonnes) | Percentage of the total |

|---|---|---|---|

| 1 | Chile | 9,300,000 | 35.7% |

| 2 | Australia | 6,200,000 | 23.8% |

| 3 | Argentina | 2,700,000 | 10.4% |

| 4 | China | 2,000,000 | 7.7% |

| 5 | United States | 1,000,000 | 3.8% |

| 6 | Canada | 930,000 | 3.6% |

| 7 | Zimbabwe | 310,000 | 1.2% |

| 8 | Brazil | 250,000 | 1.0% |

| 9 | Portugal | 60,000 | 0.2% |

| Other | 3,300,000 | 12.7% | |

| World total | 26,000,000 | 100.0% |

Trade

Trade

Exports

- Canada exported 121 tonnes of lithium oxide and hydroxide in 2022, a 46% increase in quantity from 2021. This represented a total value of $2,107,000, almost all of which came from Quebec and was exported to France.

- Canada exported 193 kg of lithium carbonates in 2022, most of it was from Ontario and went to the United Kingdom.

- Since 2020, the quantity of both lithium carbonate and lithium oxide and hydroxide exports was a significant decline from the 41,000 tonnes exported in 2019 and 97,000 tonnes exported in 2018. The decline was due to the Whabouchi and North American Lithium mines in Quebec being suspended following the fall of global lithium prices.

- Canada domestically exported $55.7 million of lithium primary cell and batteries (non-rechargeable) and lithium-ion batteries globally, 74% of which went to the United States.

Imports

- Canada is a net importer of lithium and lithium products. Canada’s lithium oxide and hydroxide as well as lithium carbonates imports totalled $34.5 million, a 59% increase from $21.7 million in 2021. The U.S. accounted for 41% of the net imports of lithium oxide and hydroxide, whereas Chile accounted for over 64% of the net imports of lithium carbonates.

- Imports of lithium primary cells and batteries (non-rechargeable) and lithium-ion batteries were $138 million and $1,033 million, respectively, up from $92 million and $742 million in 2021. China and the United States accounted for 65% of the net imports of lithium-bearing batteries.

Prices

Prices

Lithium carbonate spot prices have been volatile over the past decade because of soaring demand and a sudden surplus of new lithium development that developed in response. For fixed-price contracts, the annual average U.S. lithium carbonate price was $37,000 per ton in 2022, almost three times higher than that in 2021.

A surge in lithium demand for use in electronics, electric vehicles and renewable energy storage led to a spike in spot carbonate prices up to US$24,000 per tonne in 2017. After a surplus of new lithium projects reached commercial production in 2017 and 2018, spot prices crashed to a low of US$12,000 per tonne by the end of 2018.

The surplus was driven primarily by new spodumene mines being considered in Australia—two in 2017 and five more in 2018. Prices dropped further to US$7,300 per tonne by the end of 2019 and less than US$5,000 per tonne by the end of 2020.

After surging from US$7,000 per tonne in January 2021 to US$26,200 per tonne by November 2021, lithium carbonate spot prices reached US$67,000 per tonne in November 2022. Prices continue to rise because of supply constraints and soaring demand for electric vehicles. Spot lithium hydroxide prices also increased significantly from US$35,300 per tonne in January 2022 to US$78,000 per tonne in November 2022.

Recycling

Recycling

In 2019, a lithium battery recycler, Li-Cycle, began operations in Ontario and ramped up to recycling and processing up to 5,000 tonnes of used lithium-ion batteries per year in 2020. A long-time battery recycler, Toxco-Canada, in British Columbia is the only facility in the world that offers both primary and secondary lithium battery recycling. Toxco-Canada has been recycling batteries since 1992. Several other companies plan to recycle lithium-ion batteries in Canada, such as Lithion, Electra Battery Materials, and Stelco.

Notes and sources

Totals may be different because of rounding.

All dollars are Canadian unless otherwise indicated.

Lithium refers to lithium metal unless otherwise specified.

Uses

- Lithium, global uses, 2022

- United States Geological Survey, Mineral Commodity Summaries 2023

Production

- Canadian lithium projects, 2021–2022

- Natural Resources Canada, compiled from company reports

International context

- World mine production of lithium by country, 2022

- United States Geological Survey, Mineral Commodity Summaries 2023

- World mine production of lithium, 2013–2022 (p)

- United States Geological Survey, Mineral Commodity Summaries 2014–2023

World reserves

- World reserves of lithium by country, 2022

- United States Geological Survey, Mineral Commodity Summaries 2023

- Canada's reserves: Natural Resources Canada, S&P Global Market Intelligence and company technical reports

Trade

- Natural Resources Canada; Statistics Canada

Prices

- United States Geological Survey, Mineral Commodity Summaries 2018-2022

Recycling

- Company reports

Page details

- Date modified: