Nickel facts

Nickel and its compounds are essential in manufacturing the stainless steel that is used in countless products we rely on in our daily lives. Nickel is also used increasingly to manufacture batteries for electric vehicles (EV), which are a key technology in the clean energy transition.

Key facts

- In 2022, Canada produced 143,000 tonnes of nickel and ranked sixth in the world nickel mine production.

- Canada's exports of nickel and nickel-based products in 2022 were valued at $7.5 billion.

- An important evolving use of nickel is in production of lithium-ion batteries for electric and hybrid vehicles, which accounted for 15% of total nickel end use globally in 2022.

Learn more about nickel

Uses

Uses

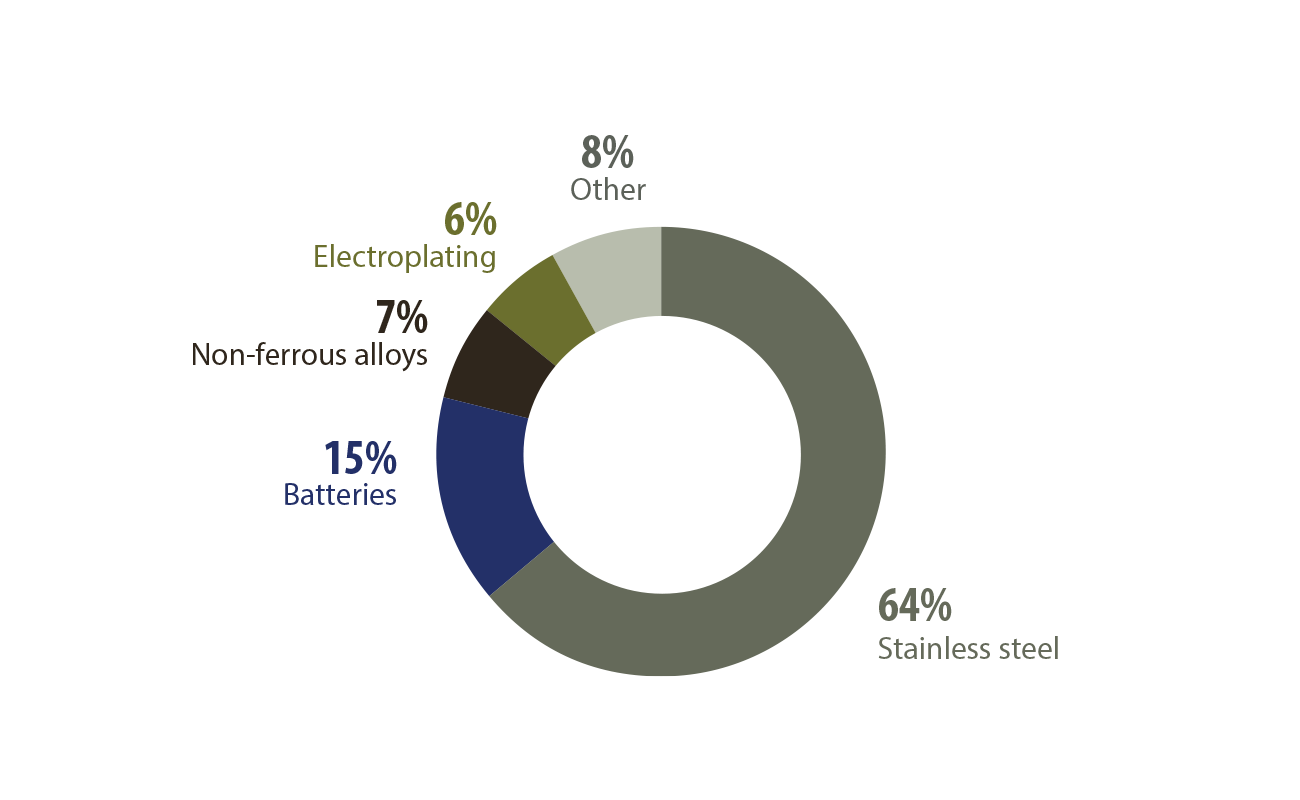

Stainless steel is the largest end use for nickel, accounting for just under two-thirds of total consumption. Nickel is used as an alloying agent in the manufacture of both metal products that contain iron and those that do not.

It is also used in electroplating, in which a thin layer of nickel is coated onto a metal object as a decorative feature or to provide resistance to corrosion and wear.

While nickel is well known as a component in the manufacture of nickel-cadmium batteries, an important evolving use is in production of lithium-ion batteries for EVs.

Nickel, global uses, 2022

Text version

This donut chart shows the major industrial uses of nickel as of 2022. The largest use was for stainless steel (64%), followed by batteries (15%), non-ferrous alloys (7%), electroplating (6%) and miscellaneous products and uses including foundry and alloy steel (8%).

Production

Production

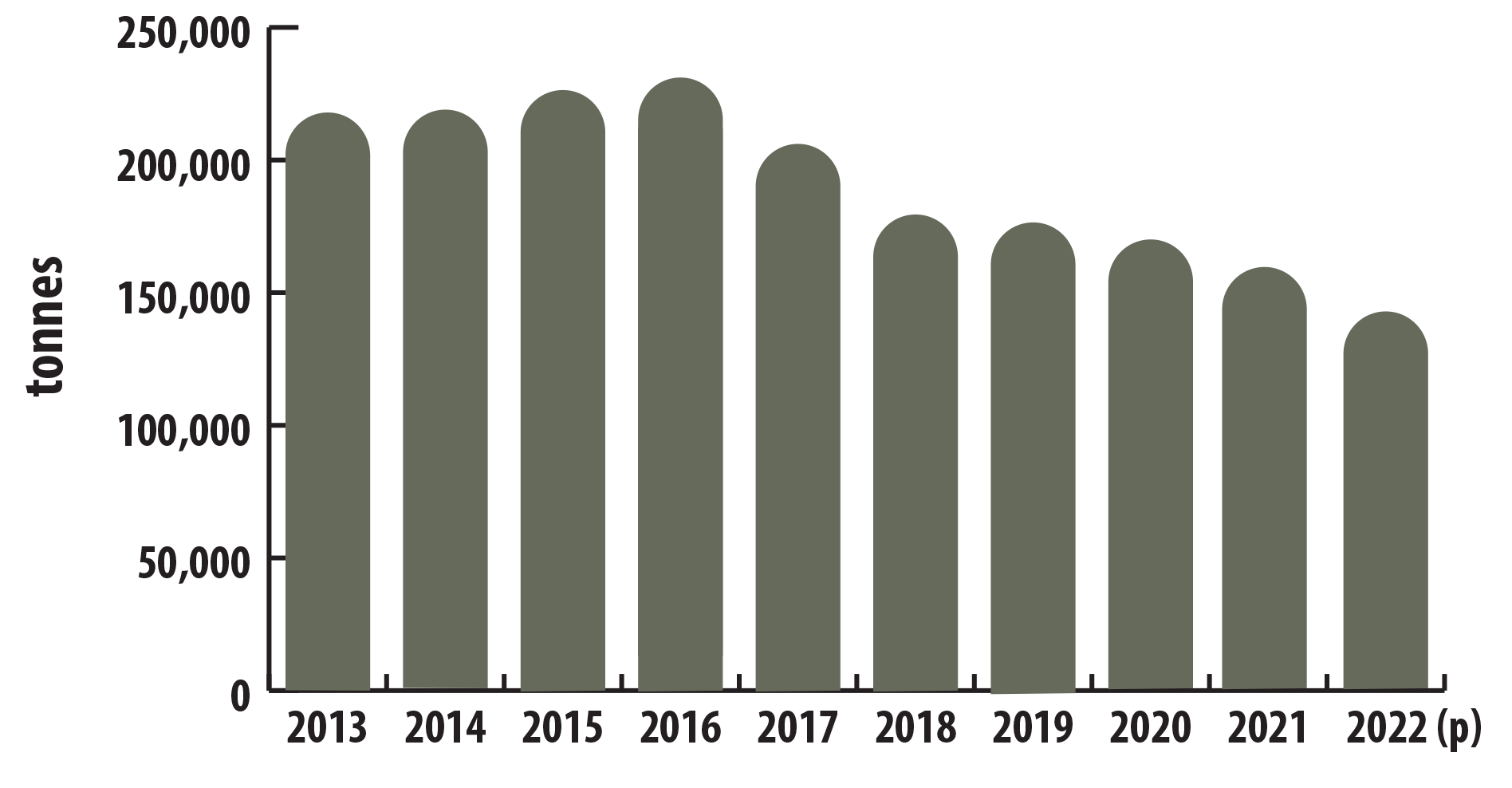

In 2022, Canada produced 143,266 tonnes of nickel in concentrate, which is 10% less than the previous year. Ontario produced 50% of Canada’s mined nickel, and Quebec produced 27%, with the rest from Newfoundland and Labrador and Manitoba.

Canada produces refined nickel at three refineries in Fort Saskatchewan, Alberta; Sudbury, Ontario; and Long Harbour, Newfoundland and Labrador.

Ontario-based Electra Battery Materials is developing a cobalt and nickel sulfate production plant and a lithium-ion battery recycling plant north of Toronto.

Consult a map of producing Canadian mines

Canadian mine production of nickel, 2013–2022 (p)

Text version

This bar graph shows Canada's annual mine production of nickel from 2013 to 2022. Canada mined 218,026 tonnes of nickel in 2013. Production fluctuated around 200,000 tonnes and reached a peak of 230,210 tonnes in 2016. Production then decreased to 177,867 tonnes in 2018 before increasing to 193,057 tonnes in 2019. In 2020, production decreased to 168,214 tonnes, then to 159,145 tonnes in 2021, and to 143,266 tonnes in 2022.

| Ranking | Province | Thousand tonnes | Percentage of total |

|---|---|---|---|

| 1 | Ontario | 71.3 | 49.8% |

| 2 | Quebec | 39.2 | 27.3% |

| 3 | Newfoundland and Labrador | 19.1 | 13.3% |

| 4 | Manitoba | 13.7 | 9.6% |

| Total | 143.3 | 100.0% |

International context

International context

Global mine production of nickel in 2022 was estimated at 3.3 million tonnes, which is an increase of 20% from 2021. Indonesia was the largest producer at 1.6 million tonnes, or 49% of global mined production. Canada ranked sixth, producing 4% of the global total.

| Ranking | Country | Thousand tonnes | Percentage of total |

|---|---|---|---|

| 1 | Indonesia | 1,600 | 48.6% |

| 2 | Philippines | 330 | 10.0% |

| 3 | Russia | 220 | 6.7% |

| 4 | New Caledonia | 190 | 5.8% |

| 5 | Australia | 160 | 4.9% |

| 6 | Canada | 143 | 4.3% |

| 7 | China | 110 | 3.3% |

| 8 | Brazil | 83 | 2.5% |

| 9 | United States | 18 | 0.5% |

| - | Other countries | 440 | 13.4% |

| Total (rounded) | 3,294 | 100.0% |

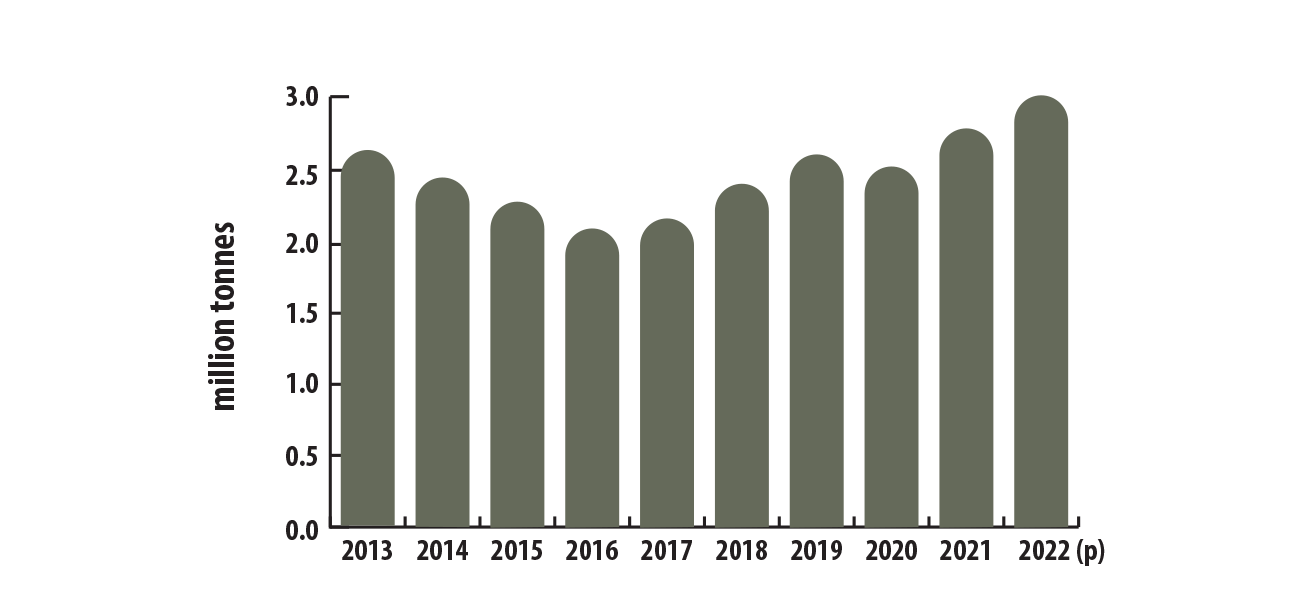

World mine production of nickel, 2013–2022 (p)

Text version

This bar graph shows the world's annual mined production of nickel from 2013 to 2022. Production decreased from 2.6 million tonnes in 2013 to 2 million tonnes in 2016. The decrease was followed by a recovery to 2.6 million tonnes in 2019 and a small decrease to 2.5 million tonnes in 2020. Following that, production increased to 2.8 million tonnes in 2021 and 3.3 million tonnes in 2022.

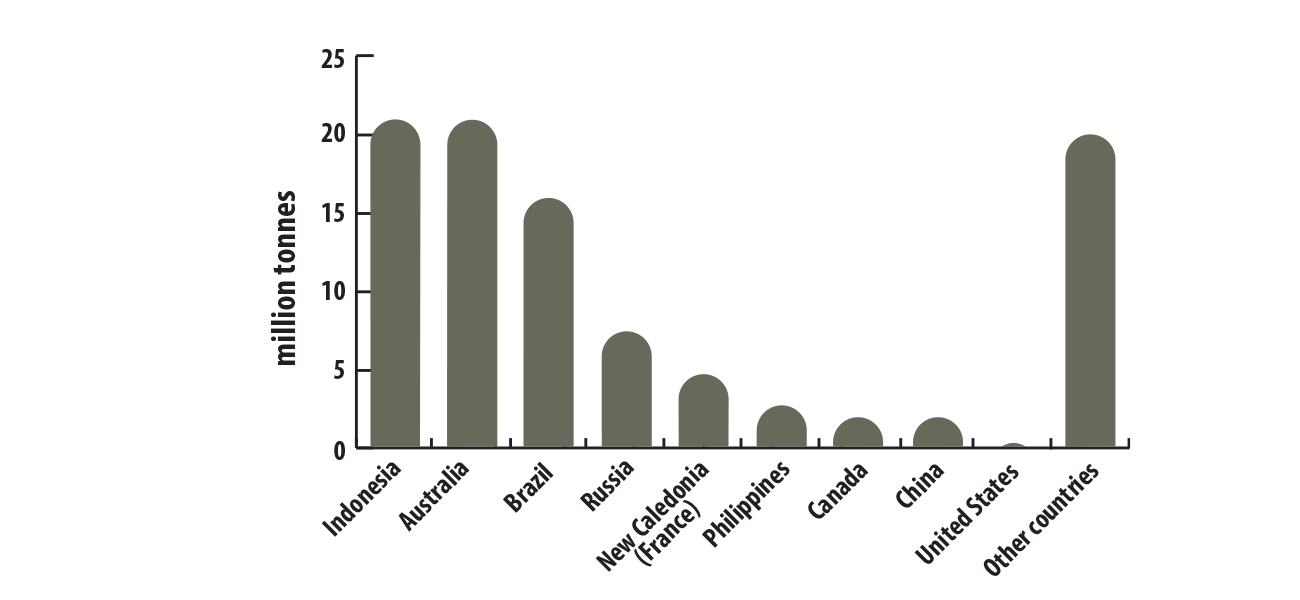

World reserves

In 2022, total world nickel reserves were estimated to be greater than 102 million tonnes by the U.S. Geological Survey. The largest known reserves are in Indonesia (21%), Australia (21%), and Brazil (16%). Canada has an estimated 2.2 million tonnes of nickel reserves, representing 2% of the world reserves, and ranking seventh globally.

In 2022, nickel resources globally were estimated at more than 300 million tonnes, with 60% in laterite deposits and 40% in magmatic sulphide deposits. Nickel has also been found in seafloor crusts and nodules.

World reserves of nickel, by country, 2022 (p)

Text version

This bar graph shows the estimated world reserves of nickel by country in millions of tonnes in 2022. Indonesia had the largest tonnage (21.0 million tonnes), the same as Australia (21.0 million tonnes), followed by Brazil (16.0 million tonnes), Russia (7.5 million tonnes), New Caledonia (France) (7.1 million tonnes), the Philippines (4.8 million tonnes), Canada (2.2 million tonnes), China (2.1 million tonnes), the United States (0.1 million tonnes) and other countries (20.0 million tonnes). Other countries include Cuba, where no current nickel reserve data is available.

Trade

Trade

Canada's total trade in nickel and nickel-based products in 2022 was valued at $7.5 billion. Exports of nickel and nickel-based products were valued at $6.8 billion, and imports were valued at $726.0 million.

Canada exported 105,621 tonnes of unwrought nickel valued at $3.5 billion in 2022. The United States imported close to 40% of these exports by volume, while 12% was destined for China. A further 12% went to the Netherlands, 7% went to Japan, and the remainder was shipped to 18 other countries.

Prices

Prices

The price of nickel has fluctuated significantly over the last decade. The average monthly price per tonne peaked at US$20,394 in February 2012 and then declined to US$15,032 in 2013. The price recovered in 2014 to US$16,893 before again decreasing in 2015 and 2016 to US$9,595. The price rose for the next three years to reach US$13,914 in 2019 before decreasing slightly in 2020 to US$13,787 because of the impacts of COVID-19. The price subsequently recovered to US$18,465 in 2021 and climbed further to US$25,834 in 2022.

In March 2022, the price of nickel briefly surged to US$33,924 following fears of the nickel supplies being disrupted by the Russian invasion of Ukraine. The London Metal Exchange briefly suspended the trading of nickel on March 8 after prices more than doubled over a few hours.

Prices for nickel have historically been linked with the demand for stainless steel, but the growing use in batteries has increased demand and raised prices since 2017.

Nickel, monthly average nominal US$ per tonne prices, 2013–2022

Text version

This line graph shows the nominal monthly average price in US dollars per tonne of nickel from 2013 to 2022. The price of nickel averaged $15,032 per tonne in 2013 and decreased steadily to $9,595 per tonne in 2016. The average price then increased to $13,914 per tonne in 2019 before increasing dramatically to $18,465 per tonne in 2021 and $25,834 in 2022. The lowest monthly price in 2022 was $21,482 per tonne in July, while the highest was $33,924 per tonne in March.

Notes and sources

(p) preliminary

(e) estimated

Totals may be different because of rounding.

All dollars are Canadian unless otherwise indicated.

Uses

- Nickel, global uses, 2022

- Wood Mackenzie

Production

- Canadian mine production of nickel, 2013–2022 (p)

- Natural Resources Canada, Statistics Canada

- Canadian mine production of nickel, by province, 2022 (p)

- Natural Resources Canada, Statistics Canada

International context

- World mine production of nickel, by country, 2022 (p)

- U.S. Geological Survey, Mineral Commodity Summaries, January 2023

- World mine production of nickel, 2013–2022 (p)

- U.S. Geological Survey, Mineral Commodity Summaries, January 2023

- World reserves of nickel, by country, 2022 (p)

- U.S. Geological Survey, Mineral Commodity Summaries, January 2023

Trade

- Natural Resources Canada; Statistics Canada

- Mineral trade includes ores, concentrates, and semi- and final-fabricated mineral products.

- Unwrought nickel corresponds to HS code 750210.

Prices

- Nickel, monthly average nominal US$ per tonne prices, 2013–2022

- World Bank Commodity Price Data (The Pink Sheet)

Page details

- Date modified: