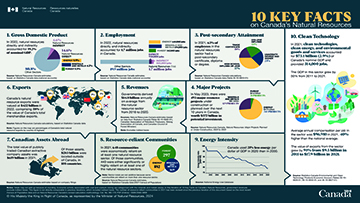

10 Key Facts on Canada’s Natural Resources

Canada has a vast wealth of natural resources, which contributes significantly to our national economy. Resource industries play a critical role in delivering jobs, growth and prosperity for Canadians.

Discover key information and facts demonstrating the importance of the natural resources sectors to the Canadian economy.

Find the latest facts

Read the 2023 version of 10 Key Facts on Canada’s Natural Resources.

Browse facts from previous years

Related links

Page details

- Date modified: