Rare earth elements facts

Rare earth elements (REE) are a group of 17 elements, including the 15 elements of the lanthanide series on the periodic table of elements together with the transition metals scandium and yttrium. The latter two elements exhibit similar properties to the lanthanides and are found in the same ore bodies. REEs are key components in many electronic devices that we use in our daily lives, as well as in a variety of industrial applications.

Key facts

- Canada has some of the largest known reserves and resources (measured and indicated) of rare earths in the world, estimated at over 15.2 million tonnes of rare earth oxide in 2023.

- Manufacturing permanent magnets is the largest global use for REEs, accounting for 44% of total demand in 2022.

- China is the world’s largest producer with an estimated 210,000 tonnes of mined REEs and 175,000 tonnes of refined REEs in 2022, accounting for 70% of global mined production and 87% of global refined production.

- Many countries, including Canada, have rare earths reserves and resources, but producing REE metals requires complex separation and refining processes.

Learn more about rare earth elements

Uses

Uses

REEs are essential components in diverse industrial and high-technology applications, including electronics, clean energy, aerospace, automotive and defence. Their unique physical, chemical, magnetic and luminescent properties provide opportunities to improve efficiency and durability while decreasing the size and weight of certain electronic components and alloys.

Manufacturing permanent magnets is the largest and most important end use of REEs, accounting for 44% of demand in 2022. Permanent magnets are used in cell phones, televisions, computers, automobiles, wind turbines, MRI machines, jet aircraft and many other products.

REEs are used extensively in clean technologies and alternative energy systems, such as wind turbines, fuel cells, rechargeable batteries, and electric vehicles.

Because of their luminescent properties, REEs are also used in an array of other applications, such as LCD screens, LEDs, lasers, and fluorescent lighting. They can be found in catalytic converters, optical glass used in camera lenses, and the polishing powders used to produce semiconductors.

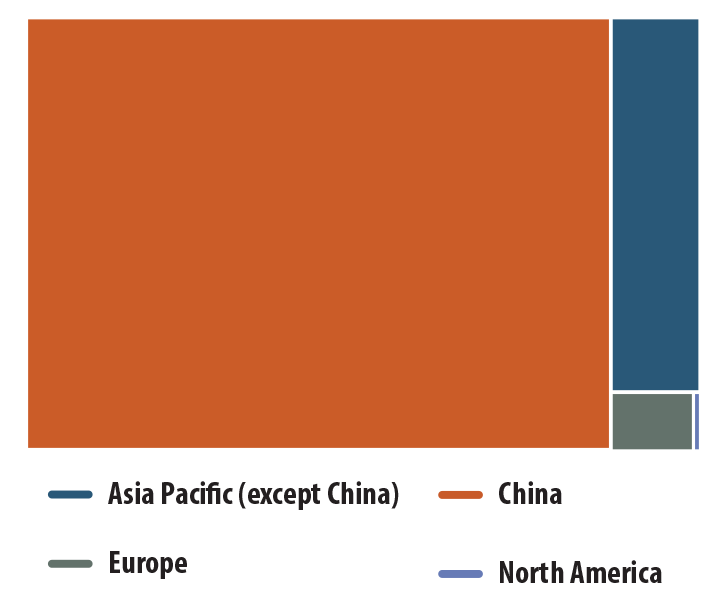

Rare earth element uses, 2022

Text version

This chart shows the global demand for REEs by market sector in 2022. The largest use is in magnets (44.3%), followed by catalysts (17.1%), polishing powders (11.1%), metallurgical (6.6%), glass (6.3%), ceramics (3.1%), battery alloys (2.6%), phosphors (0.5%), pigments (0.3%), and other products (8.1%). The highest demand is for neodymium (Nd 33%), followed by cerium (Ce 32%), lanthanum (La 20%), praseodymium (Pr 7%), yttrium (Y 3%) and the other REEs (5%).

Production

Production

Although not a current commercial producer of REEs, Canada is host to several advanced exploration projects and some of the largest reserves and resources (measured and indicated) of REEs worldwide. Canadian reserves and resources are estimated to be 15.2 million tonnes of rare earth oxide.

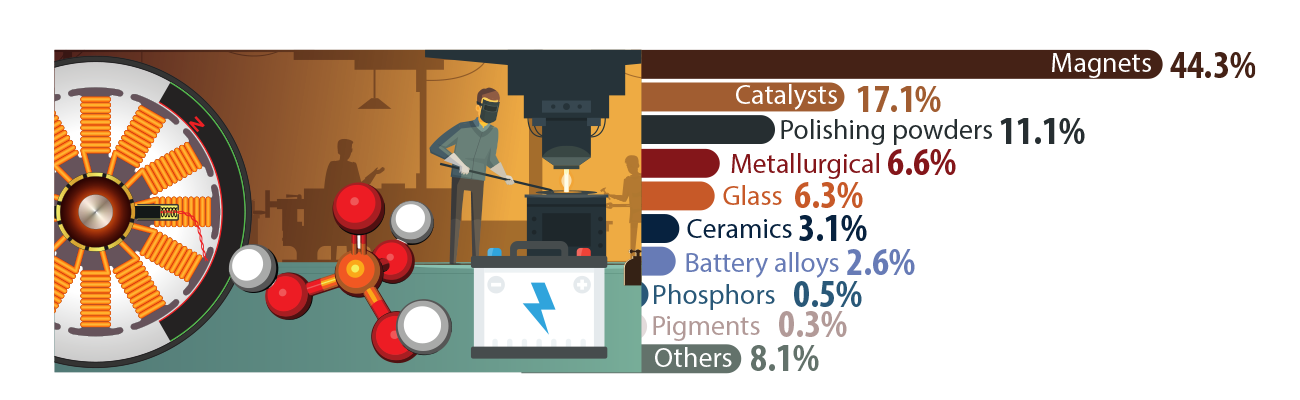

Canadian REE projects

Text version

This map shows the location, status and stage of the largest Canadian REE projects.

Northwest Territories

- Nechalacho T-Zone and Tardiff-Zone project – active at the feasibility stage

- Nechalacho Basal-Zone project – active at the feasibility stage

British Columbia

- Wicheeda project – active at the preliminary economic assessment stage

Alberta

- SBH Black Shale project – suspended/on-hold at the preliminary economic assessment stage

Saskatchewan

- Alces Lake project – active at the exploration stage

- Falcon Point project – active at the resource estimate stage

- Saskatchewan Research Council (SRC) Rare Earth Processing Facility project – active at the processing stage

- Vital Metals’ Saskatoon Rare Earth Processing Facility project – suspended/on hold at the processing stage

Ontario

- Clay-Howells project – suspended/on-hold at the resource estimate stage

- Prairie Lake project – active at the resource estimation stage

- Lackner Lake project – suspended/on-hold at the resource estimate stage

- Elliot Lake project – suspended/on-hold at the resource estimate stage

- Lavergne-Springer project – suspended/on hold at the resource estimate stage

Quebec

- Eldor (Ashram) project – active at the preliminary economic assessment stage

- Strange Lake project – active at the preliminary economic assessment stage

- Crater Lake project – active at the preliminary economic assessment stage

- Kwyjibo project – active at the preliminary economic assessment stage

- Niobec - REE Zone project – inactive at the resource estimate stage

- Montviel project – active at the resource estimate stage

- Sorel-Tracy Scandium Demonstration Plant – active at the processing stage

- Kipawa (Zeus) project – suspended/on hold at the feasibility stage

- St-Bruno Rare Earth Recycling Demonstration Plant project – active at the processing stage

Newfoundland and Labrador

- Red Wine project – suspended/on hold at the resource estimate stage

- Port Hope Simpson (Foxtrot) project – active at the preliminary economic assessment stage

REEs are categorized as being either “light” or “heavy:”

- Light REEs (lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium and scandium) are naturally more abundant than heavy REEs and are generally in surplus supply globally. Praseodymium and neodymium, both used in wind turbines and EVs, are exceptions and in high demand.

- Heavy REEs (terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium and yttrium) are produced mainly in China and are in more limited supply than light REEs. Global efforts to bring new resources to the marketplace continue.

Many of Canada’s most advanced REE exploration projects contain high concentrations of the globally valued heavy REEs used in high-technology and clean-energy applications.

Learn more about why rare earth elements are important.

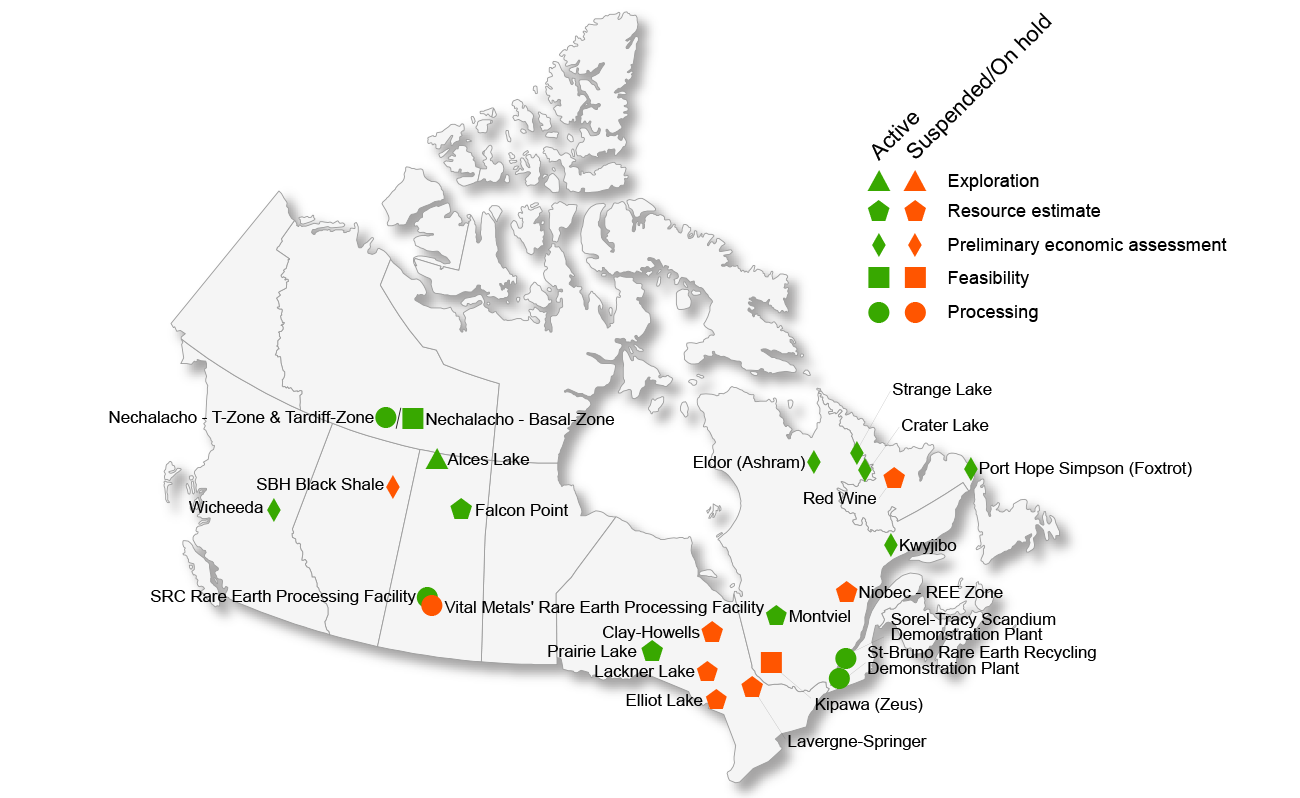

International context

International context

China is the world’s largest producer of REEs, accounting for 70% of global annual mine production, estimated at 210,000 tonnes for 2022. The United States, Australia, Burma (Myanmar) and Thailand accounted for the majority of the remaining mine production. China remains virtually the only producer of the valued heavy REEs.

| Ranking | Country | Tonnes | Percentage of total |

|---|---|---|---|

| 1 | China | 210,000 | 70% |

| 2 | United States | 43,000 | 14% |

| 3 | Australia | 18,000 | 6% |

| 4 | Burma (Myanmar) | 12,000 | 4% |

| 5 | Thailand | 7,100 | 2% |

| - | Other countries | 10,900 | 4% |

| - | Total | 301,000 | 100% |

The United States was the world’s largest supplier of REEs until the emergence of China in the mid-1990s. China was virtually the world’s sole REE supplier until 2012, when the now-bankrupt American producer Molycorp Inc. and the Australian company Lynas Rare Earths Ltd. started commercial production.

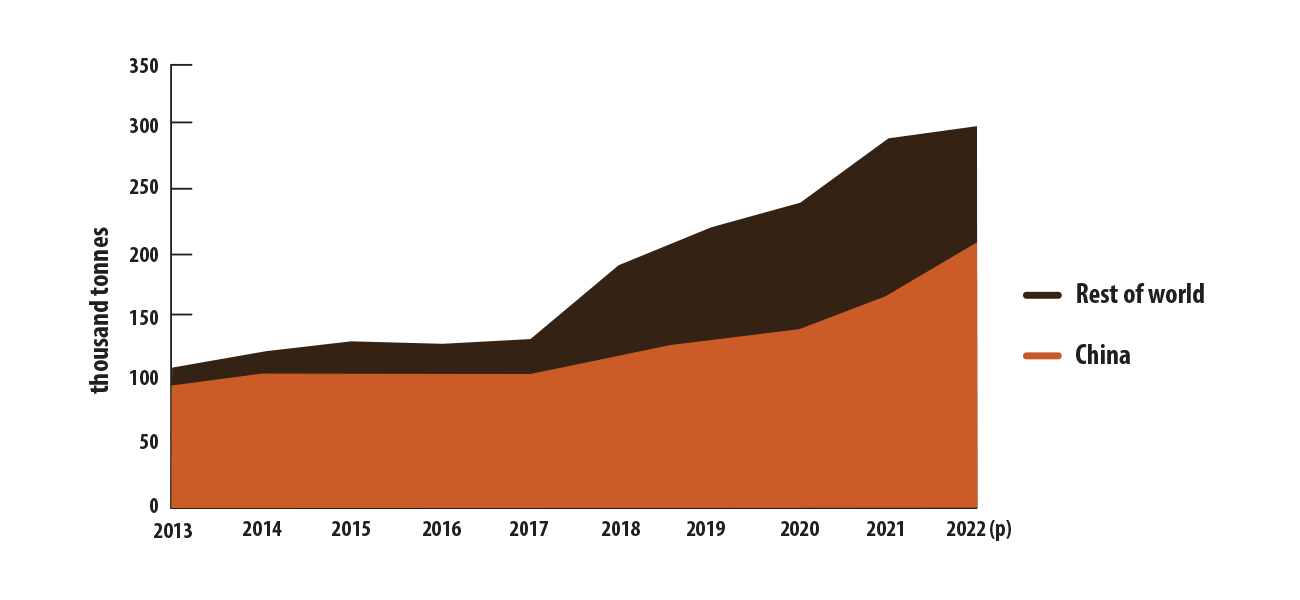

World REE mine production, 2013–2022 (p)

Text version

This graph shows REE mine production by China compared with the rest of the world from 2013 to 2022. In 2013, China’s estimated mine production was 95,000 tonnes, and the rest of the world was 15,000 tonnes. China’s annual mine production remained relatively steady, ranging between 95,000 tonnes and 105,000 tonnes from 2013 to 2017. Mine production by the rest of the world increased from 15,000 tonnes to 27,000 tonnes over the same period.

In 2018, annual mine production began increasing rapidly in China and the rest of the world. Production in China increased to 120,000 tonnes in 2018 and reached 210,000 tonnes by 2022. Similarly, production in the rest of the world increased to 70,000 tonnes in 2018 and reached 123,000 tonnes by 2021, before decreasing to 91,000 tonnes in 2022.

Separating rare earth oxides from the mined REE ore is a multi-step process that includes crushing, grinding, chemical leaching, and solvent extraction. Production of refined REEs is highly localized, with China currently producing 87% of the global refined REE supply.

Notes and sources

(p) preliminary

Totals may be different because of rounding.

Uses

- Rare earth element uses, 2022

- Wood Mackenzie

Production

- Reserves and resources

- Natural Resources Canada, compiled from company reports

- Includes reserves and minerals resources (measured or indicated). Although Canada’s REE resources continue to exist, projects may be on hold, and the corporate entities developing these resources may no longer be solvent or may have changed focus to other mineral deposits or business segments.

- Canadian REE projects

- Company websites, press releases and NI-43-101 reports

International context

- World mine production of REEs, by country, 2022 (p)

- U.S. Geological Survey

- World REE mine production, 2013–2022 (p)

- U.S. Geological Survey

- World supply of REE (refined), 2022

- Wood Mackenzie

Page details

- Date modified: